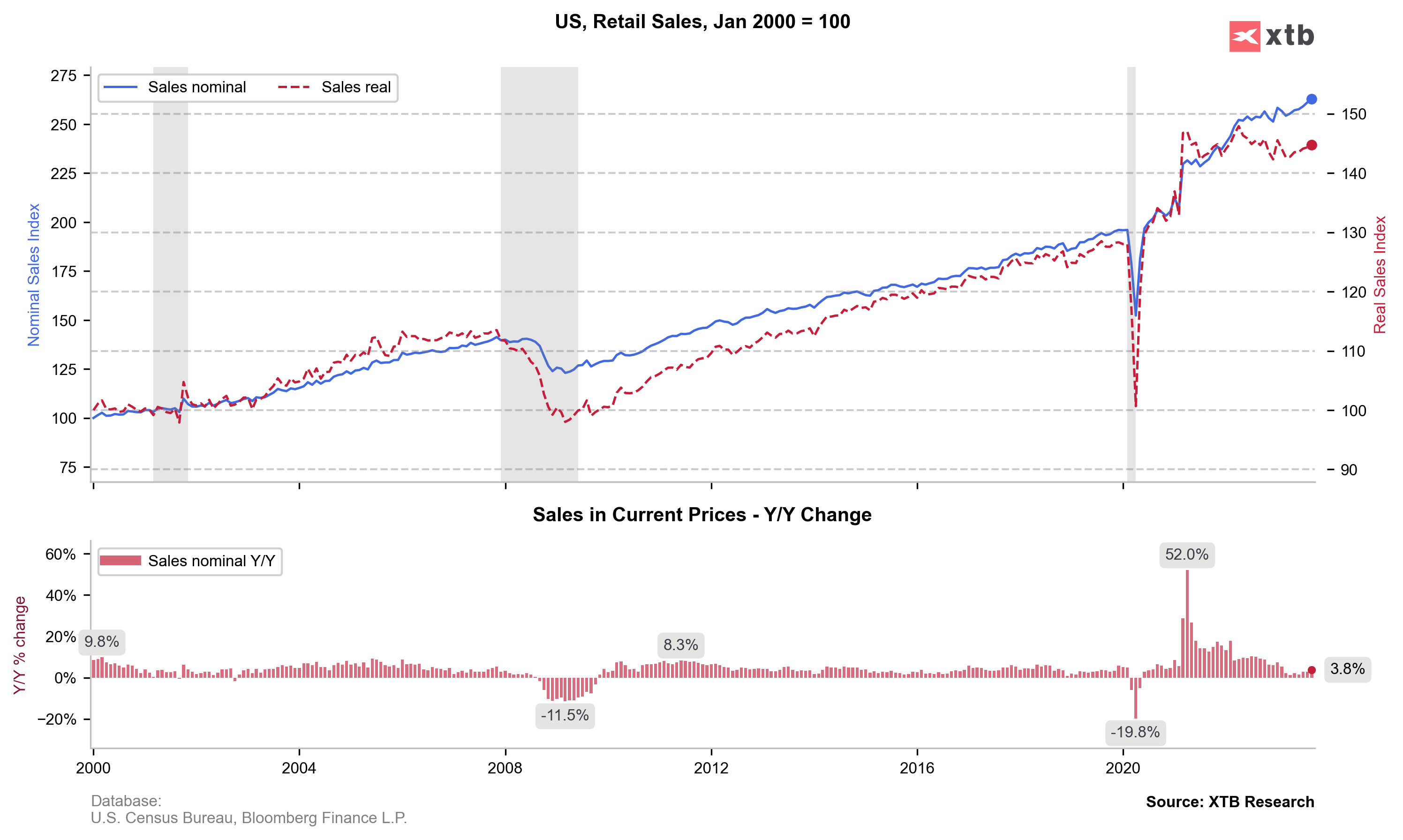

- US Retail sales m/m: 0,7% vs 0,3% exp and 0,6% previously

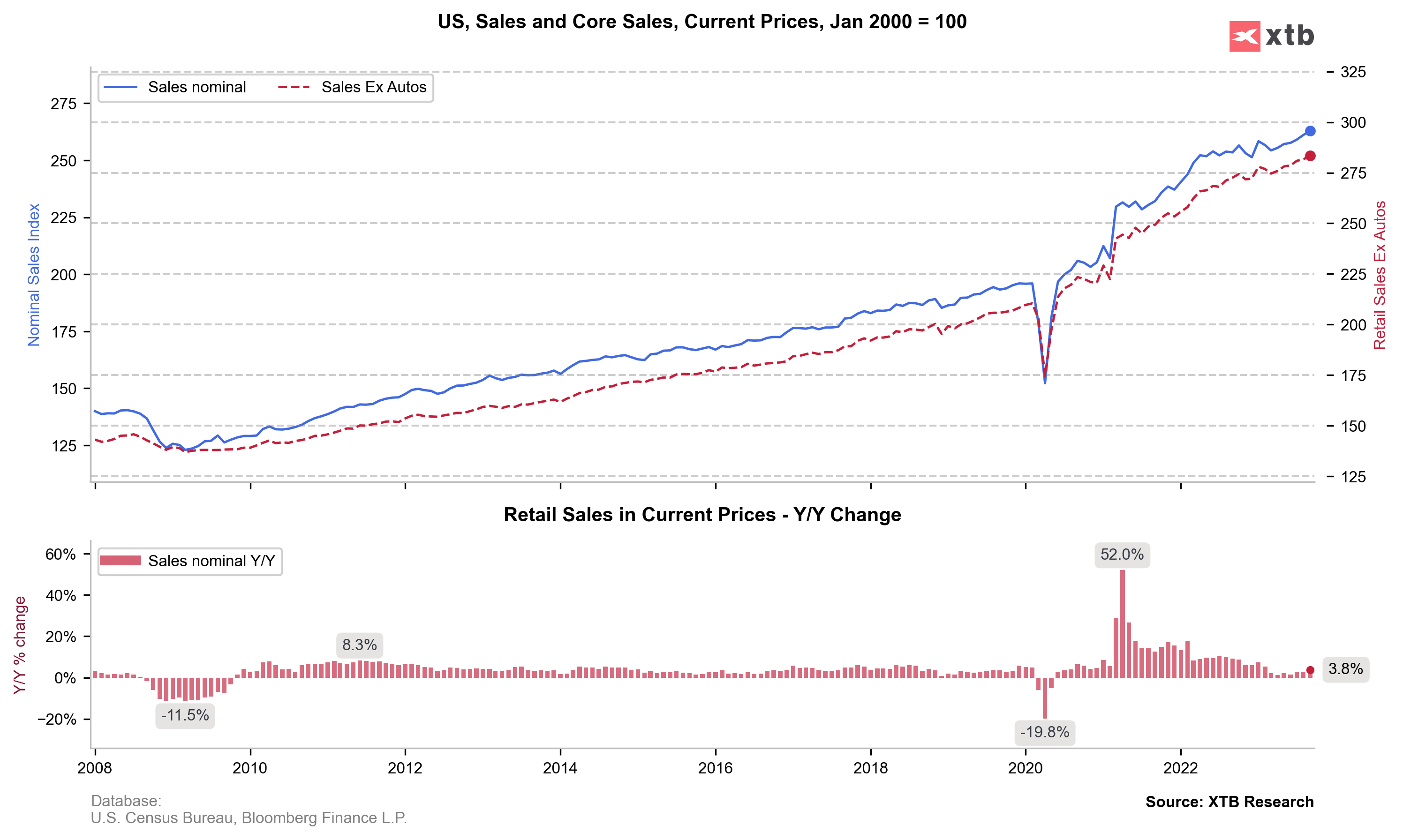

- US core retail sales mm/m 0,6% vs 0,2% exp. and 0,6% previoulsy

In first reaction we can see weaker sentiments on Wall Street becuase strong sales reading may be a signal that Fed will have to increase interest at least once more time. US consumers are still strong.

US500 reaction after the reading

Source: xStation5

Source: xStation5

US Retail sales readings (charts)

Source: XTB Research, US Census Bureau, Bloomberg Finance LP

Source: XTB Research, US Census Bureau, Bloomberg Finance LP

Source: XTB Research, US Census Bureau, Bloomberg Finance LP

Source: XTB Research, US Census Bureau, Bloomberg Finance LP

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)