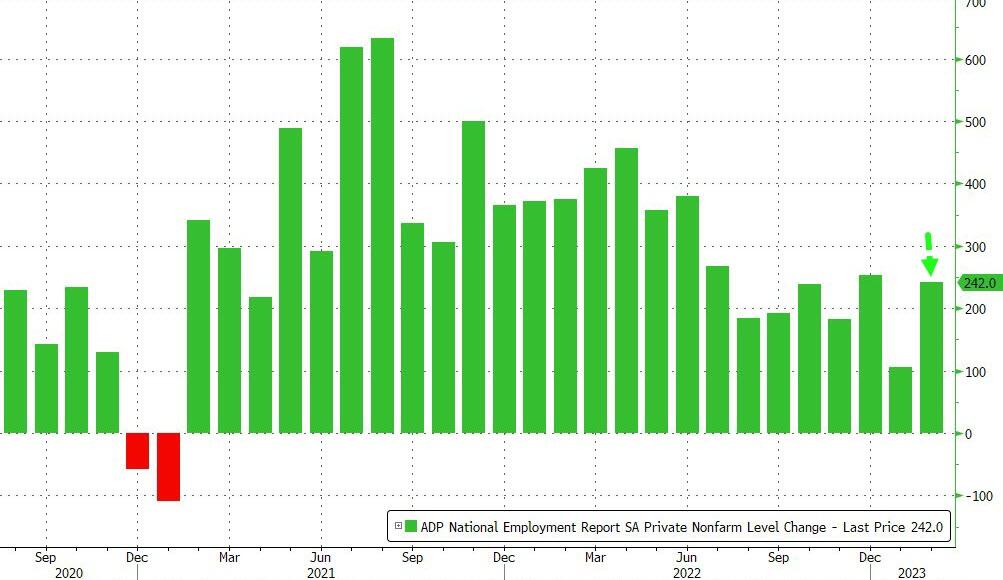

ADP employment report for February was released today at 1:15 pm GMT. As a final hint ahead of the NFP release this Friday (1:30 pm GMT), the report was closely watched by investors. Data showed an employment gain of 242k, from upwardly revised 119k (initial106 k) in the previous month and well above market expectations of 200k.

The services sector added 190K jobs, led by leisure and hospitality (83K), financial activities (62K), education/health services (35K), information (9K) and trade/transportations and utilities (3K) while the professional/business industry shed 36K jobs. Meanwhile, the goods-producing industry added 52K jobs due to manufacturing (43K) and mining (25K) while construction lost 16K.

-

Annual pay increase of job stayers +7.2% vs +7.3% prior

-

Pay increase of job changers +14.3% vs +15.4% prior

Details of today's publication. Source: ADP

"There is a tradeoff in the labor market right now," said Nela Richardson, chief economist, ADP. "We're seeing robust hiring, which is good for the economy and workers, but pay growth is still quite elevated. The modest slowdown in pay increases, on its own, is unlikely to drive down inflation rapidly in the near-term."

ADP rebounded sharply last month, which was accompanied by slowing wage growth. Source: Bloomberg via ZeroHedge

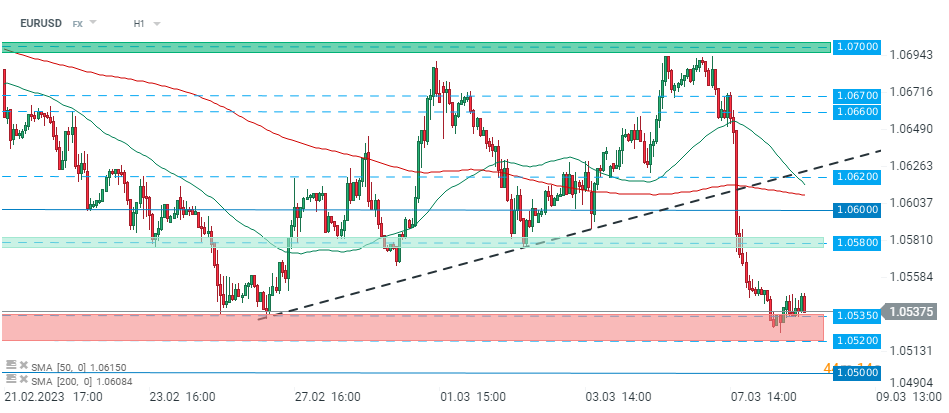

Today's reading signals that the labour market is still tight and raises bets that the FED will continue the tightening process in the near future. US futures pulled back, while USD appreciated after publication of today's data.

EURUSD pair pulled back towards support at 1.0535. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS