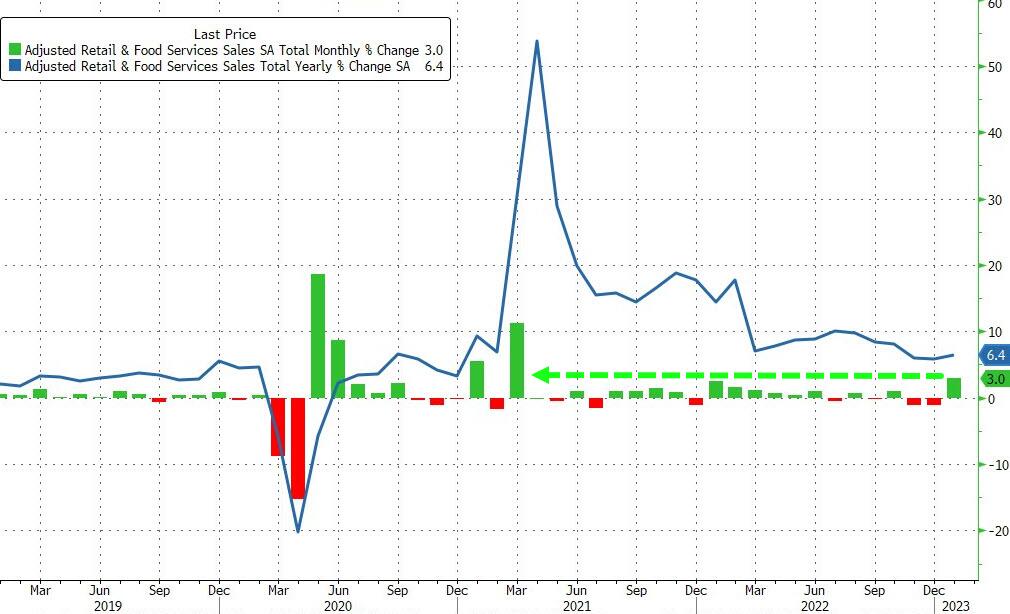

US retail sales data for January was released at 1:30 pm GMT. Report turned out to be better than expected and caused some moves on the markets. Highlights of the report:

• Headline: 3.0% MoM vs 1.8% MoM expected (-1.1% MoM previous), which is the biggest increase since March 2021.

Biggest rises were seen in sales at department stores (17.5%), food services and drinking places (7.2%), motor vehicles and parts (5.9%), furniture stores (4.4%), electronics and appliances (3.5%), miscellaneous stores (2.8%), clothing (2.5%). On the other hand, sales at gasoline stations were flat.

• Ex-autos: 2.3% MoM vs 0.8% MoM expected (-1.1% MoM previous)

• Control group +1.7% vs +0.8% expected

The data showed that consumer spending remains robust after a slowdown last year, amid a strong labour market, wage growth and signs of easing inflationary pressures. Retail sales aren’t adjusted for inflation. Today's report opens the door to further rate hikes by the Federal Reserve.

Retail sales surged in January, which supports expectations that rates will remain at a higher level for longer. Source: Bloomberg via ZeroHedge

EURUSD deepened decline after retail sales release. The pair is closing in on the support zone at 1.0670. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)