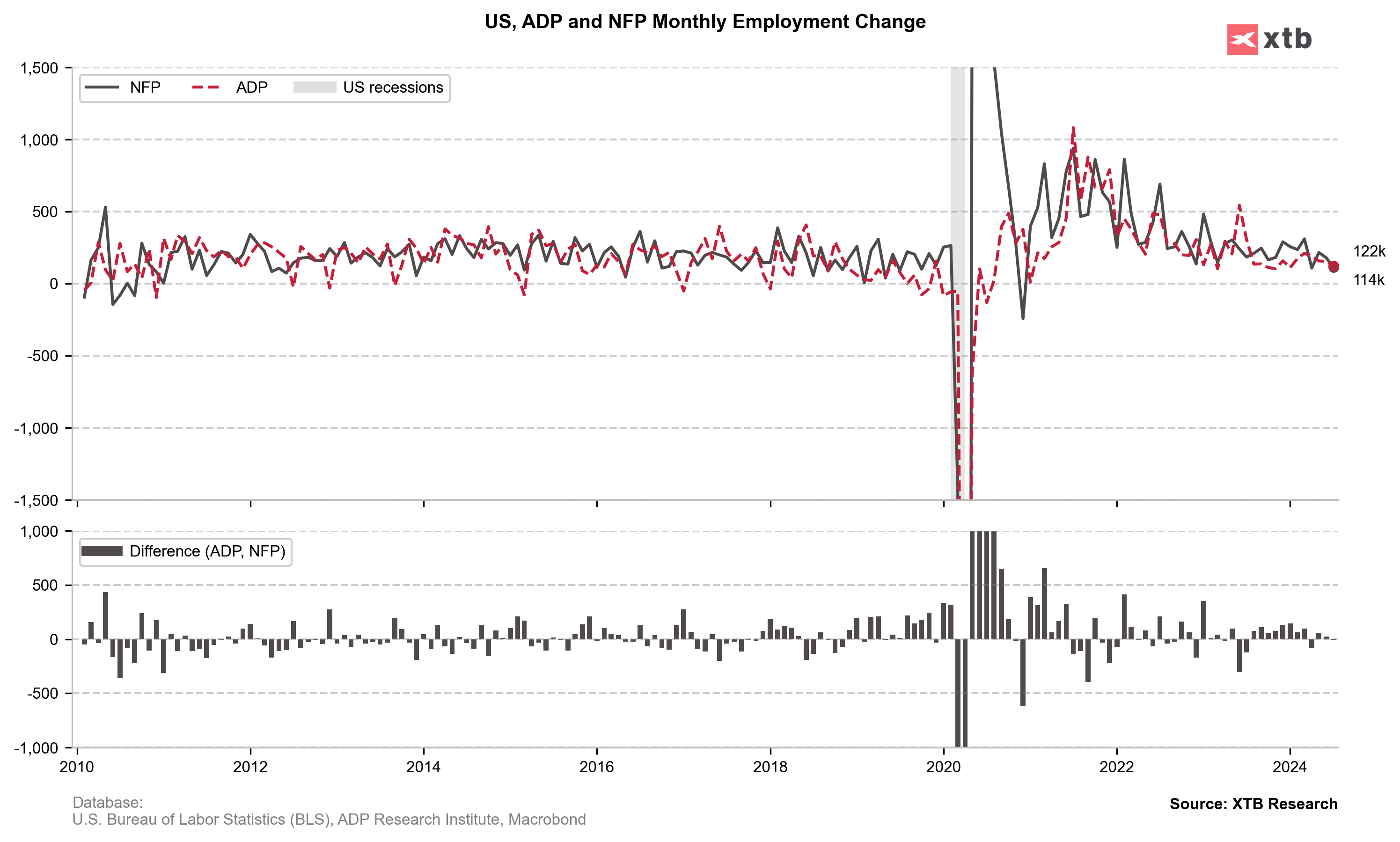

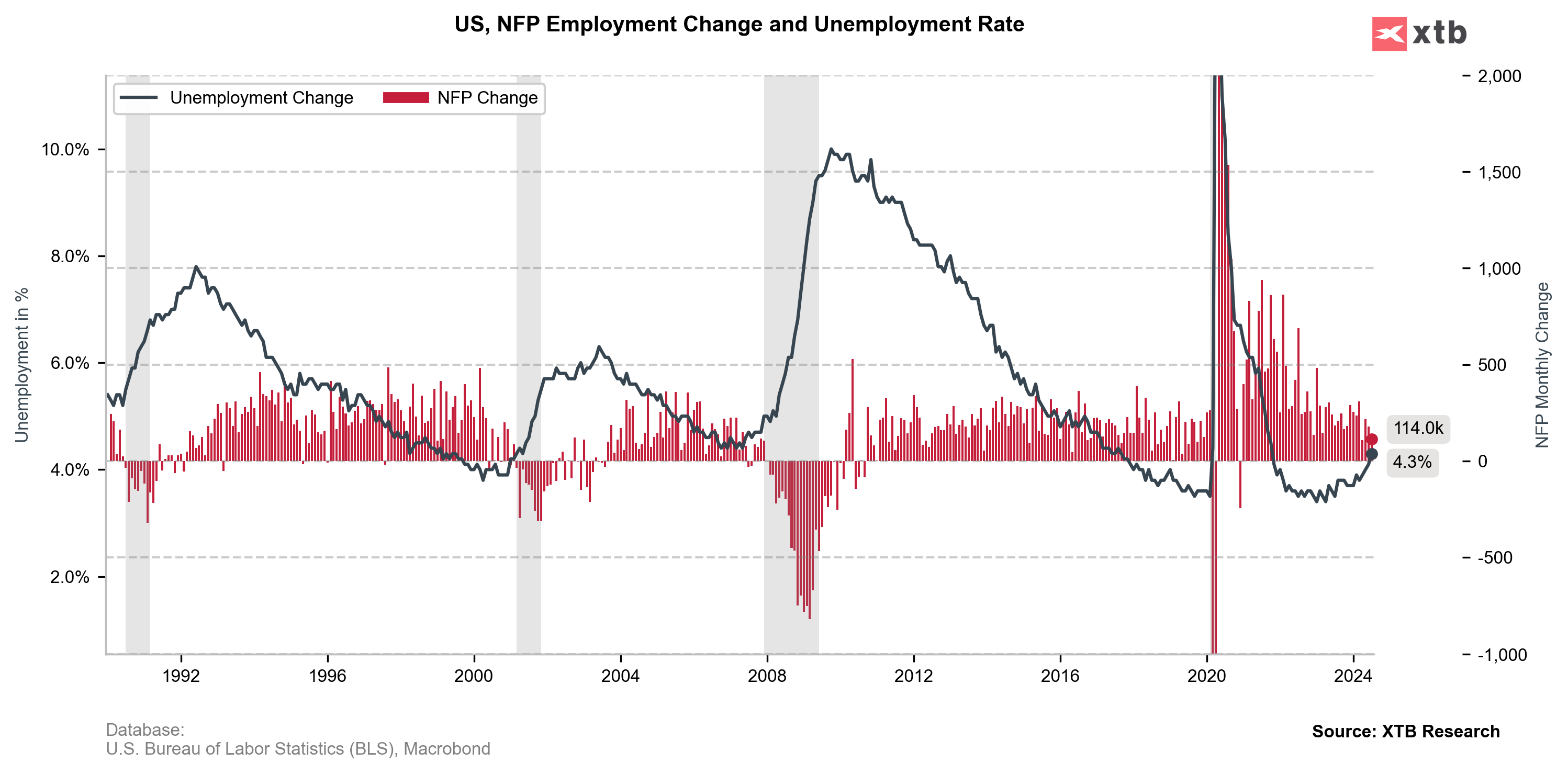

US Non-Farm Payrolls in July came in 114k vs 175k exp. and 206k previously (the weakest since 2021)

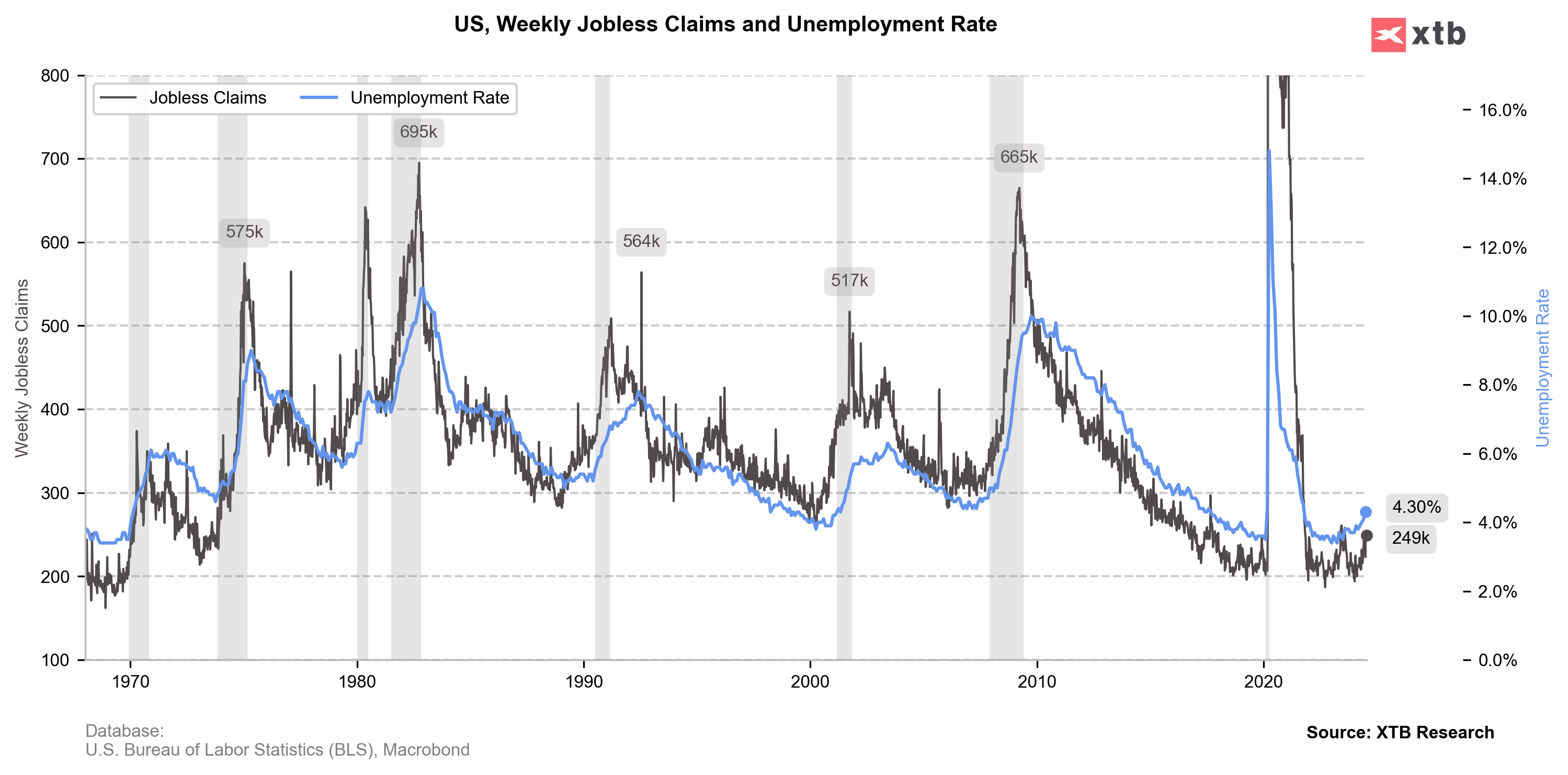

- US Unemployment rise to 4.3% vs 4.1% exp. and 4.1% previously

- US average earnings YoY came in 3.6% vs 3.7% exp. and 3.9% previously (and 0.2% MoM vs 0.3% exp.)

- Private payrolls: 97k vs 140k exp. and 136k previously

- Manufacturing payrolls: 1k vs -5k exp. and -8k previously

After NFP US interest rates futures price in 50 bps Fed interest rate cuts in September with 60% probability vs 30% probability of 50 bps rate cut before the report. US500 deepens declines after weaker than expected and dovish crucial, US job market data, which may signal that Fed is now 'late' with monetary policy easing. Markets see now as much as 111 bps US rate cuts in 2024.

Source: xStation5

Source: xStation5

Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)