US jobless claims came in higher than expected: 242 k vs 225 k expected and 229 k previously

- Continued jobless claims came in 1820 k vs 1795 k exp. and 1792 k previously

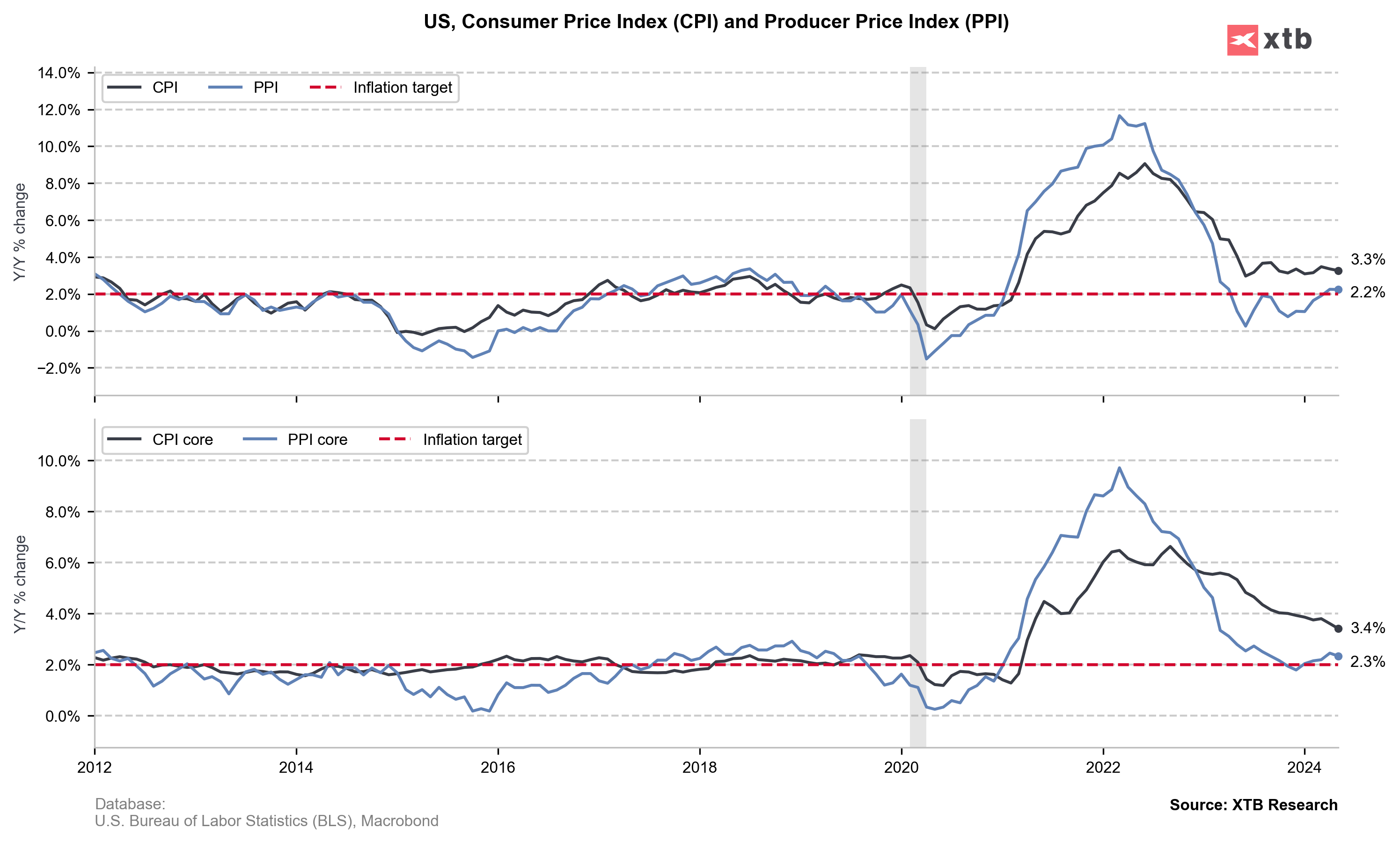

Final PPI YoY came in 2.2% vs 2.5% exp. and 2.2% previously

- Final PPI MoM came in -0.2% vs 0.1% exp. and 0.5% previously

Final PPI ex food and energy YoY came in: 2.3% vs 2.5% exp. and 2.4% previously

- Final PPI ex food and energy MoM came in: 0% vs 0.3% exp. and 0.5% previously)

US dollar loses after today macro reading. Wall Street sees today US data as a chance for faster Fed rate cuts. US producer prices surprisingly dropped -0.2% MoM vs 0.5% previously and jobless claims came in one step closer to 250k.

Source: US Bureau of Labor Statistics (BLS), XTB Research

Source: US Bureau of Labor Statistics (BLS), XTB Research

USDIDX (M15 interval)

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)