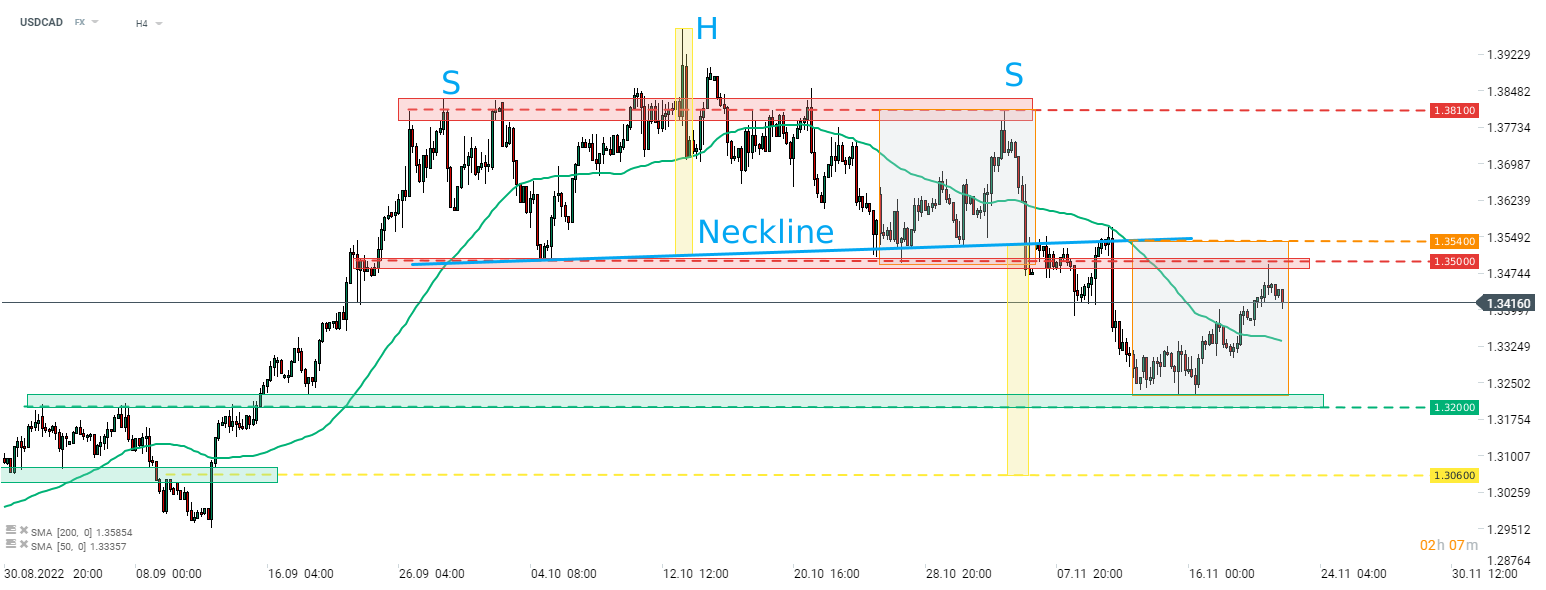

A recent recovery move on USDCAD has run into an obstacle. Pair tested the resistance zone ranging below the 1.3500 mark yesterday but failed to break above. As the recovery run failed to push the pair above 1.3540 area, where the upper limit of a local market geometry can be found, the overall technical picture for USDCAD did not change. Pair started to pull back later on and downside breakout from a previous head and shoulder pattern is still in play with a textbook range of 1.3060. A near-term support to watch in case the pair deepens ongoing pullback can be found in the 1.3200 area and it has halted the previous downward impulse. The pair may get more active in the afternoon today as Canadian retail sales data for September will be released at 1:30 pm GMT. On top of that, traders will also get speeches from 3 Fed members (Mester - 4:00 pm GMT, George - 7:15 pm GMT, Bullard - 7:45 pm GMT).

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️