Flash US GDP report for Q4 2022 is a key macro release of the day. Report will be released in the early afternoon at 1:30 pm GMT. However, it will not be the only US releases at that time as weekly jobless claims and December's durable goods orders data will also be released. Having said that, traders should expect a pick-up in USD volatility around that time.

US data at 1:30 pm GMT today

GDP report for Q4 2022.

-

GDP growth (annualized). Expected: 2.6%. Previous: 3.2%

-

Core PCE. Expected: 4.0% QoQ. Previous: 4.7% QoQ

Durable goods orders for December.

-

Headline. Expected: -0.2% MoM. Previous: +0.1% MoM

-

Ex-transport. Expected: +2.5% MoM. Previous: -2.1% MoM

Jobless claims. Expected: 205k. Previous: 190k

It should be noted that the US Q4 GDP report today, along with US core PCE data for December tomorrow, will be final prints ahead of next week's FOMC decision. As such, they may be key in determining whether the US central bank will go with a 25 basis point rate hike, as is currently expected, or whether there is a chance for a surprise.

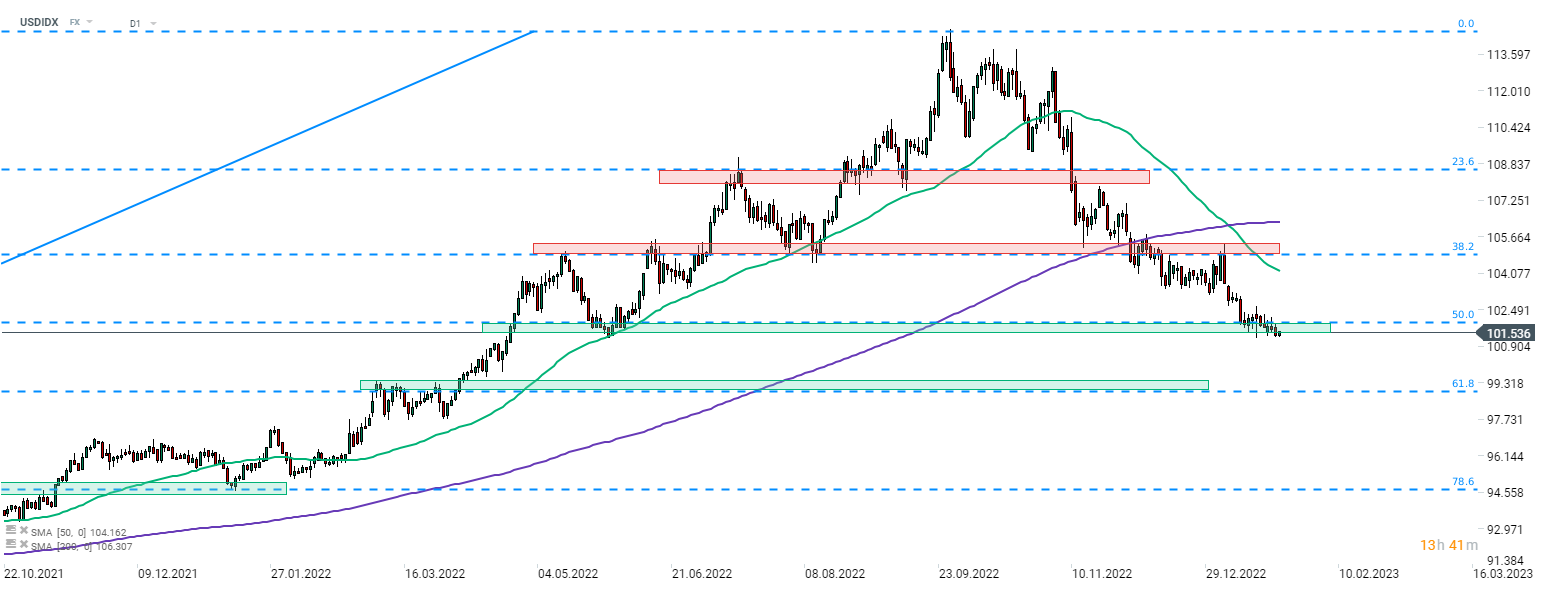

Taking a look at US dollar index (USDIDX) at the D1 interval, we can see that the greenback has been weakening as of late. The index is currently attempting to make a break below the support zone ranging between 101.50 handle and a 50% retracement of the major upward impulse started in early-2021, and threatens to move to a new 9-month low.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️