The US dollar was one of the worst performing major currencies during the Asian session today. However, USD regained ground as the beginning of the European trading session neared. Fundamental background is supportive for the US currency. Fed members are getting more hawkish in their comments. Kashkari said yesterday that 7 more rates hikes may be needed this year. Another 3 members of Fed are set to make speeches this afternoon (Williams - 2:00 pm GMT, Barkin - 3:30 pm GMT, Waller - 4:00 pm GMT) so even more hawkish comments may come later today. Banks are also expecting the Fed to become more hawkish with Morgan Stanley expecting 50 basis point rates hikes both in May and June.

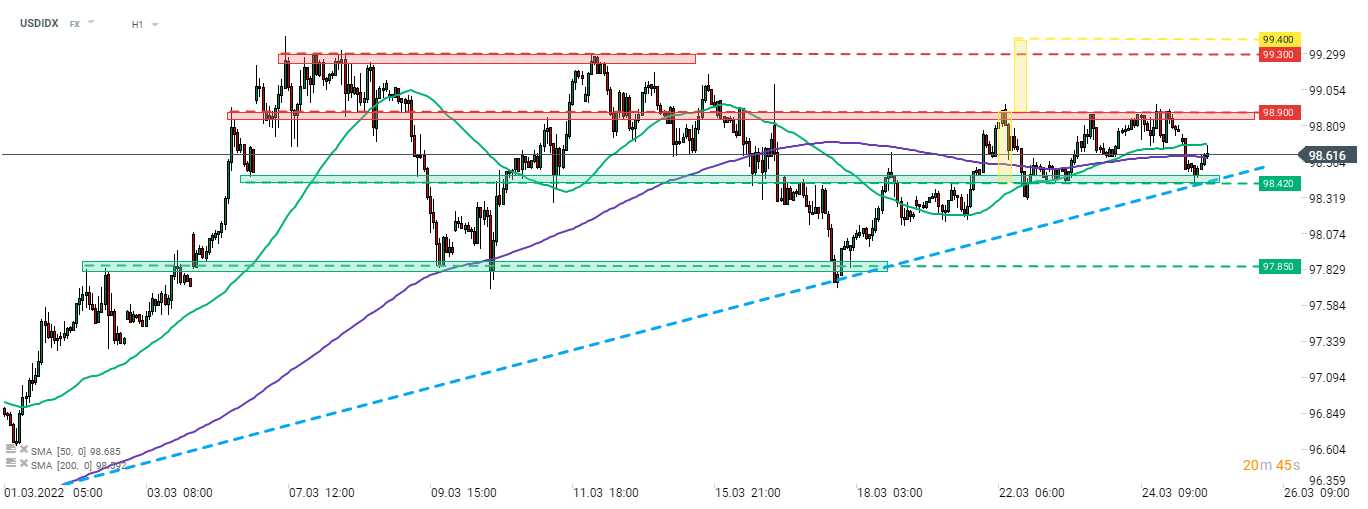

US dollar index (USDIDX) bounced off the mid-term trendline and is attempting to make a break above 50- and 200-hour moving averages at press time. If bulls manage to overcome those moving averages, a test of the mid-term resistance in the 98.90 area may follow. This resistance also serves as the upper limit of current short-term trading range and a break above could trigger an upward move with potential range at 99.40 - more or less at year-to-date highs.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️