The Italian parliament convenes today to begin voting on the next President of the Republic of Italy. Unlike in many Western countries, where citizen vote directly, members of parliament and regional officials are the ones entitled to vote in presidential elections in Italy. 630 members of the lower house of parliament, 320 Senators and 58 officials from regional governments will take part rounds of voting. A candidate needs to secure 2/3 of votes in the first three rounds or 50+% in the fourth and beyond round to become a president. The longest elections (1973) required 23 rounds of voting, spread out across 16 days.

Elections will be closely watched as the President of Italy holds more power than the President of other European countries and is often relied on to resolve government crises. So who is seen as a front-runner? Up until this weekend there were 2 leading candidates - Prime Minister Mario Draghi and former Prime Minister Silvio Berlusconi. However, scandal-involved Berlusconi announced this weekend that he decided to withdraw from the race, leaving Mario Draghi as a sole leading candidate. However, this does not mean that he will win as there are some concerns over his candidacy. Draghi is a sitting Prime Minister, who have helped resolve parliamentary crises, and some lawmakers are reluctant to support him out of fear that Draghi stepping down from PM office may lead to early parliamentary elections. Having said that, there is a scope for a surprising result.

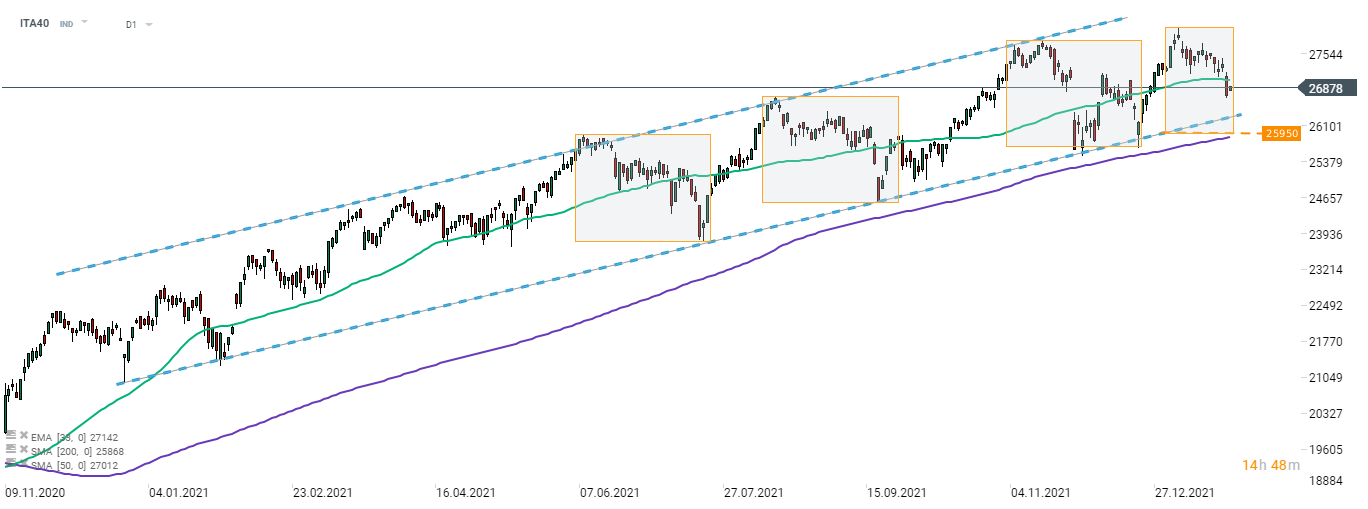

Taking a look at the Italian FTSE MIB (ITA40) chart, we can see that the Italian index has been trading in an upward channel since November 2020. ITA40 made some corrections of equal size throughout the past year so the lower limit of the market geometry at 25,950 pts can be seen as a key support, especially as it coincides with the 200-session moving average (purple line). However, in order to reach this area, the index would have to break below the lower limit of the channel earlier. Index trades slightly higher at the beginning of a new week but scale of rebound is rather small.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street