Recent readings from the Eurozone remain very weak against the backdrop of data from the U.S. economy, with communications indicating that both central banks are likely to start cutting in the same month; around the middle of this year (June). However, it seems that if any delay in policy easing were to occur, it would happen sooner in the United States than in Europe.

- Yesterday's PMI data from Germany turned out to be very weak, especially for manufacturing, where the reading indicated about 42 points against over 46 expected; services fared only slightly better than expected. Benchmarks from France fared slightly better, but it's hard to talk about the scale of improvement here to reverse the fundamentals for the euro currency.

- Neither were they reversed by today's Germany Ifo reading, which came in only marginally above expectations. On the one hand, the EURUSD is gaining on the wave of generally positive risk sentiment and the still limited strength of the dollar; but the recent Eurodollar rally does not seem to be supported by any significant fundamental improvement or higher inflation readings - although even these could support the pair only in limited way, pointing to the potentially greater negative effects of the ECB's monetary policy transmission.

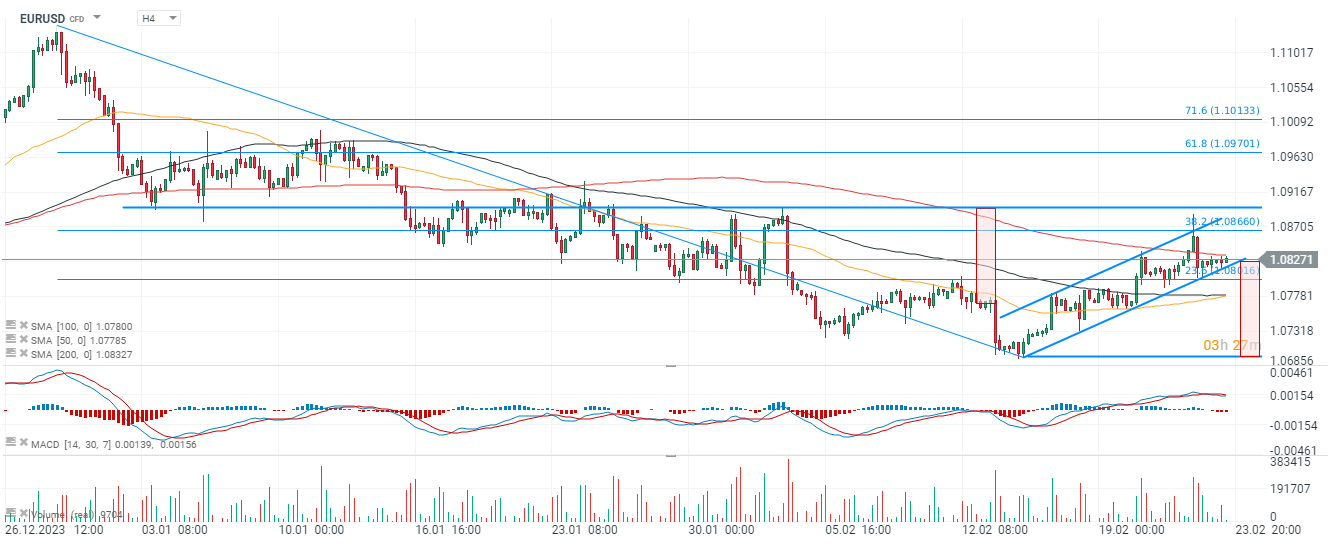

EURUSD chart (H4 interval)

Looking at the chart, we can see that EURUSD is trading in a potentially bearish flag pattern, from which an impulse could take the currency pair even to the vicinity of 1.0685. The pair has bounced off an important resistance level near 1.09, marked by previous price reactions and the 38.2 Fibonacci retracement of the December 2023 downward wave.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)