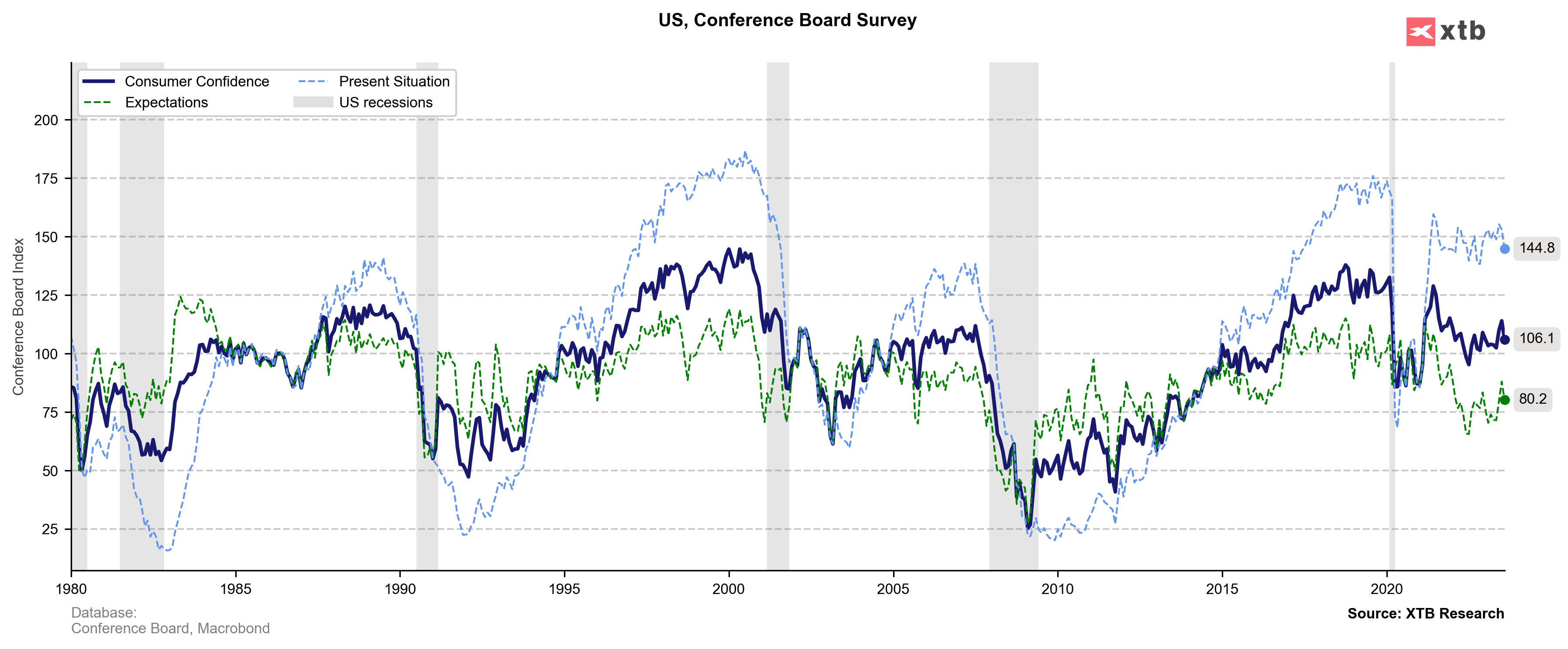

Conference Board consumer confidence index for August was released today at 3:00 pm BST. Data was expected to show a drop of the headline index to 116.1 from 117.0 reported in July. Actual report showed a much deeper drop with the index slumping to 106.1. Expectations subindex dropped to 80.2 while present situation subindex dropped to 144.8. JOTLS data on job openings released simultaneously came in much lower than expected and much lower than in previous month suggesting tightening of US labor market.

- Conference Board consumer confidence for August: 106.1 vs 116.1 expected (117.0 previously)

- JOLTS job openings: 8.827 million vs 9.500 million expected (9.582 million previously)

US dollar dropped in response to this data pack with EURUSD spiking to fresh daily high near 1.0840. Equity indices extended gains with US500 jumping above 4,460 pts mark.

EURUSD spiked to a fresh daily high after US data. Source: xStation5

EURUSD spiked to a fresh daily high after US data. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)