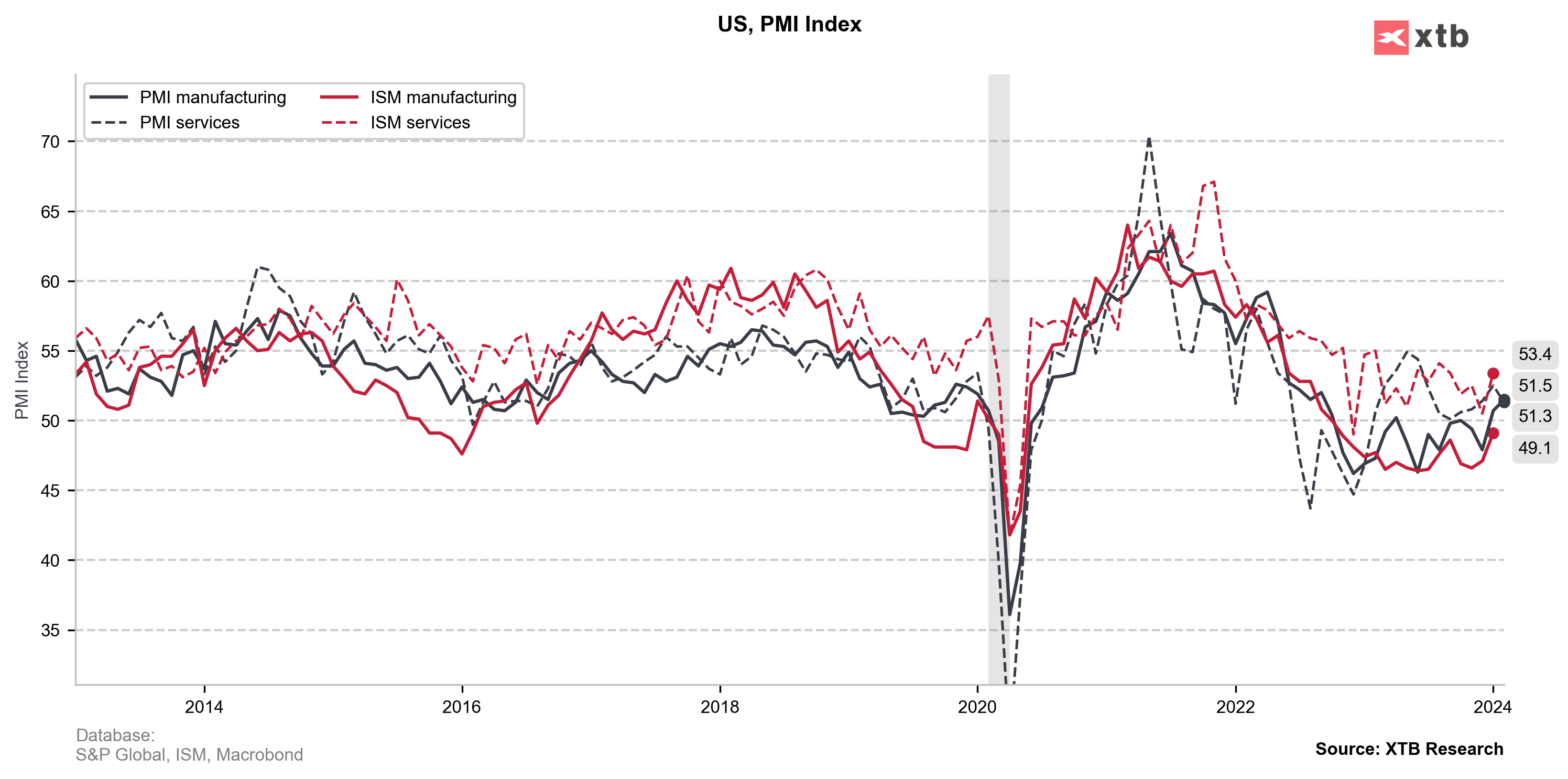

US flash PMI indices for February were released today at 2:45 pm GMT. Market was expecting a small deterioration in manufacturing and services sectors. However, both indices were expected to remain above 50 pts threshold indicating expansion.

Actual report turned out to be mixed - services index missed expectations while manufacturing index beat expectations. Services miss outweigh manufacturing beat and led to a miss in composite index.

USD weakened following the release with EURUSD bouncing off the 1.08 area. Wall Street indices continue to gain after a solid earnings report from Nvidia push company's stock over 10% higher and supported market sentiment.

US, flash PMI indices for February

- Manufacturing: 51.5 vs 50.5 expected (50.7 previously)

- Services: 51.3 vs 52.0 expected (52.5 previously)

- Composite: 51.4 vs 51.8 expected (52.0 previously)

Source: xStation5

Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀