US CPI inflation data for April, a key macro release of the day, was published at 1:30 pm BST today. Report was expected to show deceleration in core gauge to resume with annual core CPI inflation dropping from 5.6 to 5.5% YoY. Actual data has confirmed those expectations with monthly and annual core CPI coming in-line with expectations. However, annual headline CPI was expected to stay unchanged at 5.0% YoY in April but instead it dropped to 4.9% YoY. As it can be seen as a dovish development - it was enough to provide Wall Street index futures with a lift while pushing USD lower at the same time.

US CPI report for April

- Headline (annual): 4.9% YoY vs 5.0% YoY expected (5.0% YoY previously)

- Headline (monthly): 0.4% MoM vs 0.4% MoM expected (0.1% MoM previously)

- Core (annual): 5.5% YoY vs 5.5% YoY expected (5.6% YoY previously)

- Core (monthly): 0.4% MoM vs 0.4% MoM expected (0.4% MoM previously)

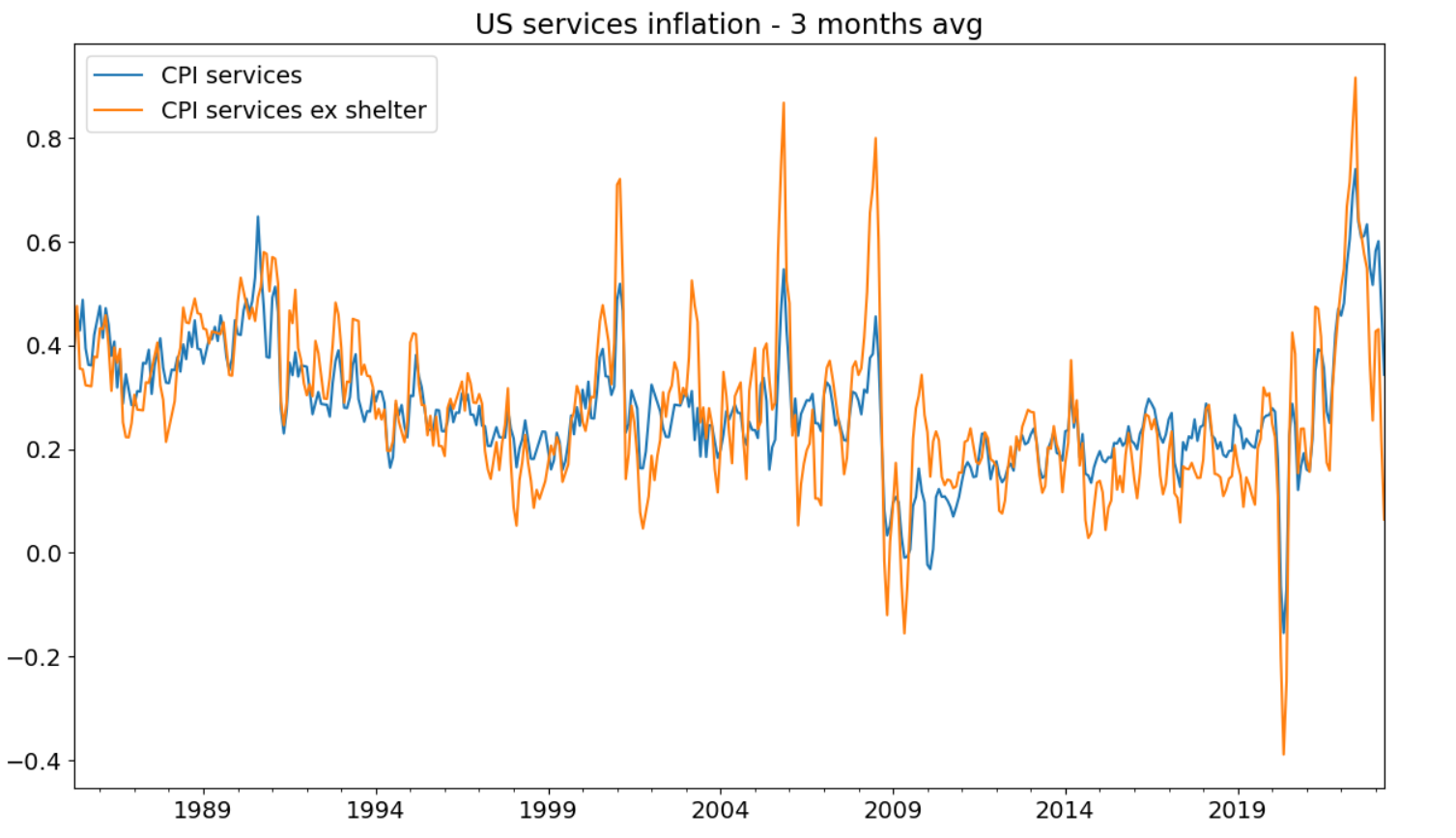

US services inflation excluding shelter increased just 0.1% MoM and a 3-month average is dropping quickly, what can be seen as good news. Source: Macrobond, XTB

EURUSD surged after US CPI data and painted a daily high just a touch below 1.0990 mark. Source: xStation5

EURUSD surged after US CPI data and painted a daily high just a touch below 1.0990 mark. Source: xStation5

US500 rallied to a fresh daily high above 4,150 pts following US CPI data. Source: xStation5

US500 rallied to a fresh daily high above 4,150 pts following US CPI data. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)