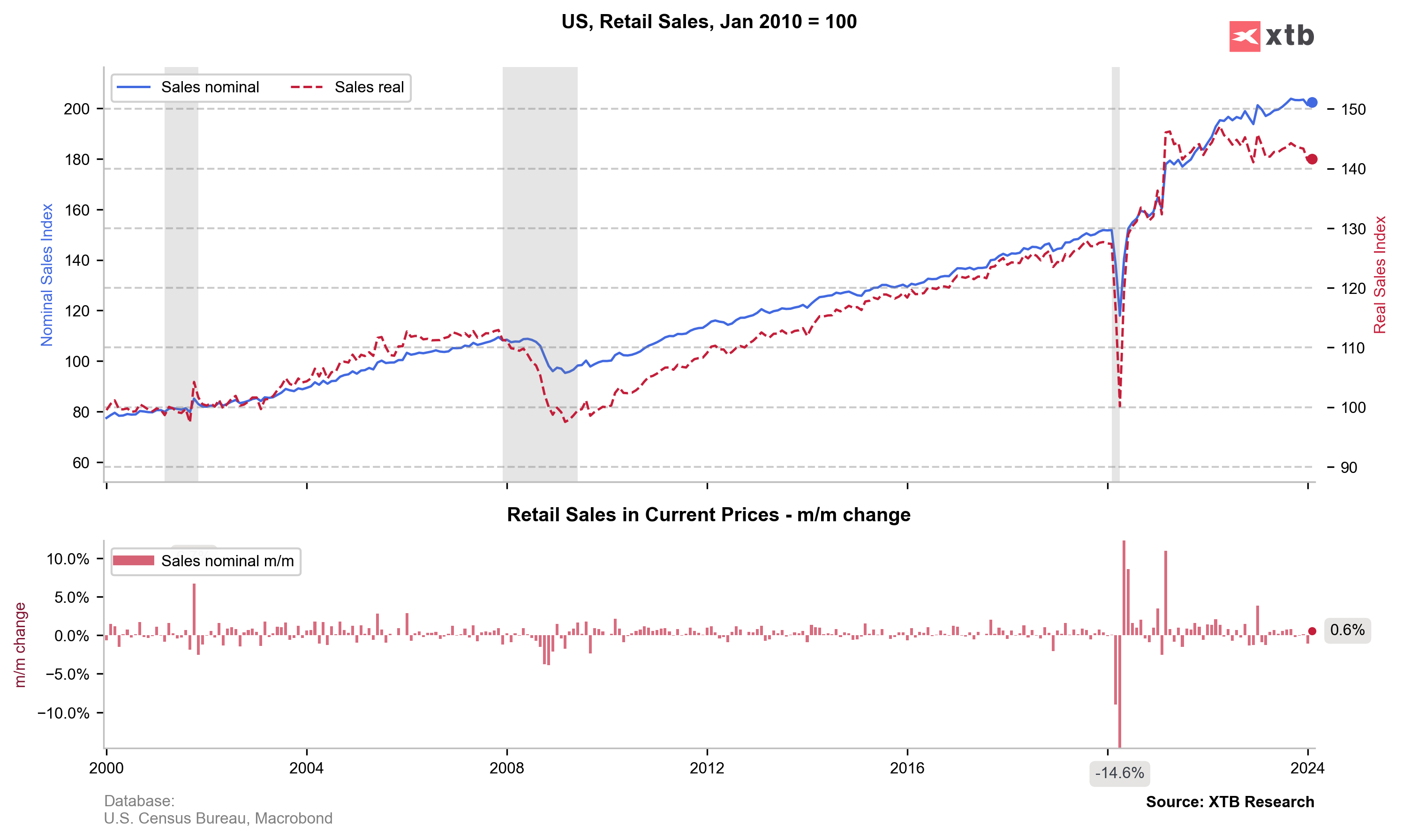

01:30 PM GMT, United States - Retail Sales Data for February:

- Retail Sales: actual 0.6% MoM; forecast 0.8% MoM; previous -1.1% MoM;

- Retail Sales: previous 0.65% YoY;

- Retail Control: actual 0.0% MoM; previous -0.3% MoM;

- Core Retail Sales: actual 0.3% MoM; forecast 0.5% MoM; previous -0.8% MoM;

The dollar strengthens after the data release, with EURUSD losing 0.20% to 1.0930. However, it's important to note that at the same time, the PPI data were published, which were significantly higher than expected. Therefore, in reaction to both reports, the USD appreciates. The fact that retail sales are lower than expected should be interpreted more dovishly, as the data indicate weakening consumers in the USA, and at the same time increase the chances of interest rate cuts. Nevertheless, the reaction is subdued by the publication of the more important PPI data from the Fed's perspective.

Source: xStation 5

Source: xStation 5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS