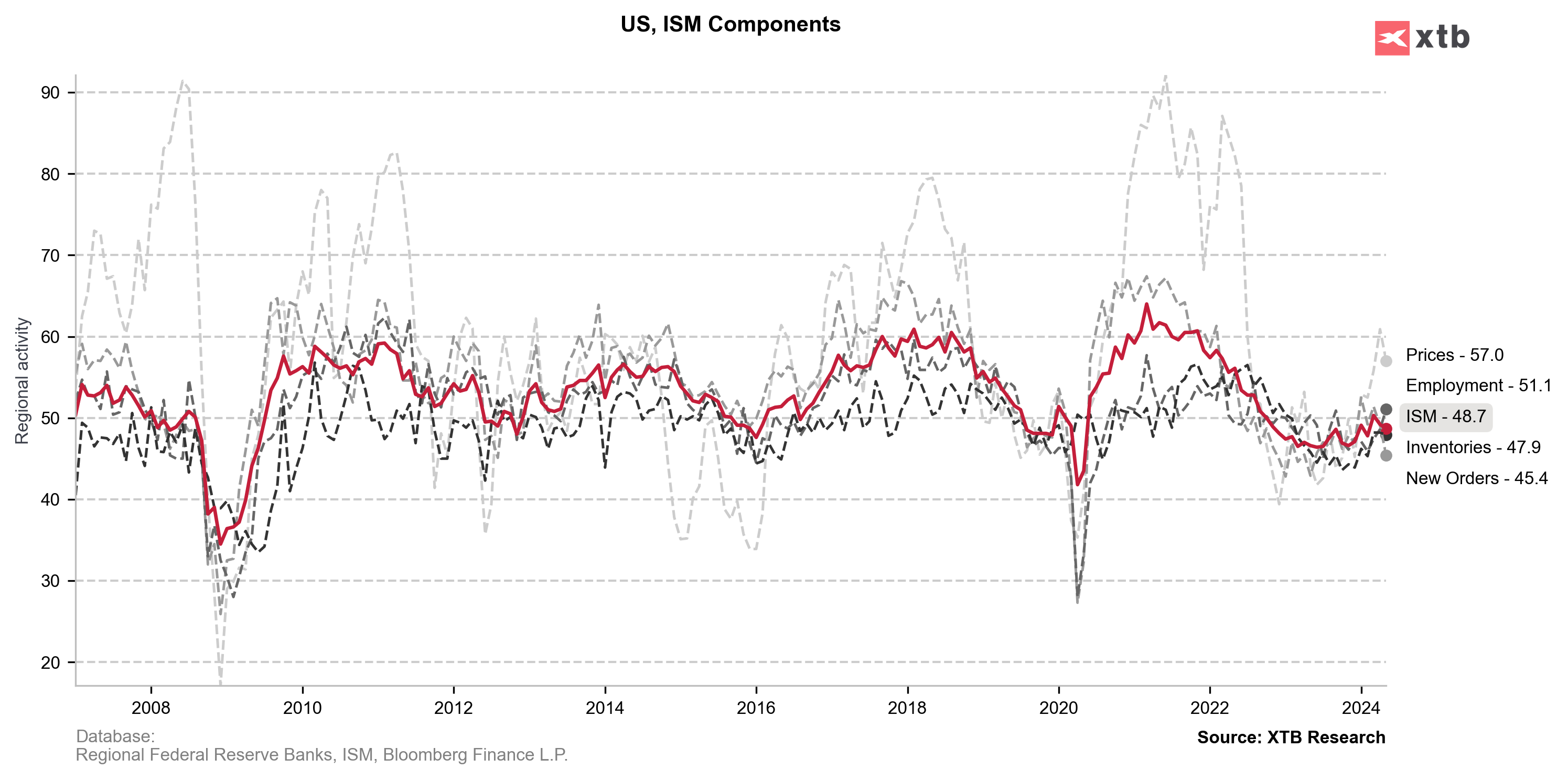

US ISM manufacturing data for May was released today at 3:00 pm BST. Report was expected to show headline index improving slightly, but also remaining in the contraction zone below 50 pts threshold. However, a closely watched Prices Paid subindex was expected to tick lower.

Actual data turned out to be a disappointment, with headline index deteriorating to 48.7 and New Orders subindex dropping to 45.4. However, Employment subindex improved significantly and returned into expansion territory. Prices Paid subindex dropped more than expected, hinting at easing price pressures. Overall, the release can be seen as slightly dovish.

US dollar weakened in a knee-jerk move while US equity futures jumped. However, gains on indices were short-lived with US500 now trading below pre-release levels.

US, ISM manufacturing index for May: 48.7 vs 49.6 expected (49.2 previously)

- New Orders: 45.4 vs 49.1 previously

- Employment: 51.1 vs 48.6 previously

- Prices Paid: 57.0 vs 60.0 expected (60.9 previously)

US, construction spending for April: -0.1% MoM vs +0.2% MoM expected (-0.2% MoM previously)

Source: xStation5

Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)