The Japanese yen has gained significantly in the last 20 minutes after the Bank of Japan announced that a further interest rate hike is possible this year, despite political uncertainty following Prime Minister Ishiba's resignation. At the September 19 meeting, the rate is likely to remain unchanged at 0.5%, with further decisions likely to be made in October or December. The basis for the hike is solid economic data: rising corporate profits, a tight labor market, and the strongest wage growth in years, coupled with a decline in risks thanks to the trade agreement with the US.

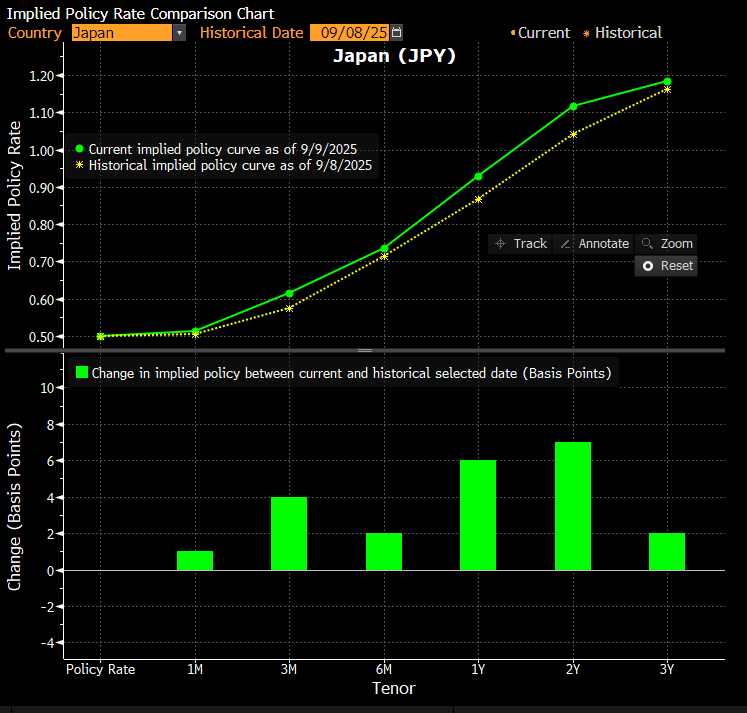

Despite the increased likelihood of a hawkish stance, the swap market continues to price in that a full 25 bp hike may not come until January 2026.

The market has indeed begun to price in faster interest rate hikes following today's announcements. The chart compares the implied interest rate path today and yesterday. Source: Bloomberg Financial LP

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)