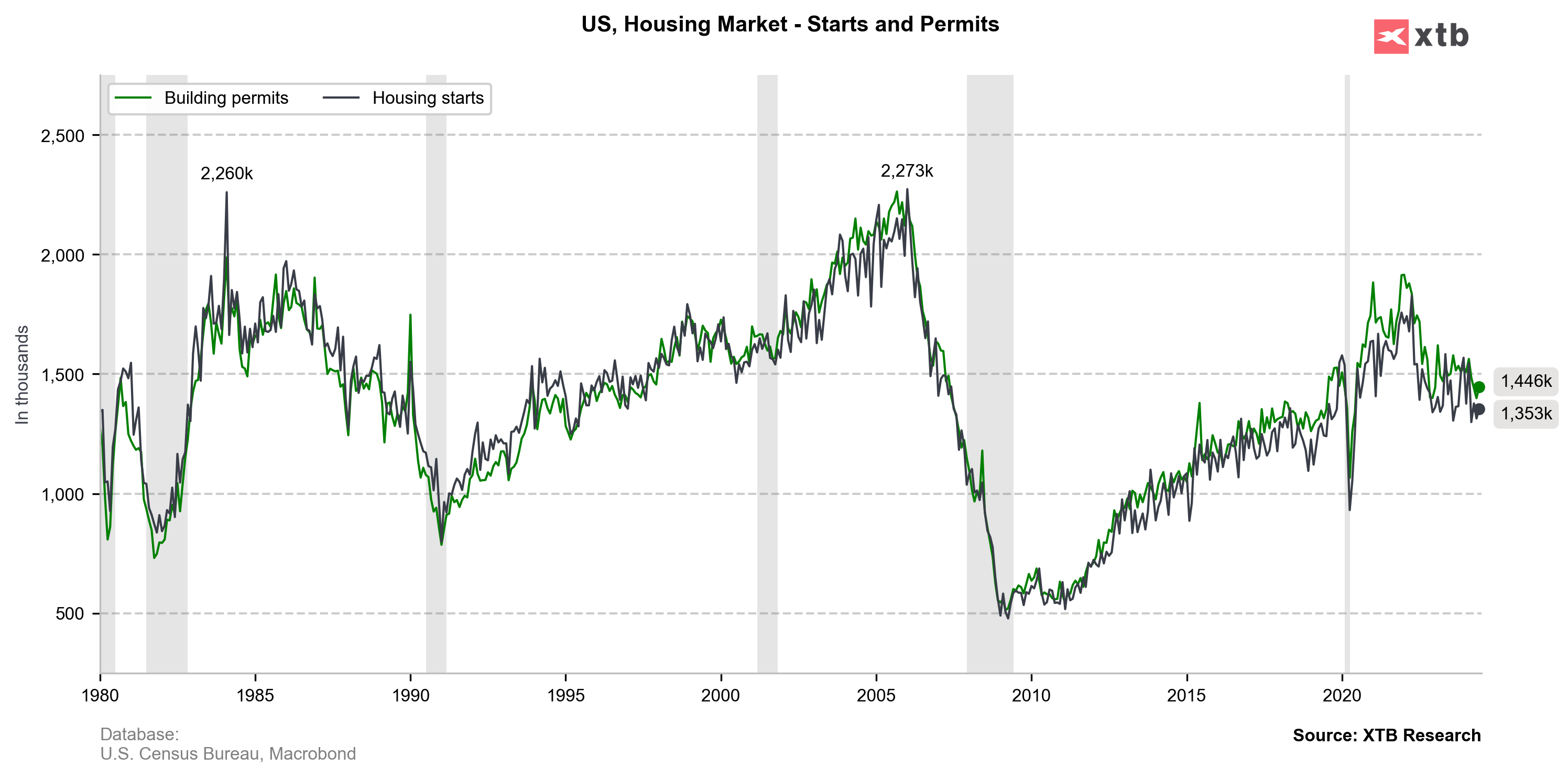

US housing market data for June was released today at 1:30 pm BST. Report was expected to show building permits staying virtually unchanged compared to May, while housing starts were expected to increase slightly.

Actual report turned out to be a positive surprise showing monthly increases of 3% and 3.4% in housing starts and buildings permits respectively. Improvement in housing market data may be to some extent driven by improved sentiment due to expectations of a cut in interest rates, which should support credit action.

In spite of solid beat in housing market data, USD has been rather muted in response to the release.

US, housing market data for June

- Building permits (nominal): 1446k vs 1395k expected (1399k previously)

- Building permits (change) +3.4% MoM vs +0.1% MoM expected (-2.8% MoM previously)

- Housing starts (nominal): 1353k vs 1300k expected (1277k previously)

- Housing starts (change): +3.0% MoM vs +1.8% MoM expected (-5.5% MoM previously)

EURUSD has barely experienced any move after release of better-than-expected US housing market data for June. Source: xStation5

EURUSD has barely experienced any move after release of better-than-expected US housing market data for June. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS