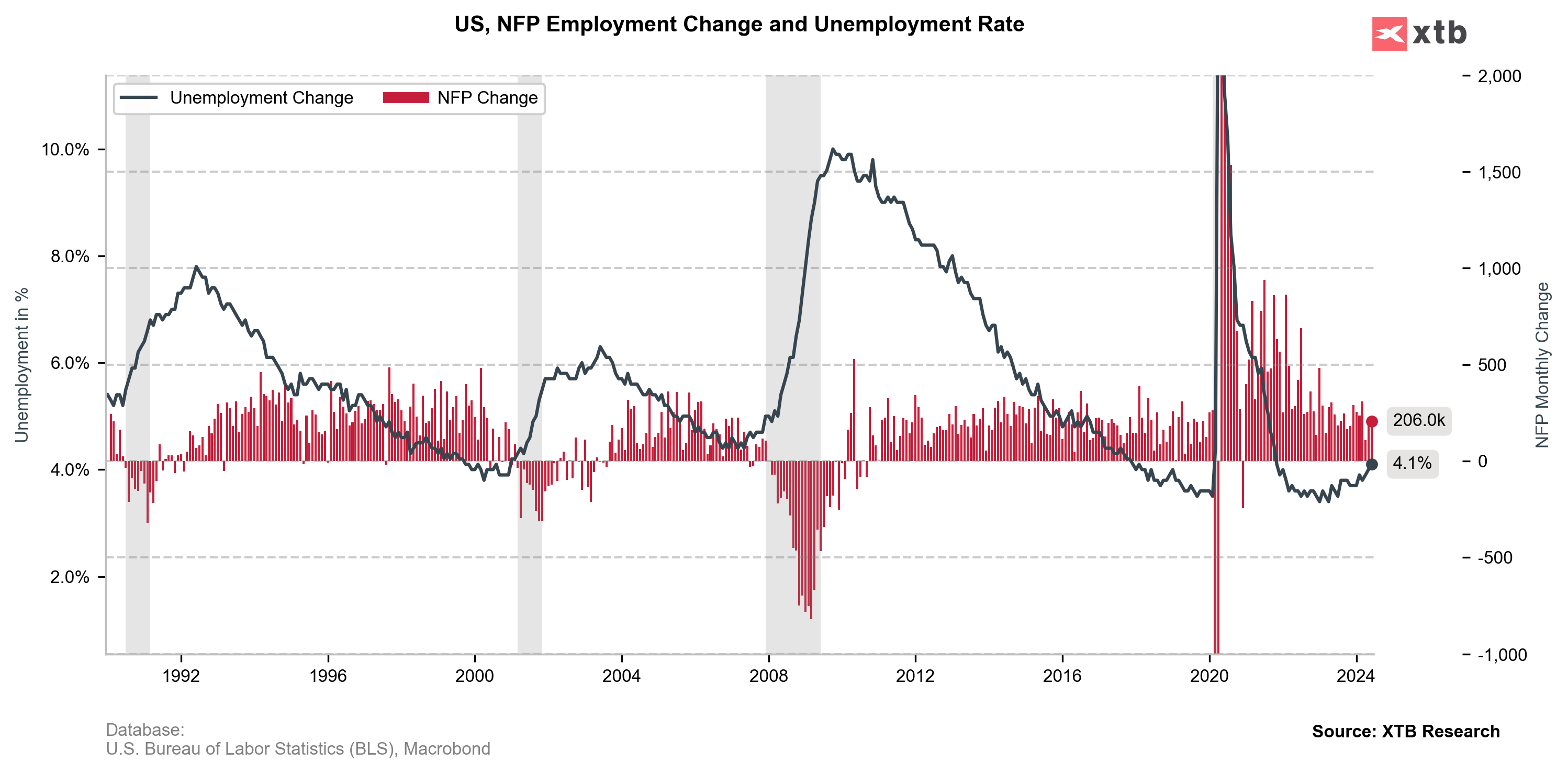

US Non-Farm Payrolls (NFP) for June: 206k Expected: 190k vs. 272k previously

- Change in private employment.136k Expected: 160k vs. 222k previously

- Change in employment in the manufacturing sector. -8k Expected: 5k vs. 8k previously

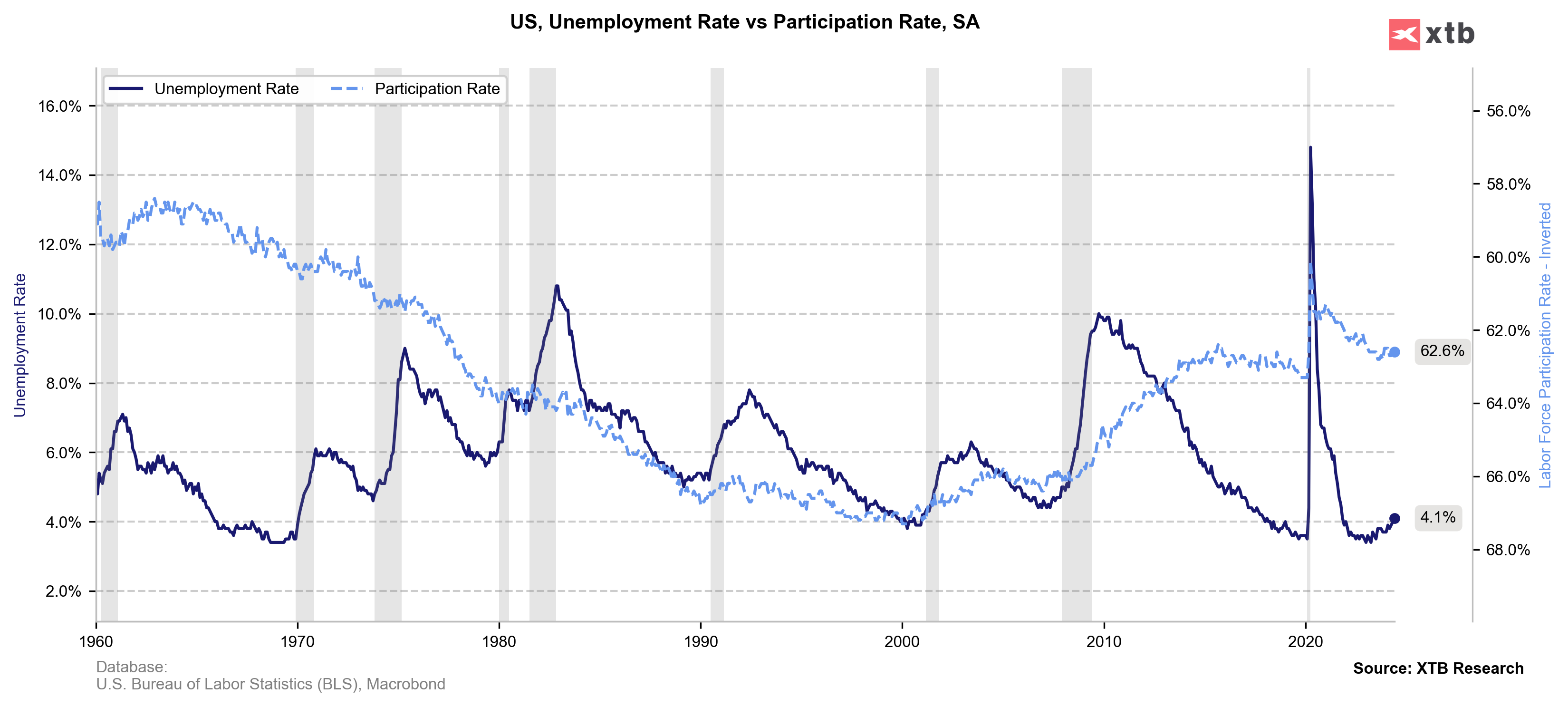

- Unemployment rate. 4.1% Expected: 4% vs. 4% previously

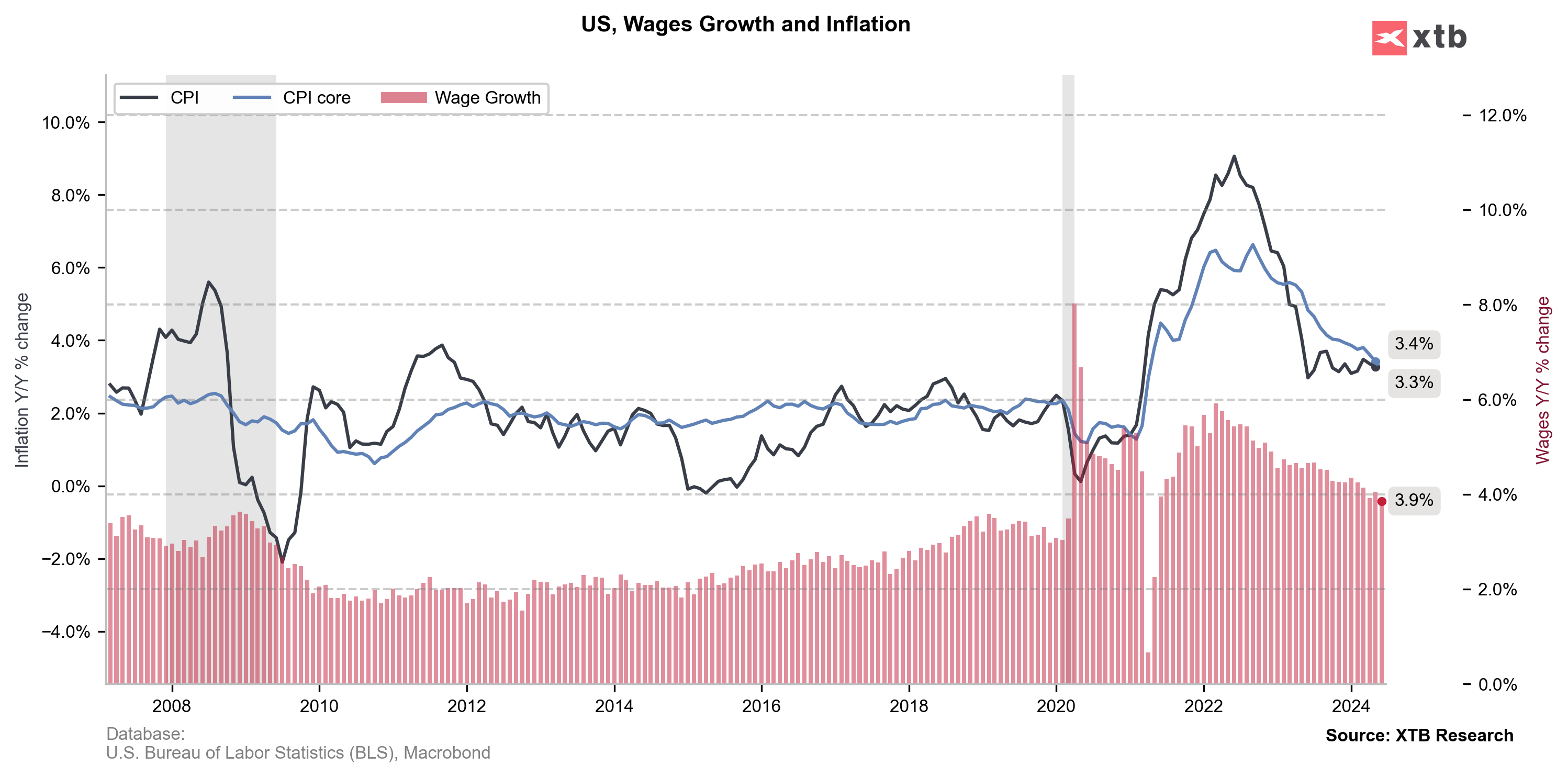

- Average earnings.3.9% Expected: 3.9% y/y growth vs. 4.1% previously (0.3% m/m growth vs. 0.4% previously)

US short-term interest-rate futures reverse earlier losses and now are mostly up vs before the NFP report. US dollar declines as data showed higher unemployment rate, lower change in private employment and unexpected drop in manufacturing employment change. The US dollar declines slightly and Wall Street sees the today report as quite dovish, despite slightly higher than expected Non-Farm Payrolls change. As for now, US rate-futures traders price in slightly higher chance for September Fed rate cut.

US500

In the first reaction after NFP data, futures on S&P 500 (US500) dropped slightly, but buyers reversed the sell-off very fast and now Wall Street futures are on slightly higher levels, than before the key US labour market data.

Source: xStation5

Source: xStation5

Source: BLS, XTB Research, Macrobond

Source: BLS, XTB Research, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉