The Australian dollar is one of the worst performing G10 currencies at the beginning of a new week. While there was no major news coming out from Australia over the weekend, there was some worrisome news relating to China - Australia's largest trading partner. A number of large financial institutions - including Goldman Sachs, UBS and Nomura - decided to cut their 2023 GDP growth forecasts for China. Goldman Sachs explained its decision saying that fiscal and monetary stimulus in China will not be enough to generate a strong growth impulse.

China, 2023 GDP growth forecasts

- Goldman Sachs: 5.4% vs 6.0% previously

- Nomura: 5.1% vs 5.5% previously

- UBS: 5.2% vs 5.7% previously

RBA minutes are scheduled for release tomorrow at 2:30 am BST and will be a potential mover for AUD. RBA delivered an unexpected rate hike at its latest meeting and traders will look for a hints on whether this means that more rate hikes are coming. There is a feeling that recent upbeat data as well as the more hawkish stance of other central banks will encourage RBA to deliver another rate hike at July meeting as well.

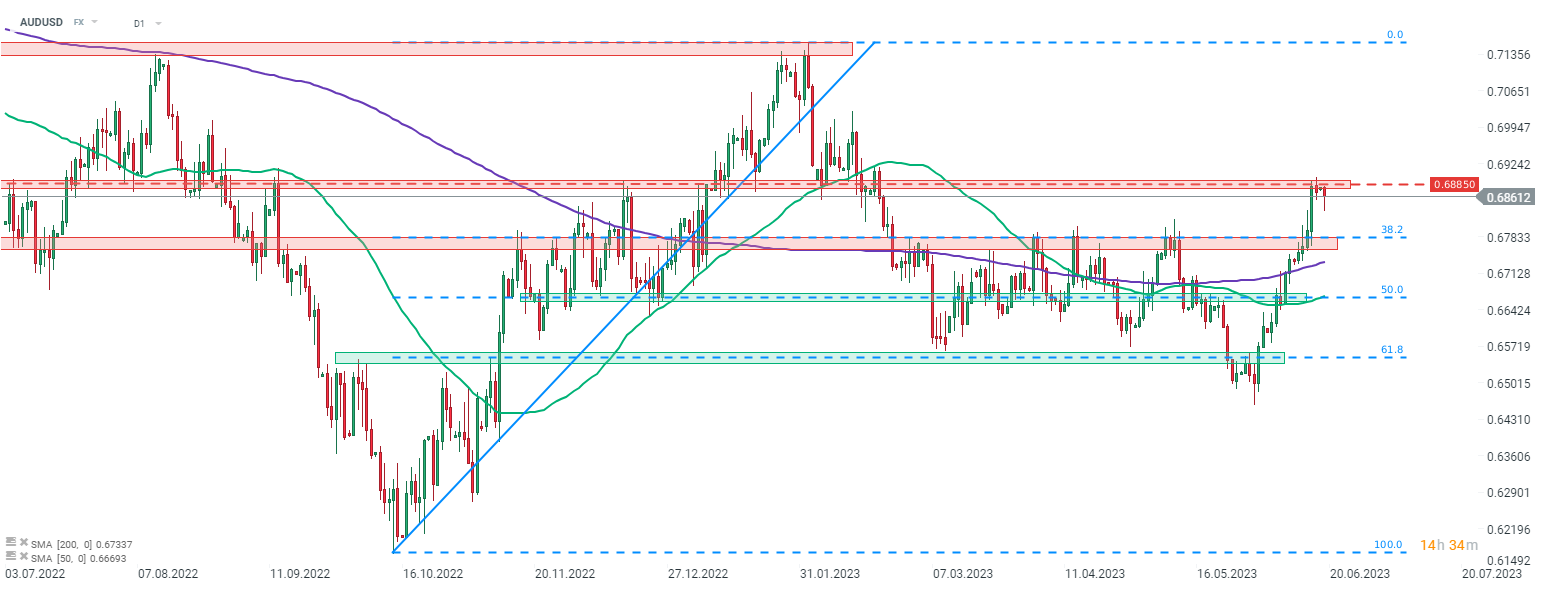

Taking a look at AUDUSD at D1 interval, we can see that the pair halted an advance after reaching the 0.6885 resistance zone recently. Pair experienced a massive, almost-7% rally in the first half of June and given how steep those gains were, a correction or a period of profit taking cannot be ruled out. However, should the ongoing pullback deepen, the first support level to watch will be zone marked with 38.2% retracement of the upward impulse launched in October 2022.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️