01:30 PM BST, United States - Inflation Data for April:

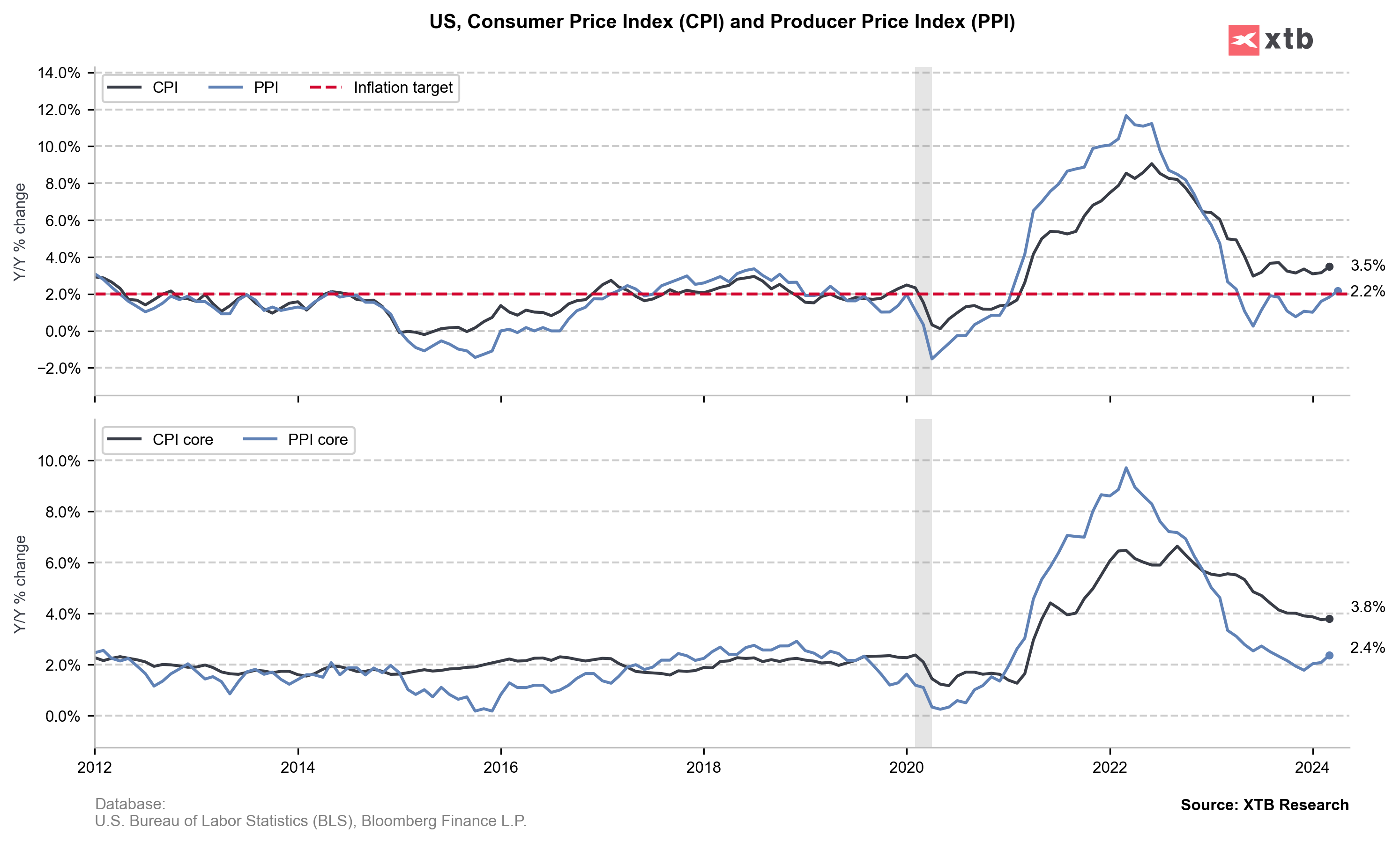

- PPI ex. Food/Energy/Transport: actual 3.1% YoY; previous 2.8% YoY;

- PPI: actual 0.5% MoM; forecast 0.3% MoM; previous -0.1% MoM;

- PPI: actual 2.2% YoY; forecast 2.2% YoY; previous 1.8% YoY;

- Core PPI: actual 0.5% MoM; forecast 0.2% MoM; previous -0.1% MoM;

- Core PPI: actual 2.4% YoY; forecast 2.4% YoY; previous 2.4% YoY;

- PPI ex. Food/Energy/Transport: actual 0.4% MoM; previous 0.2% MoM;

The Producer Price Index (PPI) for final demand increased by 0.5% month-over-month, surpassing the expected 0.3%, while the previous month's figure was revised from +0.2% to -0.1%. Excluding food and energy, PPI rose by 2.4% year-over-year, meeting expectations, and by 0.5% month-over-month, exceeding the anticipated 0.2%. The market's reaction was influenced by the month-over-month reading; however, the higher number was largely due to a downward revision of the February data. When accounting for these revisions, the data aligns with expectations, reflected in the year-over-year headline figures.

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎