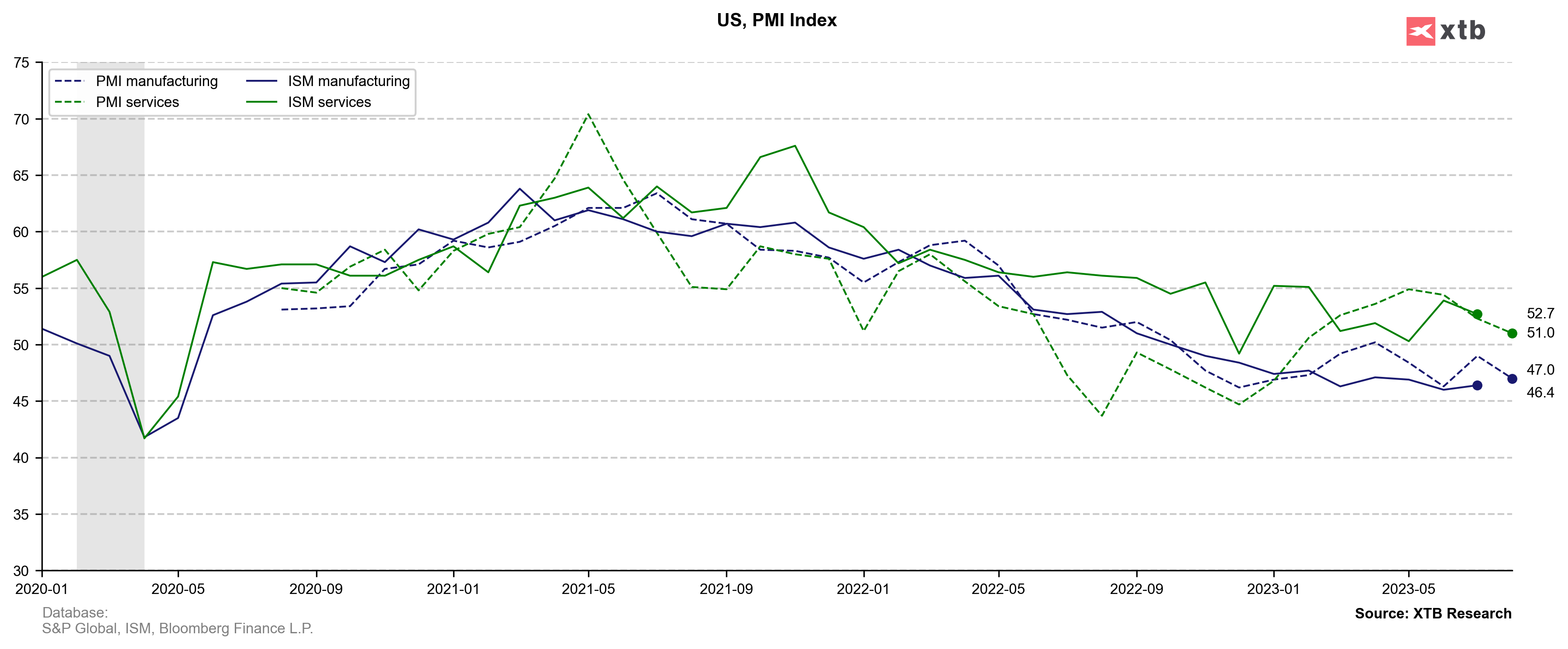

Flash PMI indices from the United States for August were released today at 2:45 pm BST. Report was expected to show a small improvement in the manufacturing sector index as well as a small deterioration in the services gauge.

However, actual data was more in-line with the tone set by European PMIs earlier today and also missed expectations. Manufacturing index disappointed the most as it dropped from 49.3 to 47.0. On a positive note, it should be said that while services index missed expectations, it managed to stay above 50 points expansion/contraction threshold (unlike European services PMIs).

Nevertheless, it was a dovish reading from Fed's point of view and markets react accordingly - USD drops and equities gain.

US, flash PMI indices for August

- Manufacturing: 47.0 vs 49.3 expected (49.0 previously)

- Services: 51.0 vs 52.2 expected (52.3 previously)

- Composite: 50.4 vs 51.5 expected (52.0 previously)

EURUSD jumped following US PMI miss and has now recovered more than half of the losses made following the release of disappointing PMIs from Europe earlier today. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report