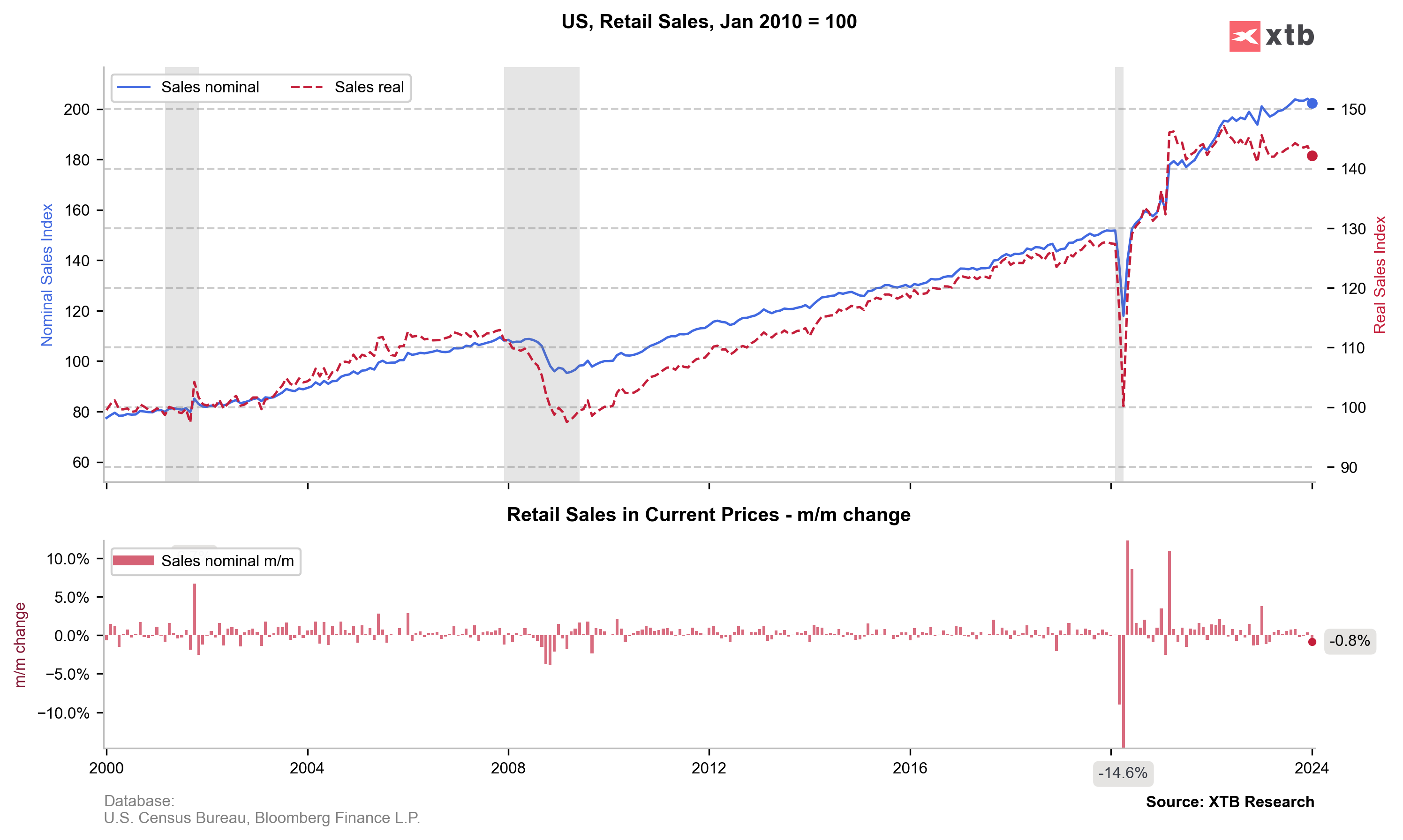

US retail sales report for January was released today at 1:30 pm GMT. This was the second most important US reading scheduled for this week, following US CPI data for January that was released on Tuesday. Report was expected to show a small drop in headline retail sales, as well as increases in core and core-core retail sales.

Actual report turned out to be a negative surprise, with data missing expectations all across the board. Data hints at weakness of US consumer and may be an argument for central bankers to opt for quicker rate cuts, therefore it can be described as dovish. Such was also the reaction of the market - USD dropped in a knee-jerk move while US equity index futures moved higher.

US, retail sales for January

- Headline: -0.8% MoM vs -0.1% MoM expected (+0.6% MoM previously)

- Ex-autos: -0.6% MoM vs +0.2% MoM expected (+0.4% MoM previously)

- Ex-autos & fuels: -0.5% MoM vs +0.2% MoM expected (+0.8% MoM previously)

- Control group: -0.4% MoM vs +0.2% MoM expected (0.8% MoM previously)

EURUSD jumped following disappointing US retail sales report and broke above the 200-hour moving average (purple line). Source: xStation5

EURUSD jumped following disappointing US retail sales report and broke above the 200-hour moving average (purple line). Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)