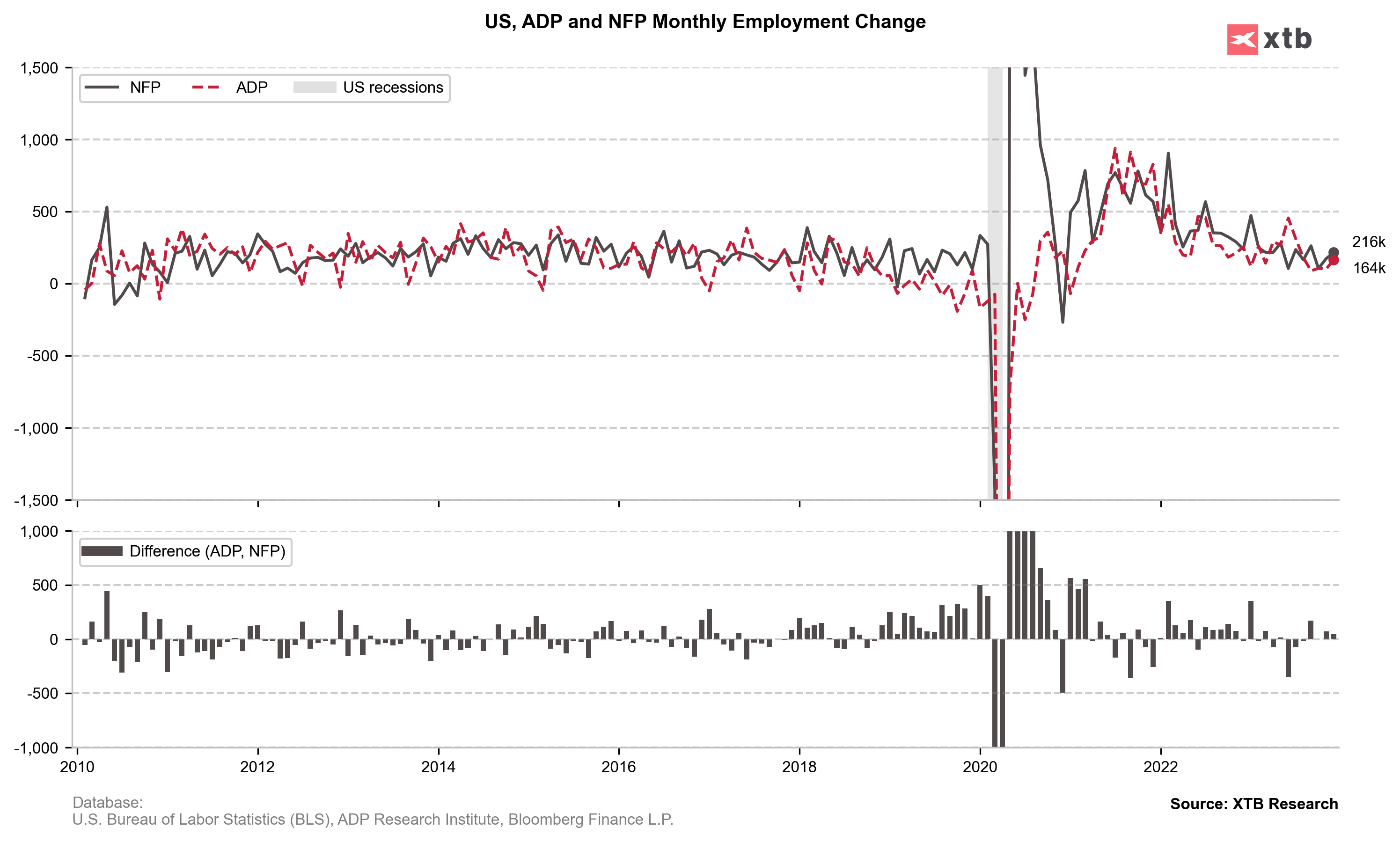

US NFP report for December 2023 was released at 1:30 pm GMT, and it was a key macro release of the day, as well as the whole week. Report was expected to show a smaller employment gain than in November, as well as an uptick in the unemployment rate. Wage growth was expected to slow. A point to note is that the ADP employment report released yesterday this week turned out to be better-than-expected and showed the biggest increase in private employment since August.

Actual report showed turned out to be a positive surprise - employment growth turned out to be higher than expected, unemployment rate stayed unchanged and wage growth turned out to be faster-than-expected. Such data is clearly 'hawkish' and markets reacted accordingly - USD gained while equities pulled back. Declines were also spotted on the precious metals market. Money markets are now pricing in a roughly 50-50 chance of Fed delivering the first rate cut at March meeting, down from over-80% earlier this week.

US, NFP report for December

- Non-farm payrolls: 216k vs 170k expected (199k previously)

- Private payrolls: 164k vs 130k expected (150k previously)

- Unemployment rate: 3.7% vs 3.8% expected (3.7% previously)

- Wage growth (annual): 4.1% YoY vs 3.9% YoY expected (4.0% YoY previously)

- Wage growth (monthly): 0.4% MoM vs 0.3% MoM expected (0.4% MoM previously)

EURUSD took a dive following NFP data release and dropped to the lowest level since December 14, 2023. However, declines were halted at the 61.8% retracement of the upward move launched on December 8, 2023. Source: xStation5

EURUSD took a dive following NFP data release and dropped to the lowest level since December 14, 2023. However, declines were halted at the 61.8% retracement of the upward move launched on December 8, 2023. Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀