The Australian Dollar (AUD) is facing a downturn for the second consecutive session. Today, AUD is the weakest currency among G10 currencies, influenced by weaker-than-expected inflation data from Australia. The Monthly Consumer Price Index (CPI) for December reported a decrease to 3.4%, a significant drop from November's 4.3%. This slowing inflation rate has led traders to anticipate two potential rate cuts from the Reserve Bank of Australia (RBA) in 2024.

01:30, Australia - Inflation data:

- Weighted average CPI (Q4): current 4.4% y/y; forecast 4.5% y/y; previously 5.2% y/y;

- Weighted average CPI: current 3.40% y/y; forecast 3.70% y/y; previous 4.30% y/y;

- Trimmed Mean CPI (Q4): current 4.2% y/y; forecast 4.3% y/y; previous 5.2% y/y;

- Trimmed Mean CPI (k/k) (Q4): current 0.8%; forecast 0.9%; previous 1.2%;

- CPI (k/k) (Q4): current 0.6%; forecast 0.8%; previously 1.2%;

- CPI (Q4): current 4.1% y/y; forecast 4.3% y/y; previous 5.4% y/y;

In response to the latest Australian inflation data, the likelihood of the RBA maintaining interest rates unchanged at its upcoming meeting, however, the likelihood of an earlier rate cut later in the year has increased. The Trimmed Mean CPI, a core measure of inflation closely watched by the RBA, also showed a decline to 4.2%, down from 5.2% and below the expected 4.3%.

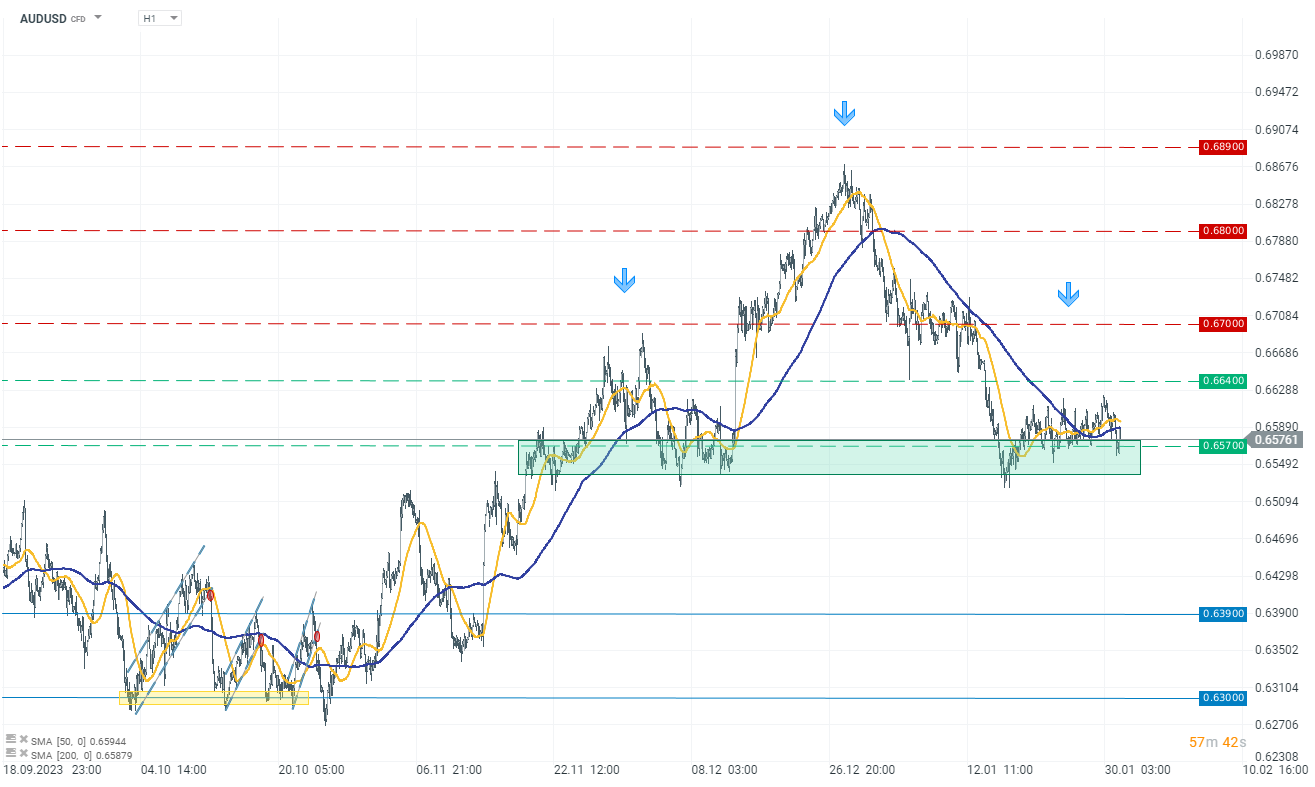

The Australian Dollar reacted negatively to these developments, with the AUDUSD pair declining by 0.40% at 0.6576.

Source: xStation 5

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️