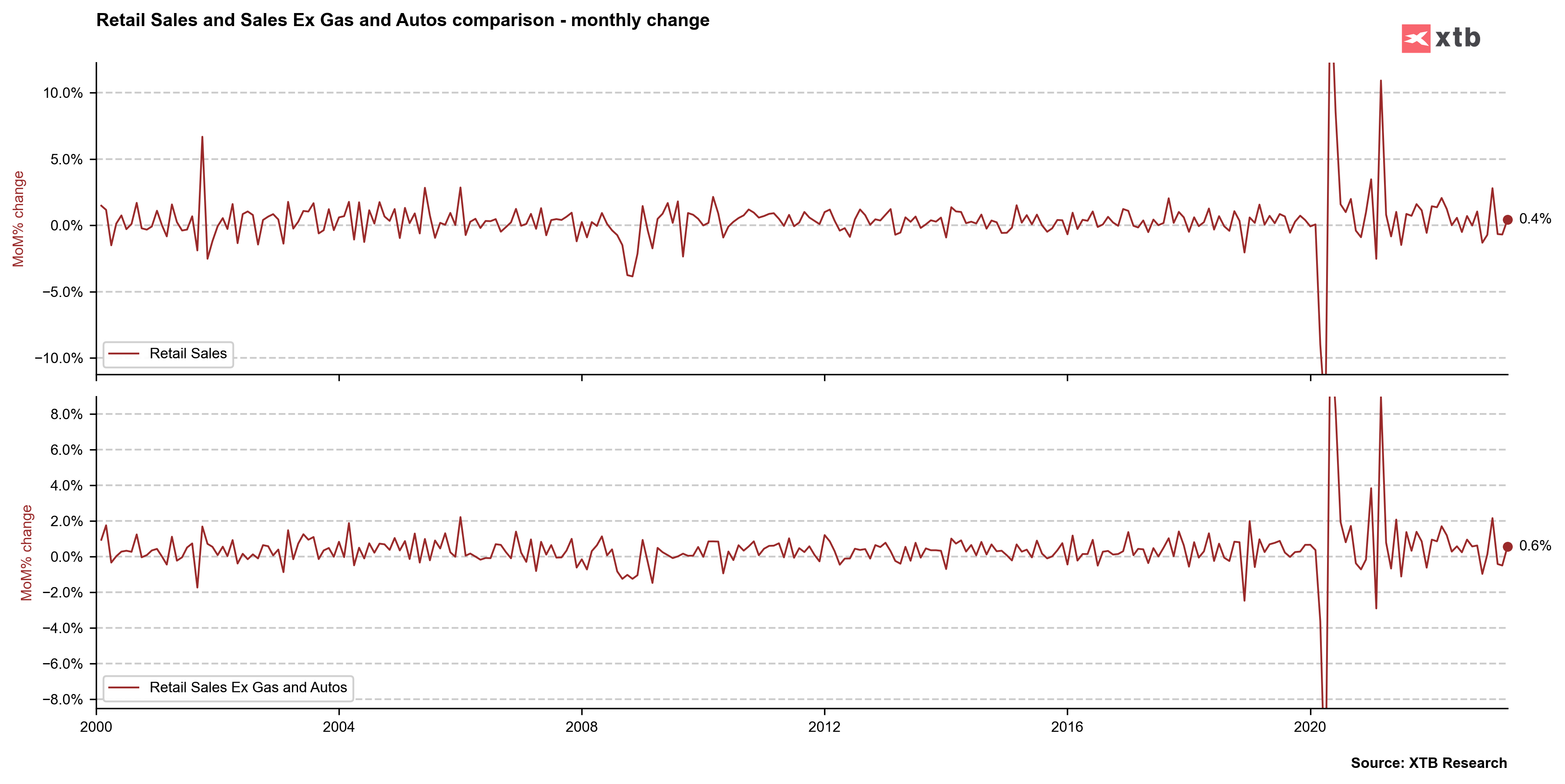

US retail sales data for April was a key macro event of the day and was released at 1:30 pm BST. Report was expected to show US retail sales rebounding in April, following a drop across all major measures in March. Report indeed showed monthly increase in retail sales but data itself can be seen as mixed - headline retail sales increased less than expected, core retail sales (ex-autos) increased in-line with expectations while core-core retail sales (ex-autos and gas) increased more than expected.

- Retail sales: 0.4% MoM vs 0.8% MoM expected (-1.0% MoM Previously)

- Retail sales ex-auto: 0.4% MoM vs 0.4% MoM expected (-0.8% MoM previously)

- Retail sales ex-auto and gas: 0.6% MoM vs 0.2% MoM expected (-0.3% MoM previously)

- Control group: 0.7% MoM vs 0.4% MoM expected (-0.3% MoM previously)

USD gained in response to the release. EURUSD dropped below a short-term support zone in the 1.0880 area and tested 1.0870 area later on. However, part of the move has been erased already. Equity indices were mixed in the first minutes following the release.

Source: xStation5

Source: xStation5

US retail sales increased following two months of declines. Source: Macrobond, XTB

US retail sales increased following two months of declines. Source: Macrobond, XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)