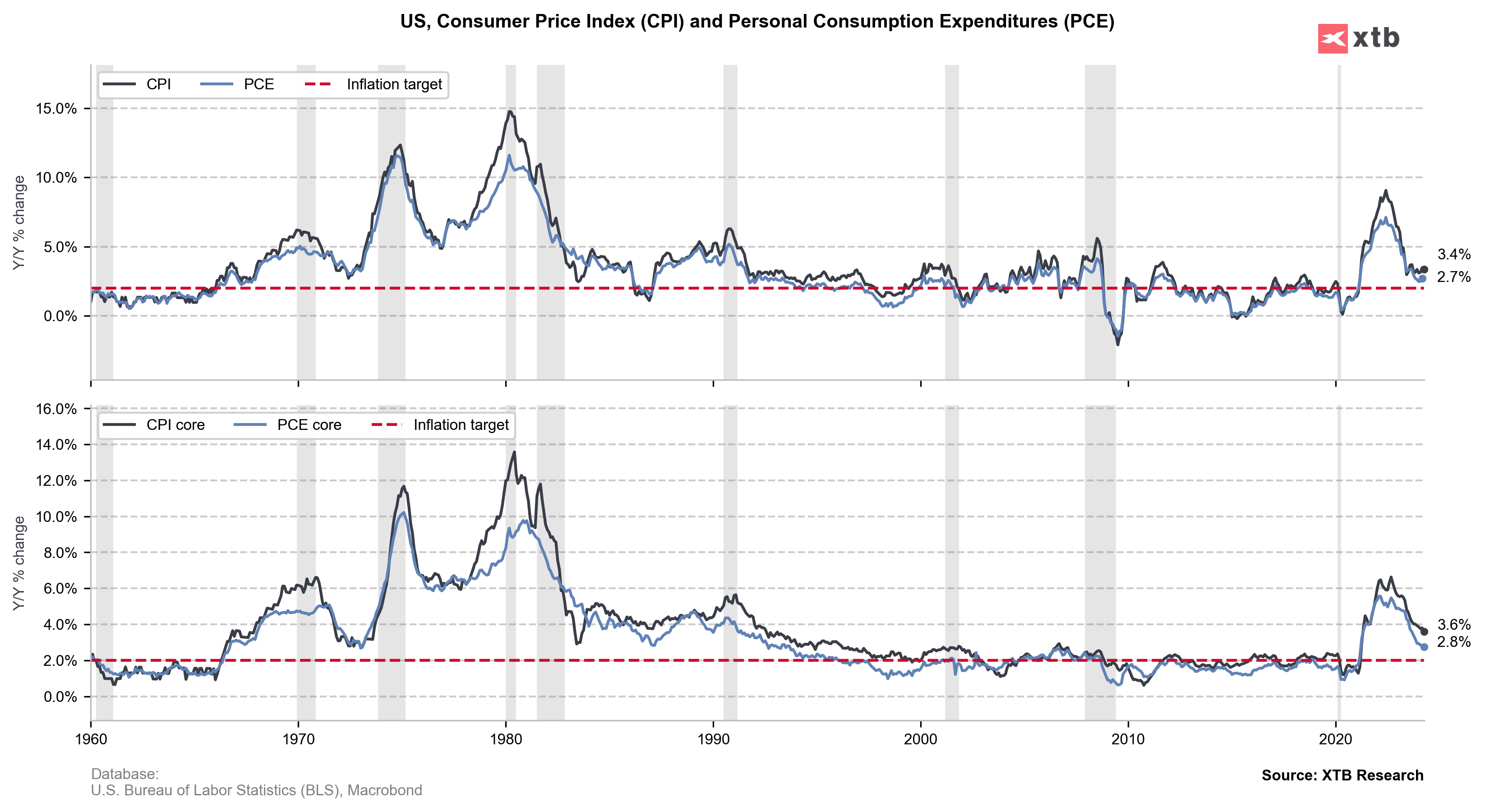

US PCE data (for April)

- Headline (annual). 2.7% Expected: 2.7% YoY. Previous: 2.7% YoY

- Headline (monthly). 0.25% Expected: 0.25% MoM. Previous: 0.3% MoM

- Core (annual). 2.8% Expected: 2.76% YoY. Previous: 2.8% YoY

- Core (monthly). 0.249% Expected: 0.25% MoM. Previous: 0.3% MoM

- US personal income. 0.3% Expected: 0.3% MoM. Previous: 0.5% MoM

- US consumer spending. 0.2% Expected: 0.3% MoM. Previous: 0.8% MoM

- US PCE real personal consumption. -0.1% Expected: 0.1% MoM. Previous: 0.5% previously MoM

US short-term interest-rate futures rise after US PCE data released. Traders are adding bets on Fed rate cuts. Data showed slowed spending and weakening real consumption may be a signal of slightly weakening consumers.

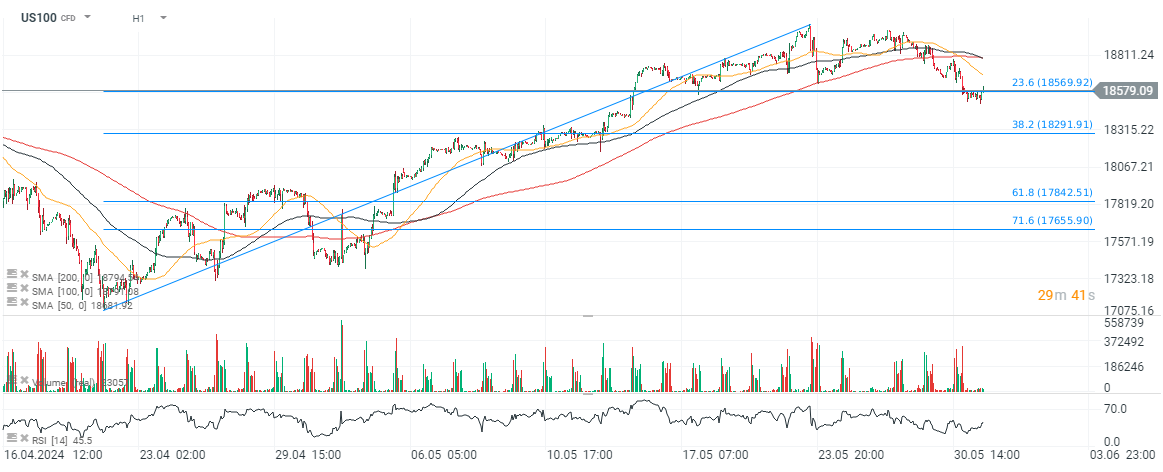

US100

Source: xStation5

Source: xStation5

Source: BLS, Macrobond

Source: BLS, Macrobond

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report