Governor of the Bank of Japan Kazuo Ueda said that the central bank will act cautiously to anchor inflation expectations at 2% during his speech at the BOJ's annual conference.

- some challenges are exceptionally difficult for the BOJ compared to other central banks worldwide;

- assessing the neutral interest rate is particularly challenging in Japan, considering the prolonged period of nearly zero short-term interest rates over the past three decades;

- deputy Governor Shinichi Uchida mentioned that although the end of deflation is near, anchoring inflation expectations is a challenge;

- former board member Takako Masai suggested that the BOJ could raise its benchmark interest rate to 0.5% by the end of the year if current economic conditions persist;

- Ueda and Uchida gave no clear indications of immediate monetary policy actions.

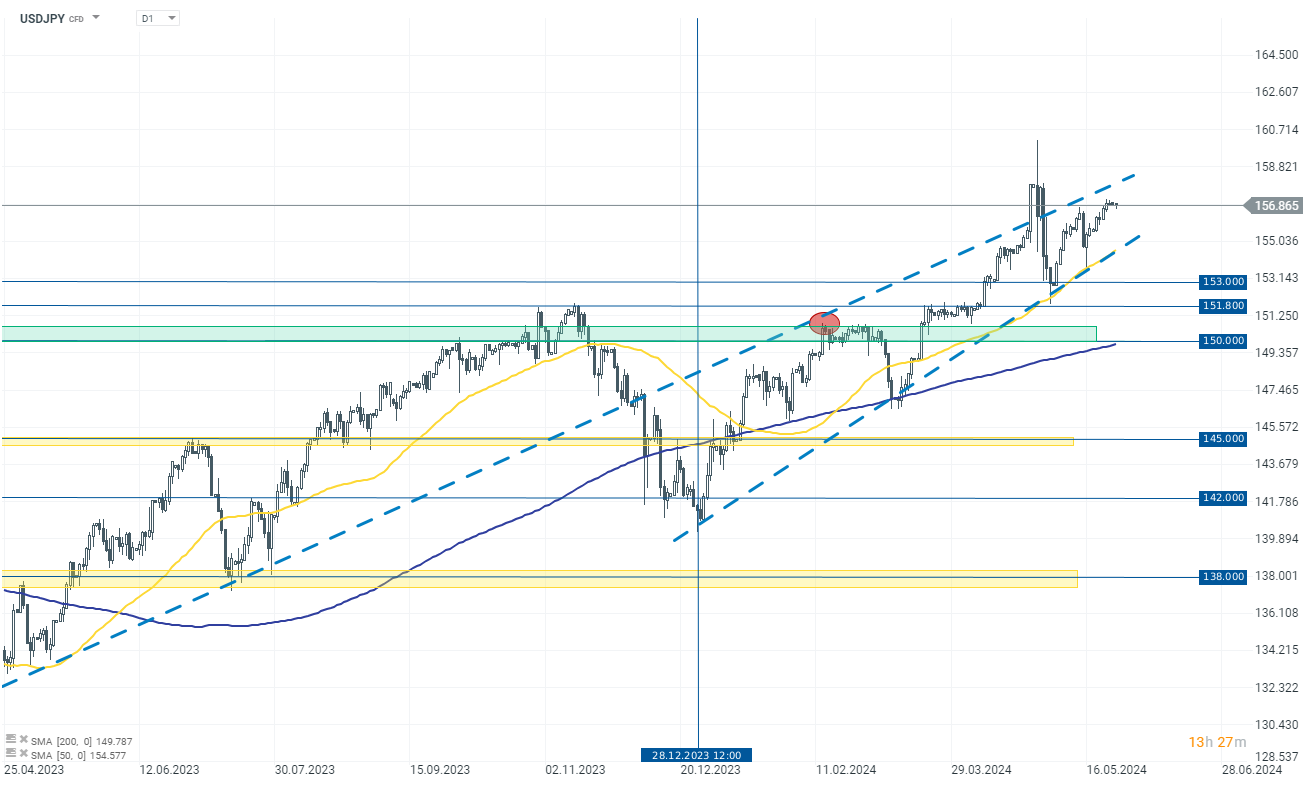

The Japanese yen is consolidating around historical highs at 157.0000 per USD. Recent statements from BOJ officials emphasize further mobilization in normalizing monetary policy. However, the bank's actions alone are insufficient to revive demand for the Japanese currency. Investors still lack clear assurances of the Bank of Japan's subsequent actions, and this uncertainty contributes to the continued weakening of the JPY. Currently, on the daily interval chart, we can observe a rising wedge formation on USDJPY, which may signal a potential reversal in an uptrend. It is characterized by converging trend lines, where the upper trend line (resistance) is rising, and the lower trend line (support) is rising at a steeper angle.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️