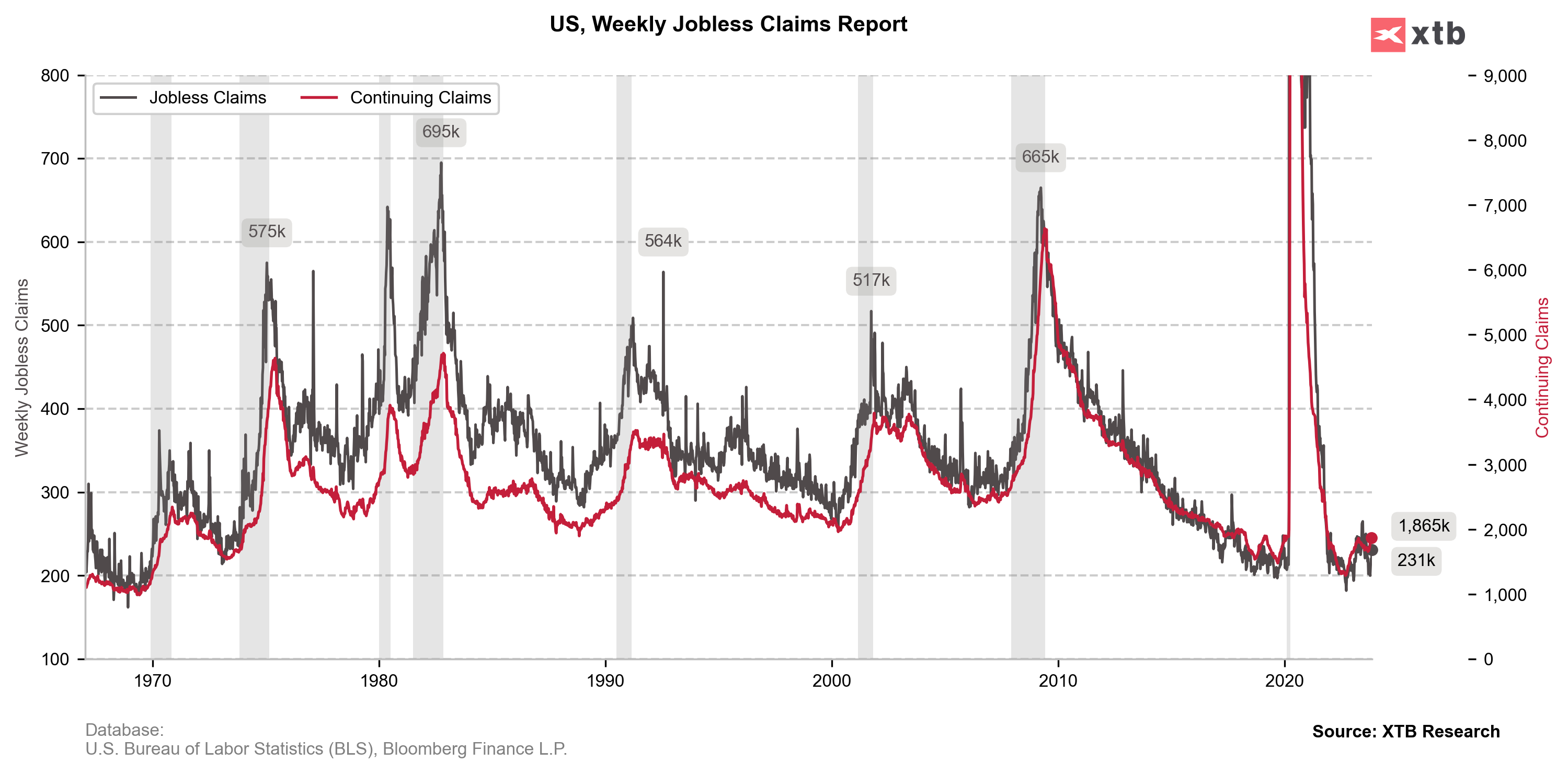

US jobless claims data was released today at 1:30 pm GMT. Reading was expected to show a slightly higher initial and continuing claims than a week ago. Actual data showed initial claims at 231k and continuing claims at 1.865 million - much higher than expected. Philadelphia Fed index that was released simultaneously showed an unexpected improvement from -9.0 to -5.9.

While both jobless claims and Philly Fed are considered second-tier data and market often looks past them without reacting in any significant way, today's reading was a different story. A much higher-than-expected jobless claims print triggered USD weakening with EURUSD reaching a fresh daily high slightly above 1.0860 mark. Gold and indices benefitted from USD weakness and moved higher.

US, jobless claims

- Initial jobless claims: 231k vs 220k expected (217k previously)

- Continuing claims: 1.865 million vs 1.845 million expected (1.834 million previously)

Philadelphia Fed index for November: -5.9 vs -9.0 expected (-9.0 previously)

Source: xStation5

Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)