US PPI inflation report for March was released today at 1:30 pm BST. Report was expected to show an acceleration in the headline as well as core producers' inflation. However, as we have already received CPI data for March, PPI report was expected to have little impact on the markets.

Actual report turned out to be mixed - headline inflation accelerated less than expected while core inflation accelerated more than expected. A miss in headline inflation seems to be outweighting a beat in core measure, with US dollar moving lower following the release.

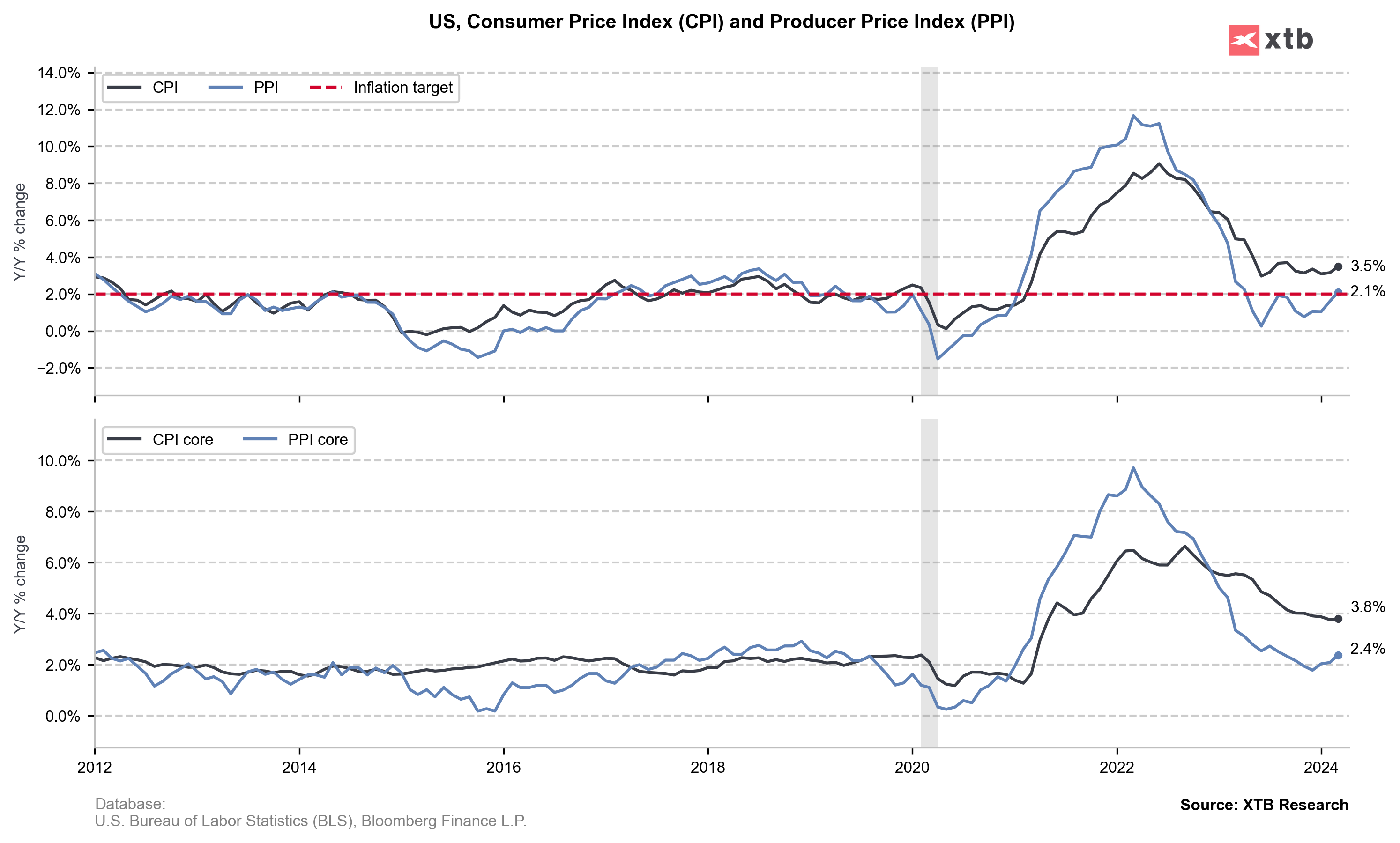

US, PPI inflation for March

- Headline (annual): 2.1% YoY vs 2.2% YoY expected (1.6% YoY previously)

- Headline (monthly): 0.2% MoM vs 0.3% MoM expected (0.6% MoM previously)

- Core (annual): 2.4% YoY vs 2.3% YoY expected (2.0% YoY previously)

- Core (monthly): 0.2% MoM vs 0.2% MoM expected (0.3% MoM previously)

Source: xStation5

Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)