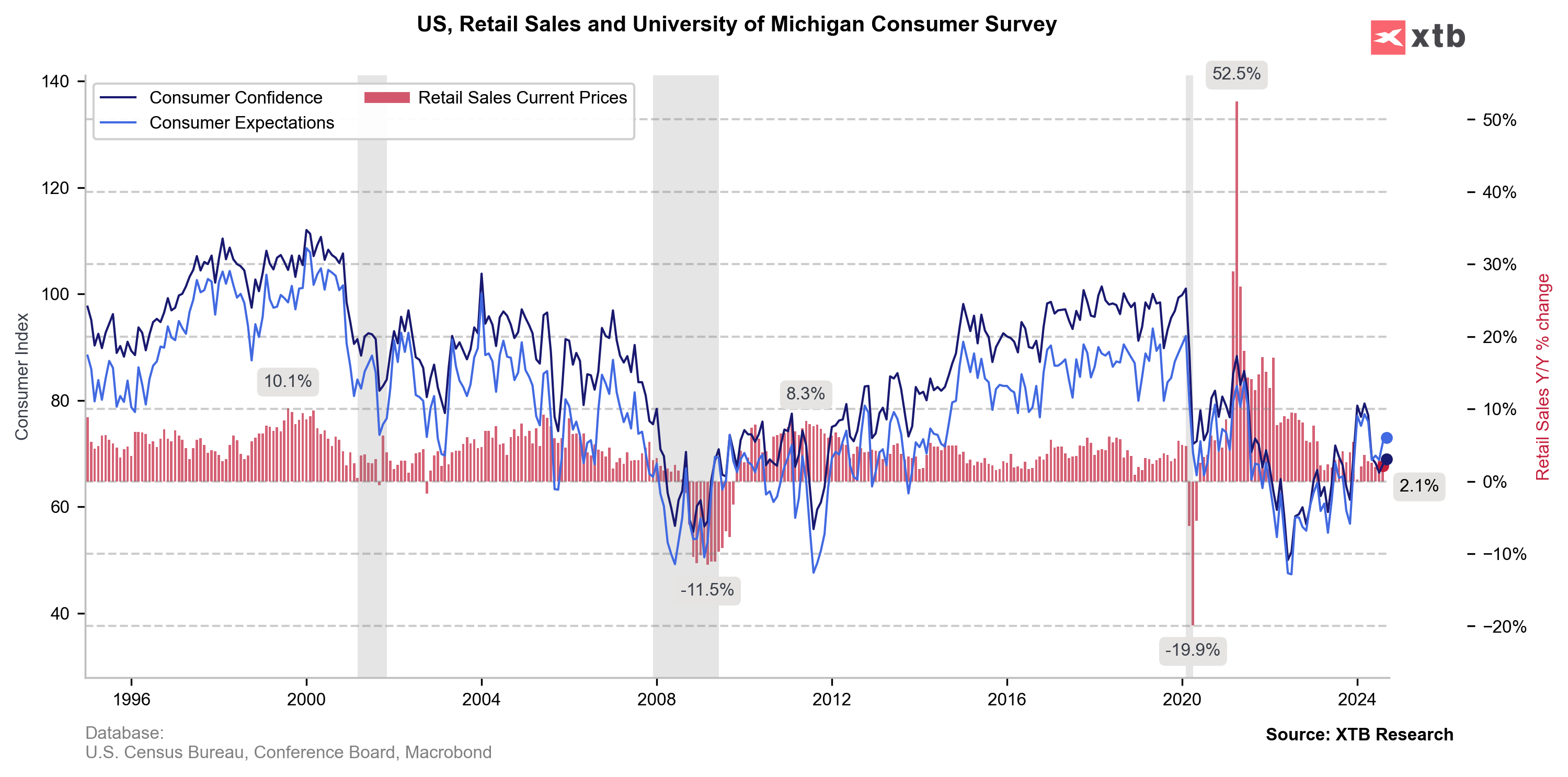

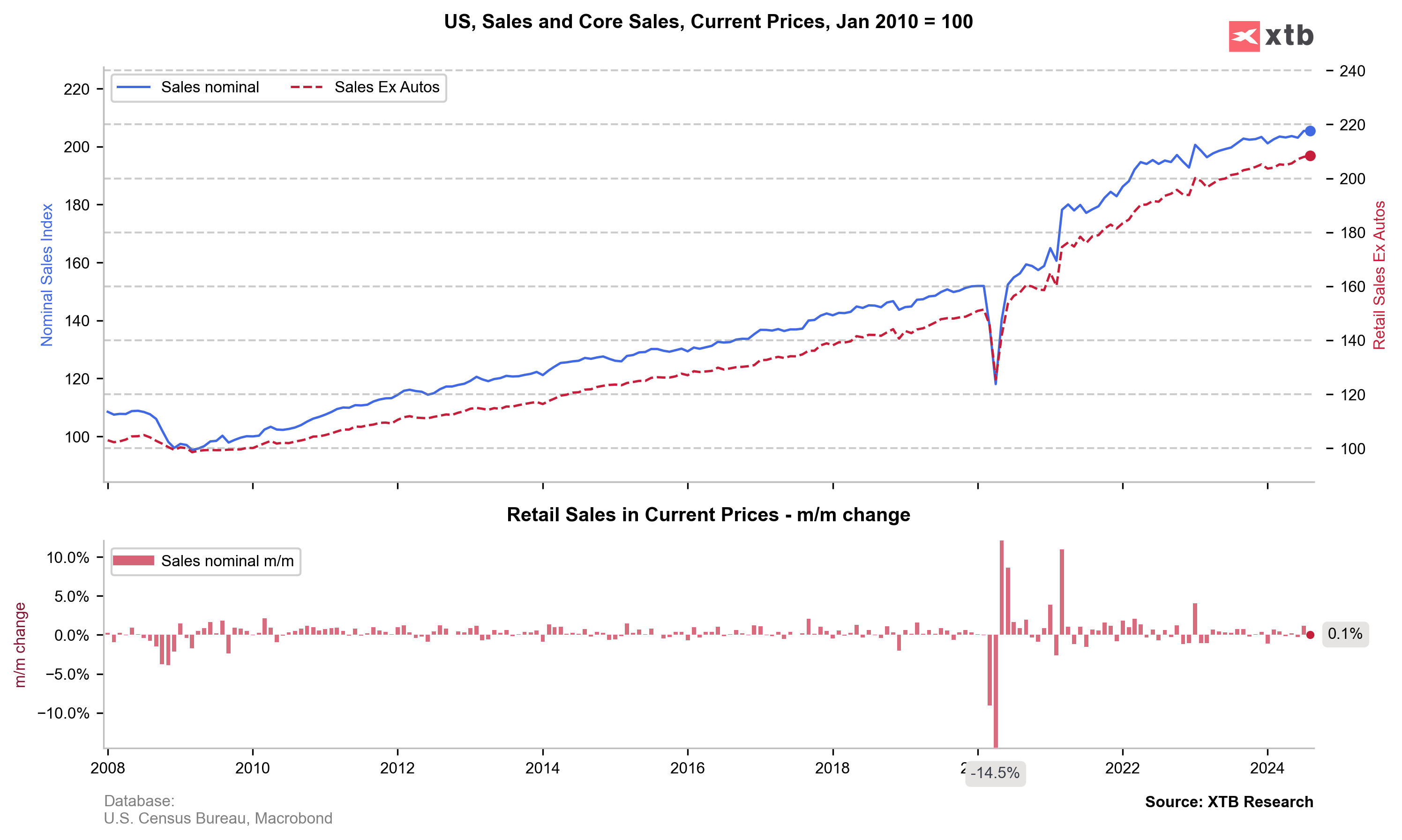

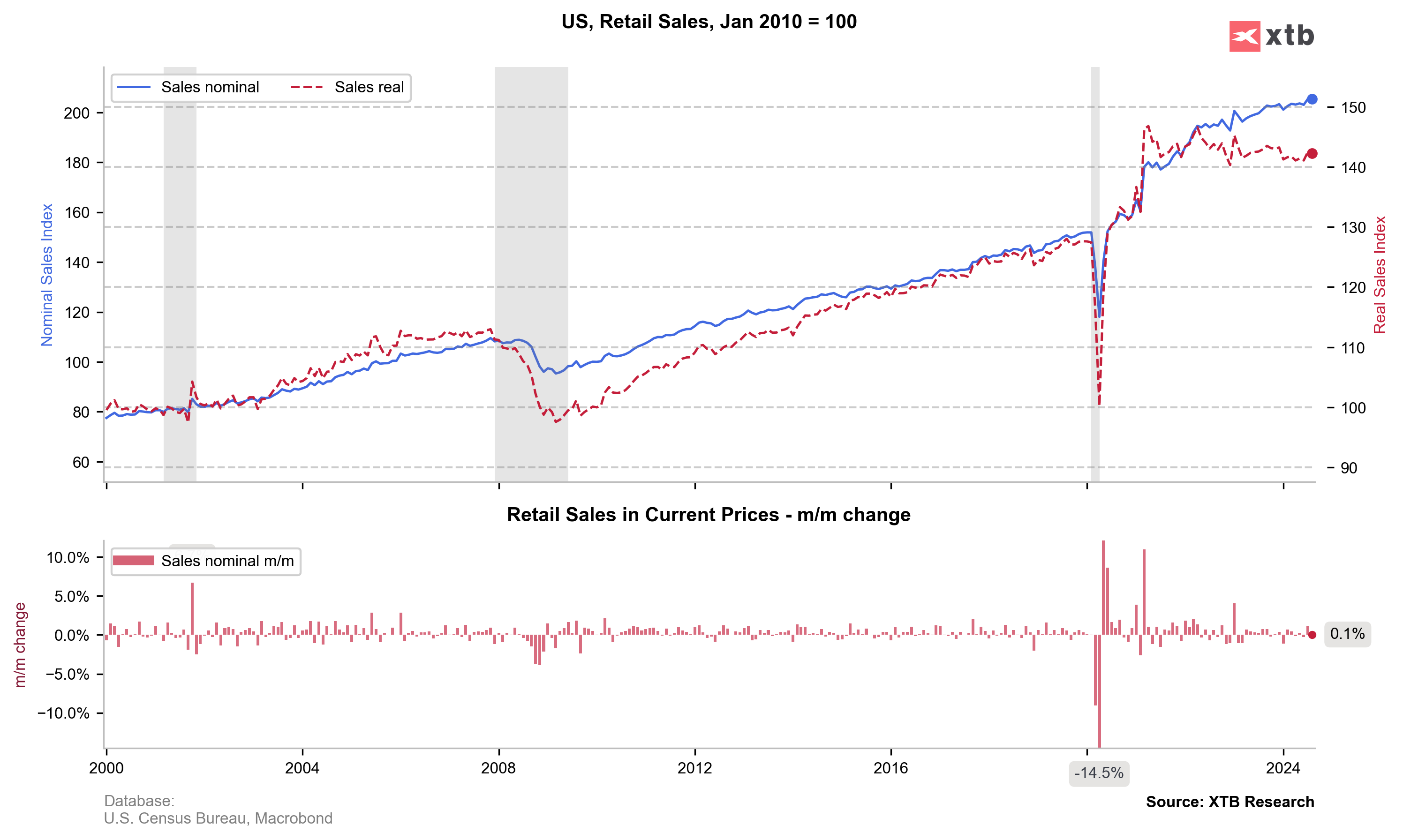

US retail sales data for August came in 0.1% MoM vs -0.2% exp. and 1% previously; revised to 1.1% (2.1% YoY vs 2.5% YoY previously)

- Core retail sales (ex-auto) came in 0.1% vs 0.2% exp. and 0.4% previously

Overall, today retail sales reading points to still solid demand across the US economy, and lower near-term recession odds. However, it may be a signal, that 50 bps cut may be too much on tomorrow's meeting. In the first reaction after the data, Nasdaq 100 futures (US100) gained, but erased some gains, as US dollar strengthened.

Source: Macrobond, XTB Reserach, Conference Board, US Census Bureau

Source: Macrobond, XTB Reserach, Conference Board, US Census Bureau

Source: US Census Bureau, Macrobond, XTB Research

Source: US Census Bureau, Macrobond, XTB Research

Source: XTB Research, US Census Bureau, Macrobond

Source: XTB Research, US Census Bureau, Macrobond

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report