British pound caught a bid this morning after UK retail sales data for November came in much above expectations. Beat in retail sales seemed to offset a downward revision to UK Q3 GDP data, also released this morning. GBPCAD bounced off the 1.6850 support zone, but the rebound seems to be losing steam. The pair may remain volatile throughout the day as Canadian GDP report for October is scheduled to be released at 1:30 pm GMT. Market expectations suggests that Canadian economy grew at a pace of 0.2% MoM in October, after stagnating in September (0.0% MoM).

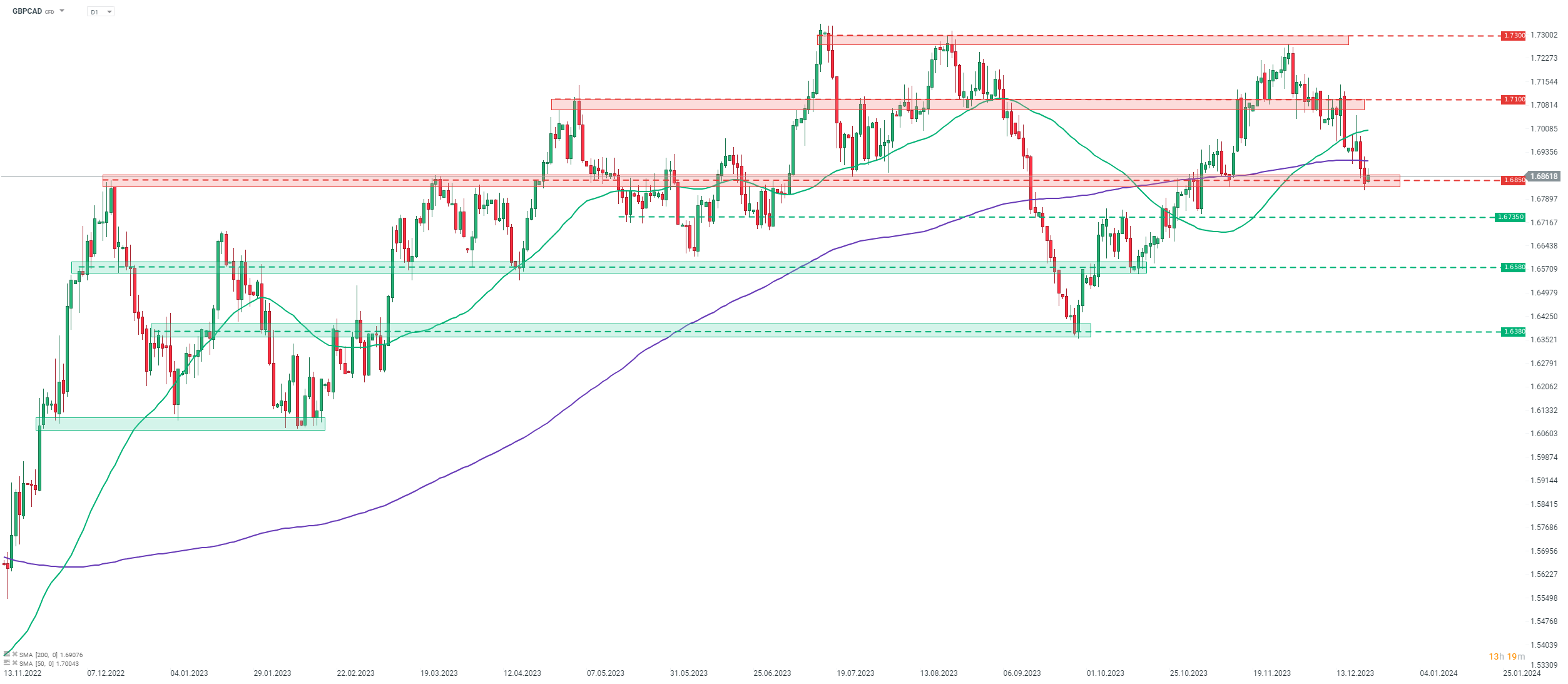

Taking a look at GBPCAD chart at 1 interval, we can see that the pair has dropped around 2.5% off a local high reached at the end of November 2023. The pair broke below the 200-session moving average (purple line) earlier this week and is now testing the mid-term 1.6850support zone. Should Canadian GDP data surprise to the upside, an attempt may be made to break below this area. Should sellers succeed, the next two support levels to watch can be found in the 1.6735 and 1.6580 areas.

Source: xStation5

Source: xStation5

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

EURUSD gains 0.2% on unexpectedly bigger trade surplus in Germany 🇩🇪 📈