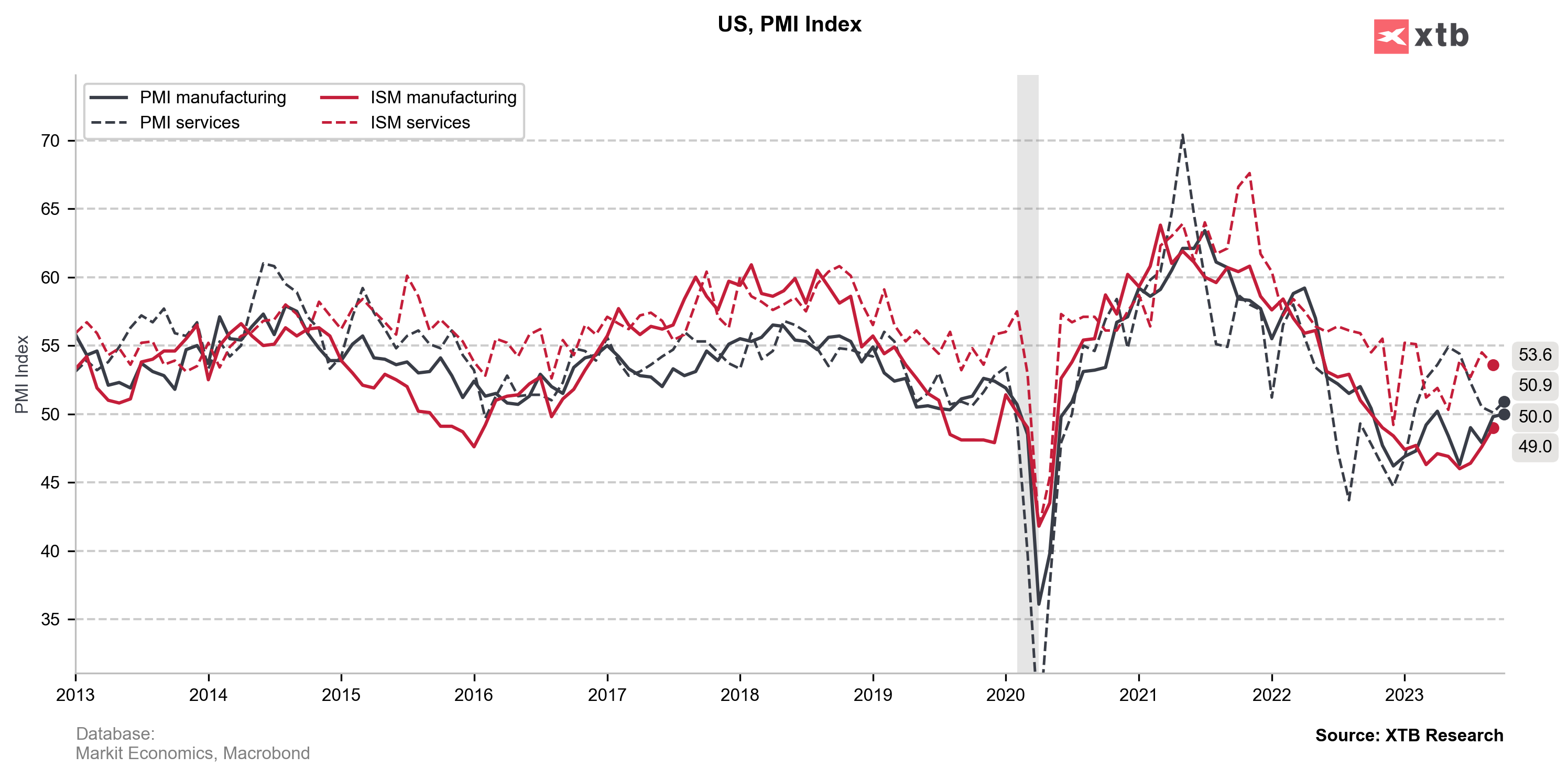

Flash PMI indices from the United States for October were published at 2:45 pm BST today. Report was expected to show a deterioration in manufacturing and services sectors compared to September's data. Moreover, services index was expected to drop below 50 pts expansion-contraction threshold.

Actual report turned out to be a positive surprise with both indices beating expectations. US manufacturing and services sectors are back in expansion territory following data for October. USD gained following the release with EURUSD testing the 1.06 area. US equity indices dropped with US500 dropping around 0.2% in a knee-jerk move.

US, PMI indices for October

- Manufacturing: 50.0 vs 49.5 expected (49.8 previously)

- Services: 50.9 vs 49.9 expected (50.1 previously)

- Composite: 51.0 vs 50.2 previously

Source: xStation5

Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)