-

The UK labor report showed a decrease in the unemployment rate, which fell to 3.8% from the previous 3.9%.

-

The payrolls report revealed a 6.5% increase in wages in April, surpassing expectations for 6.1%.

-

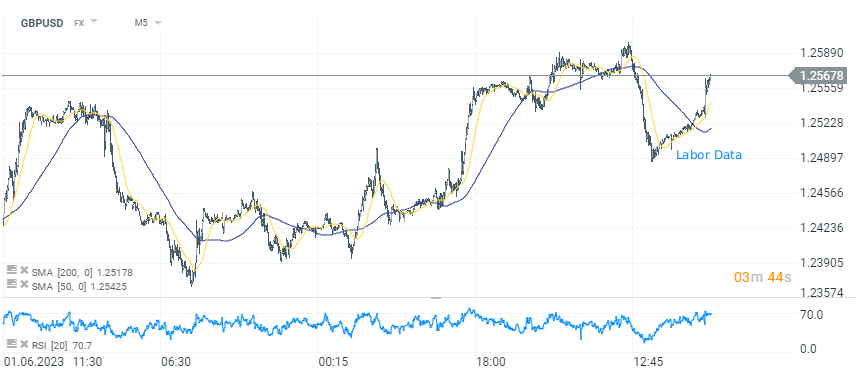

GBPUSD has risen from 1.2530 to a high of 1.2566 after the publication of the labor data.

Labor data

The UK labor report outperformed expectations, demonstrating the resilience of the labor market despite economic pressures. The unemployment rate dropped unexpectedly to 3.8% from 3.9%, propelled by a significant rise in employment, with a growth of 250K in the three months to April. The report also showed a decline in those seeking out-of-work benefits and a 6.5% increase in wages in April, exceeding market forecasts. However, gains may be limited due to ongoing concerns about inflation in the UK.

Economic outlook

The robust labor data suggest that the UK economy is doing better than predicted despite high inflation and rising central bank interest rates. The job report indicates that workers are demanding and receiving pay awards, which, coupled with businesses' higher pricing intentions, risk of a wage-price spiral. As such, the Bank of England may decide to continue raising interest rates to fight inflation.

GBPUSD

Post-publication of the labor data, GBPUSD has seen a modest rise. The pair is currently hovering near the highs, although the jump only roughly halves the losses from the previous day. Given that markets have already priced in about 100 bps worth of future rate hikes, this report doesn't significantly change that. Therefore, the gains for the pound may be more limited if solely reacting to the labor data. Additionally, GBPUSD performance will be highly reactive to the upcoming US CPI inflation report and the tone set by the Federal Reserve. The possibility of a future rate hike in July by the Federal Reserve may support dollar and could put a downward pressure on GBPUSD currency pair.

Post-publication of the labor data, GBPUSD has seen a modest rise. The pair is currently hovering near the highs, although the jump only roughly halves the losses from the previous day. Given that markets have already priced in about 100 bps worth of future rate hikes, this report doesn't significantly change that. Therefore, the gains for the pound may be more limited if solely reacting to the labor data. Additionally, GBPUSD performance will be highly reactive to the upcoming US CPI inflation report and the tone set by the Federal Reserve. The possibility of a future rate hike in July by the Federal Reserve may support dollar and could put a downward pressure on GBPUSD currency pair.

GBPUSD, M5 interval, source xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️