A number of reports from the United States was released at 3:00 pm BST today. Conference Board was the most closely watched one and was expected to show a slightly deterioration compared to August. Actual report showed a bigger-than-expected drop from 106.1 to 103.0. Apart from CB data, investors were also offered Richmond Fed index for September and new home sales data for August. The former turned out to be a positive surprise while new home sales data came in slightly lower than expected.

Conference Board consumer confidence index for September

- 103.0 vs 105.5 expected (106.1 previously)

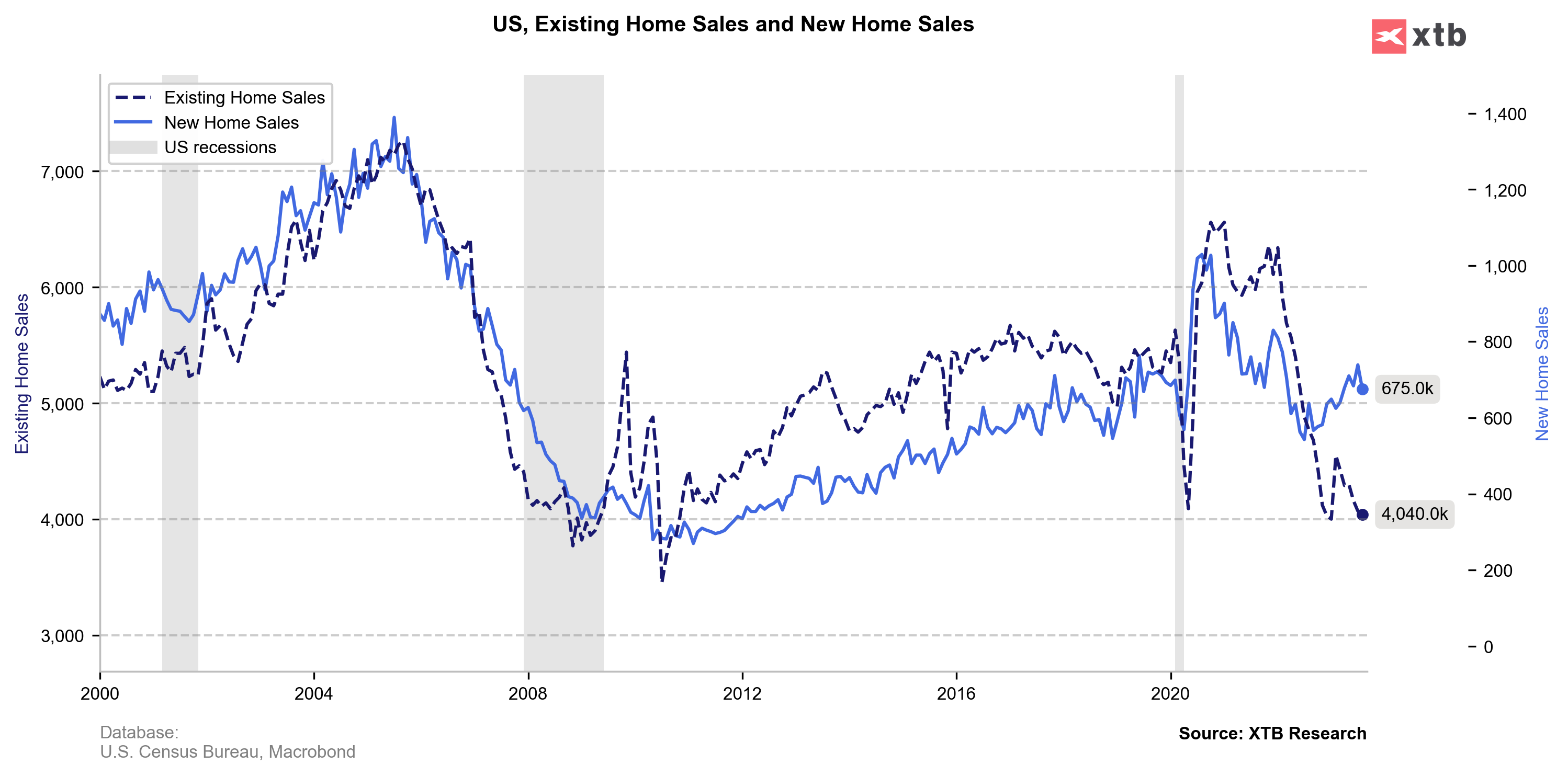

New home sales for August

- 675k vs 700k expected (714k previously)

Richmond Fed index for September

- +5 vs -6 expected (-7 previously)

USD took a hit following data release. However, market reaction was minimal with EURUSD moving up around 0.05% in the first minutes of trade while USDJPY dropped around 0.1%. Stock markets ignored the data.

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report