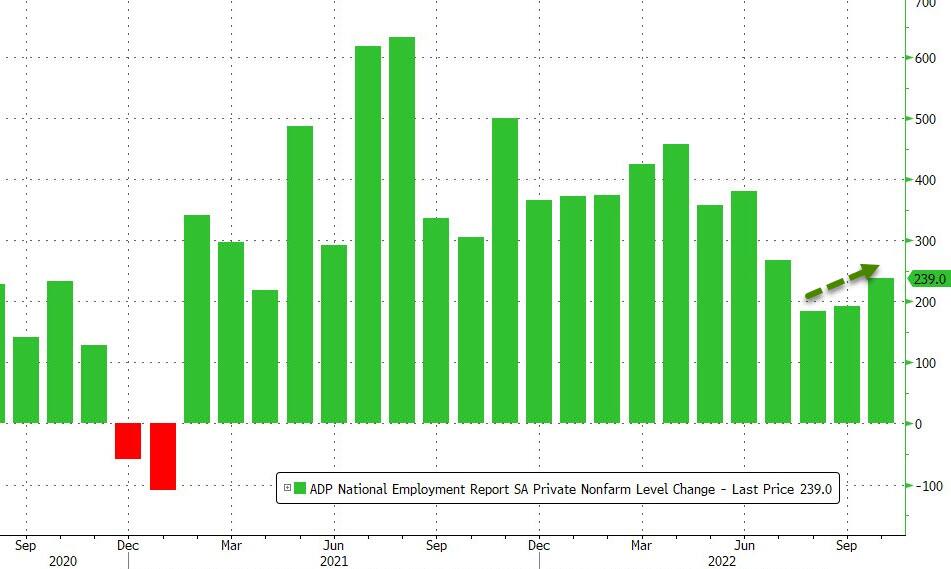

ADP employment report for October was released today at 12:15 pm GMT. As a final hint ahead of the NFP release this Friday (12:30 pm GMT), the report was closely watched by investors. However, as today is also a FOMC decision day (6:00 pm BST), one should not be surprised by the lack of major reaction to the news. Report showed an solid employment gain of 239k, well above market expectations of 195k. Today's data shows that the US labor market is still strong, which is lowering chances of FED pivot.

The services-providing sector created 247K jobs, with most significant gain in the leisure/hospitality (210K) and trade/transportation/utilities (84K) while a decline was seen in information (-17K); professional/business (-14KK); financial activities (-10K); education/health (-5K). Also, the goods sector shed 8K jobs, mainly due to manufacturing (-20K). Most workplaces were created by small and medium businesses.

ADP wage growth indicator retracted last month:

- Job-stayers 7.7%, vs Sept 7.8%

- Job-changers 15.2% vs Sept 15.7%

"This is a really strong number given the maturity of the economic recovery but the hiring was not broad-based," said Nela Richardson, chief economist, ADP. "Goods producers, which are sensitive to interest rates, are pulling back, and job changers are commanding smaller pay gains. While we're seeing early signs of Fed-driven demand destruction, it's affecting only certain sectors of the labor market."

Similar to recent JOLTS data ,a fresh ADP report showed an improvement, indicating that the US economy remains resilient despite aggressive FED tightening. Source: Bloomberg

Similar to recent JOLTS data ,a fresh ADP report showed an improvement, indicating that the US economy remains resilient despite aggressive FED tightening. Source: Bloomberg

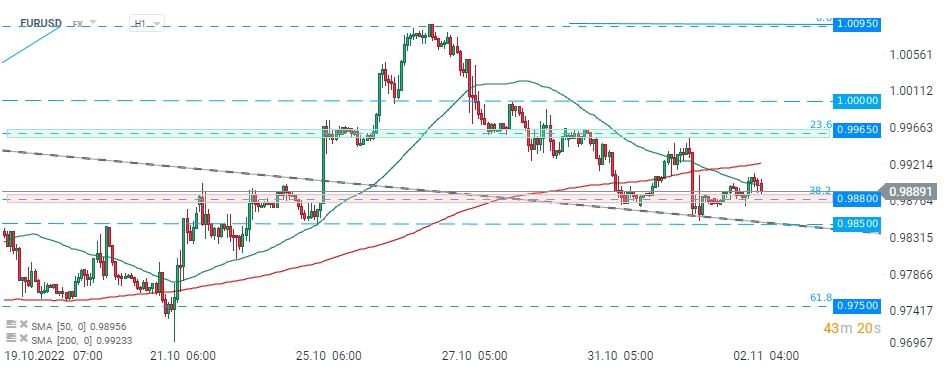

EURUSD saw a relatively small reaction to today’s data inflation release. The most popular currency pair approaches local support at 0.9880 level. Source: xStation5

EURUSD saw a relatively small reaction to today’s data inflation release. The most popular currency pair approaches local support at 0.9880 level. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS