USDCAD is one of the currency pairs that may see some bigger volatility this afternoon. This is because traders will be offered top-tier macro reports from the United States and Canada at 1:30 pm BST.Investors will be offered retail sales reading for September while Canadian CPI report for September will be released simultaneously. When it comes to US data, retail sales are seen increasing but less than they did in August. Meanwhile, headline Canadian CPI is expected to stay unchanged at 4.0% YoY.

1:30 pm BST - US, retail sales for September.

- Headline. Expected: 0.3% MoM. Previous: 0.6% MoM

- Ex-transport. Expected 0.2% MoM. Previous: 0.6% MoM

1:30 pm BST - Canada, CPI inflation for September. Expected: 4.0% YoY. Previous: 4.0% YoY

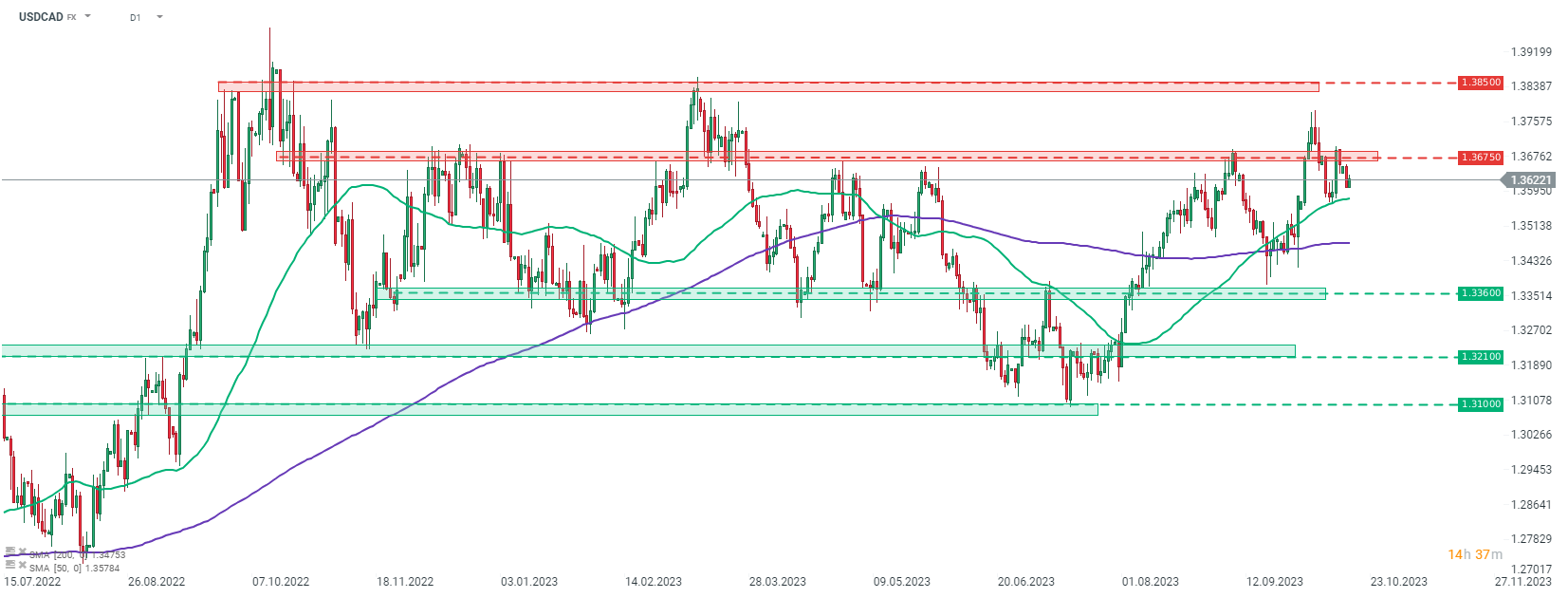

Taking a look at USDCAD chart at D1 interval, we can see that the pair has been trading higher since mid-July. The upward move has been quite steady, spare for a 2-week correction in September. However, some weakness could be spotted on the pair recently with USDCAD pulling back from 6-month high. Declines were halted at the 50-session moving average (green line) but the pair struggled to get back above the 1.3675 resistance zone later on. A strong US retail sales report combined with a lower than expected Canadian CPI could lead to a test of the aforementioned resistance.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️