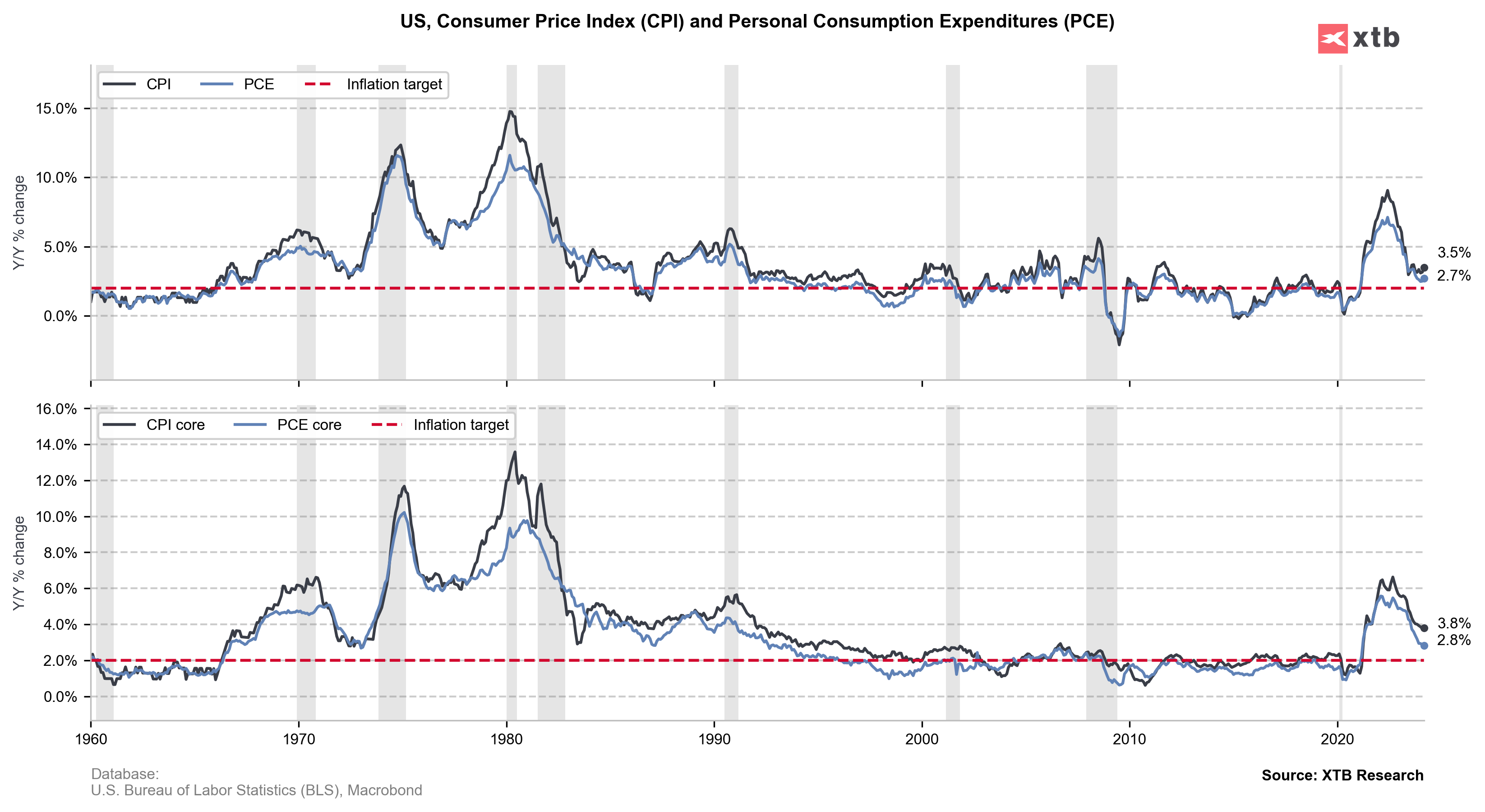

A monthly data pack for March from the United States, including PCE inflation, was released today at 1:30 pm BST. Report was closely watched as PCE is Fed's preferred measure of inflation and the next rate decision of US central bank is scheduled for Wednesday next week. Market was expecting a small acceleration in headline PCE as well as small deceleration in core PCE. Personal income growth was expected to accelerate compared to a month ago, while personal spending growth was expected to slow.

Actual report turned out to be a hawkish surprise, with headline accelerating more than expected and core PCE holding unchanged. However, data matched expectations on a month-over-month basis. Personal income grew 0.5% MoM, in-line with expectations, while personal spending increased 0.8% MoM, more than expected.

US, data pack for March

- Headline PCE (annual): 2.7% YoY vs 2.6% YoY expected (2.5% YoY previously)

- Headline PCE (monthly): 0.3% MoM vs 0.3% MoM expected (0.3% MoM previously)

- Core PCE (annual): 2.8% YoY vs 2.7% YoY expected (2.8% YoY previously)

- Core PCE (monthly): 0.3% MoM vs 0.3% MoM expected (0.3% MoM previously)

- Personal income: 0.5% MoM vs 0.5% MoM expected (0.3% MoM previously)

- Personal spending: 0.8% MoM vs 0.6% MoM expected (0.8% MoM previously)

In spite of the data being slightly hawkish, US dollar dropped in a knee-jerk move, with EURUSD jumping around 0.2%. However, around half of the move has been erased already. Equity indices, like US500, moved higher.

Source: xStation5

Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)