Oil

-

Oil prices attempted to break out of a consolidation range. WTI trades in the $81-82 per barrel area while Brent attempts to break above the $88-89 per barrel resistance zone

-

While oil demand in China is almost 3 times higher than in India (OPEC forecast: 15.2 mbpd vs 5.3 mbpd in Q2), changes in demographics outlook may lead markets to reconsider their view of the oil market

-

India is expected to see its oil demand increase 6% this year while Chinese demand may increase by as low as 3%

-

IEA points that oil prices will be driven by Chinese demand recovery in the first half of this year

-

United States plan to further complicated Iranian oil exports after Teheran supported Russia in its war effort

-

When it comes to near-term outlook, prices of fuels, especially diesel, are likely to be more important than level of crude oil prices

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDiesel prices in Europe have rebounded significantly recently (price per tonne - white line on the chart). One can see that diesel price increase outpace price increase on oil. Diesel prices may jump further once Western sanctions on Russian oil derivatives go live. Source: Bloomberg

Brent (OIL) breaks above 100-session moving average but seasonal patterns suggest that period of range trading may last until the first week of February. Cheap USD, however, could provide more fuel for the up move. Source: xStation5

Brent (OIL) breaks above 100-session moving average but seasonal patterns suggest that period of range trading may last until the first week of February. Cheap USD, however, could provide more fuel for the up move. Source: xStation5

Natural Gas

-

US natural gas prices rebounded at the beginning of this week, thanks to expectations of increase gas consumption amid lower forecasted temperatures

-

Temperature in Europe is also dropping and increase in consumption is evidenced by a drop in inventories. While pace of withdrawals is in-line with 5-year average for the period, level of inventories continues to sit above 5-year average

-

Speculative positioning on US natural gas remains negative but futures curve is no longer as extremely sloped as it was the case 6 months ago

-

Freeport informed that it has completed all necessary repair works to resume LNG exports

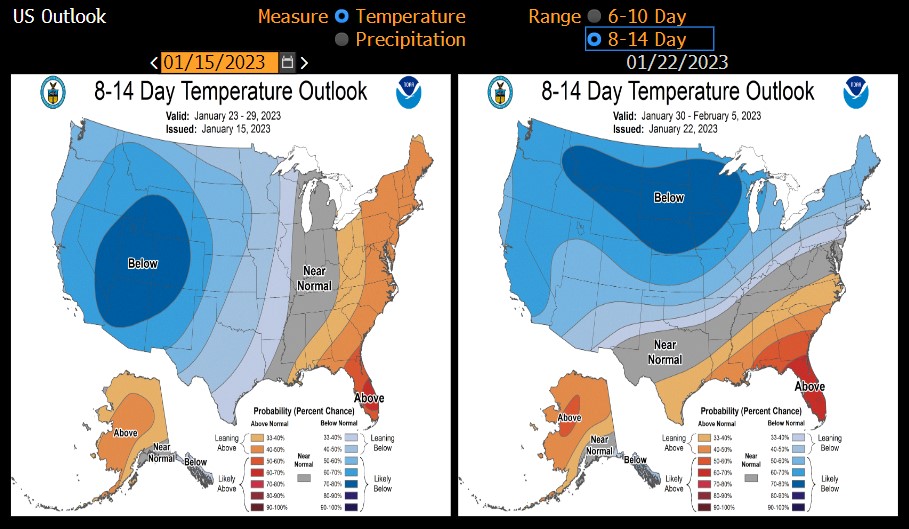

US weather forecasts still suggest that pick-up in consumption due to low temperatures remains a real possibility in the coming weeks. Source: Bloomberg

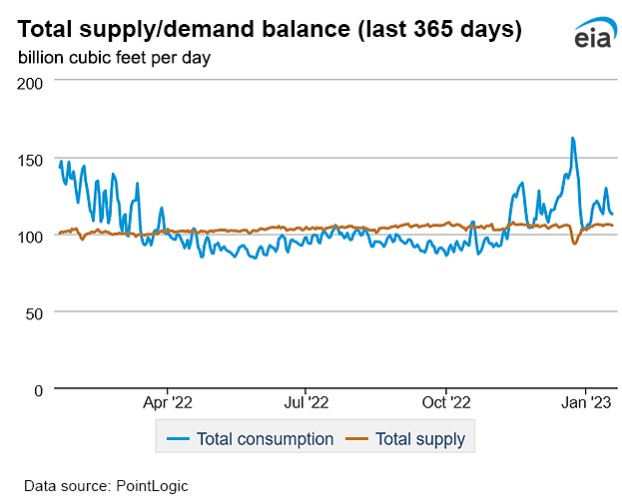

US daily natural gas consumption hit a record high on December 23, 2022. Currently, demand slightly exceeds production, which remains at a level exceeding 100 billion cubic feets per day. Source: EIA, PointLogic

US natural gas futures curve is no longer in extreme backwardation. Temporary demand dropped but the coming weeks may see more volatility on the natural gas market. Source: Bloomberg

US natural gas futures curve is no longer in extreme backwardation. Temporary demand dropped but the coming weeks may see more volatility on the natural gas market. Source: Bloomberg

NATGAS is testing resistance zone marked with 78.6% retracement of the 2020-2022 upward impulse. Should natural gas demand indeed rebound as expected in the coming weeks, prices may experience a strong upward impulse with $3.60-4.00 per MMBTu area being a potential target. Source: xStation5

NATGAS is testing resistance zone marked with 78.6% retracement of the 2020-2022 upward impulse. Should natural gas demand indeed rebound as expected in the coming weeks, prices may experience a strong upward impulse with $3.60-4.00 per MMBTu area being a potential target. Source: xStation5

Silver

-

Significant divergence between silver and gold prices surfaced recently. In spite of a positive moods related to Chinese reopening, precious metals with significant industrial use have been sold off in recent days

-

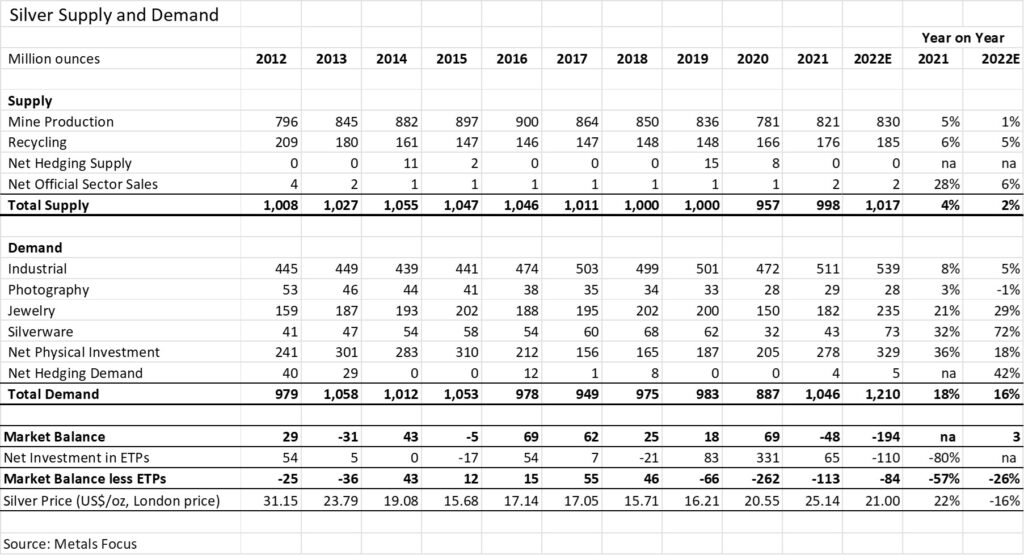

Silver demand in 2022 is expected to have grown 16%, even in spite of weak demand from ETFs

-

A market deficit of around 200 million ounces of silver is also expected for 2022

-

Deficit may grow further in 2023 should ETFs return to the market as silver buyers

Silver market deficit in full-2022 is expected to have reached 200 million ounces, what would be the first such situation in history. Weak ETF demand can be named as a reason but cheap US dollar and drop in US yields may lead to pick-up in silver investment demand in 2023. Source: Metal Focus, Silver Institute

Silver market deficit in full-2022 is expected to have reached 200 million ounces, what would be the first such situation in history. Weak ETF demand can be named as a reason but cheap US dollar and drop in US yields may lead to pick-up in silver investment demand in 2023. Source: Metal Focus, Silver Institute

A recovery in net speculative positioning on silver resembles the situation from 2018 and 2019. Gold suggests that silver should trade at higher levels than now. Holding above 61.8% retracement would provide bulls with a ground to extend the upward impulse. Source: xStation5

A recovery in net speculative positioning on silver resembles the situation from 2018 and 2019. Gold suggests that silver should trade at higher levels than now. Holding above 61.8% retracement would provide bulls with a ground to extend the upward impulse. Source: xStation5

Gold

-

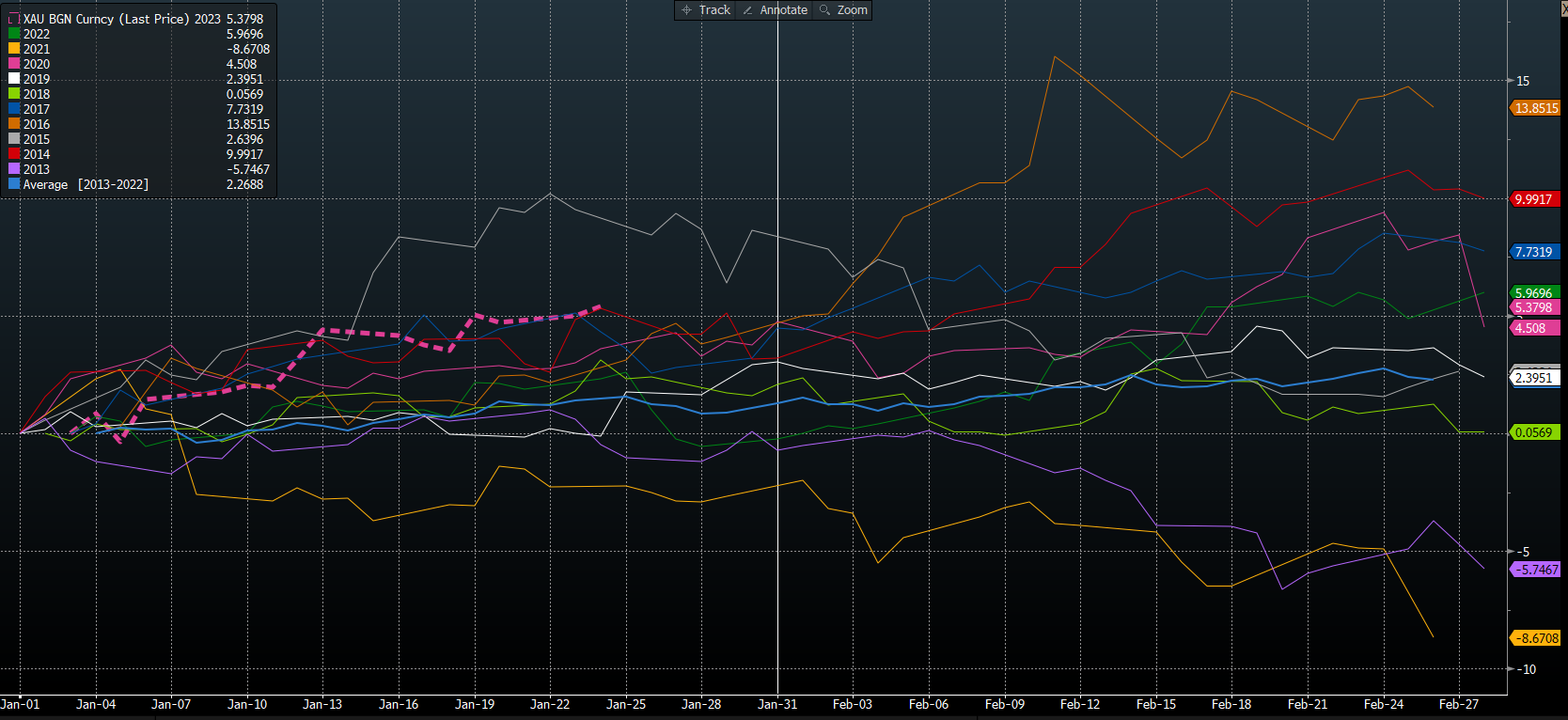

Gold had a superb start of the year, thanks to weaker US dollar and forecasts for a lower terminal rate in the United States

-

2015 was the only year in the past decade when gold had a better start to the year than now

-

Central banks purchased a record amount of gold in Q3 2022 and this shopping spree extended into Q4 2022 as well

-

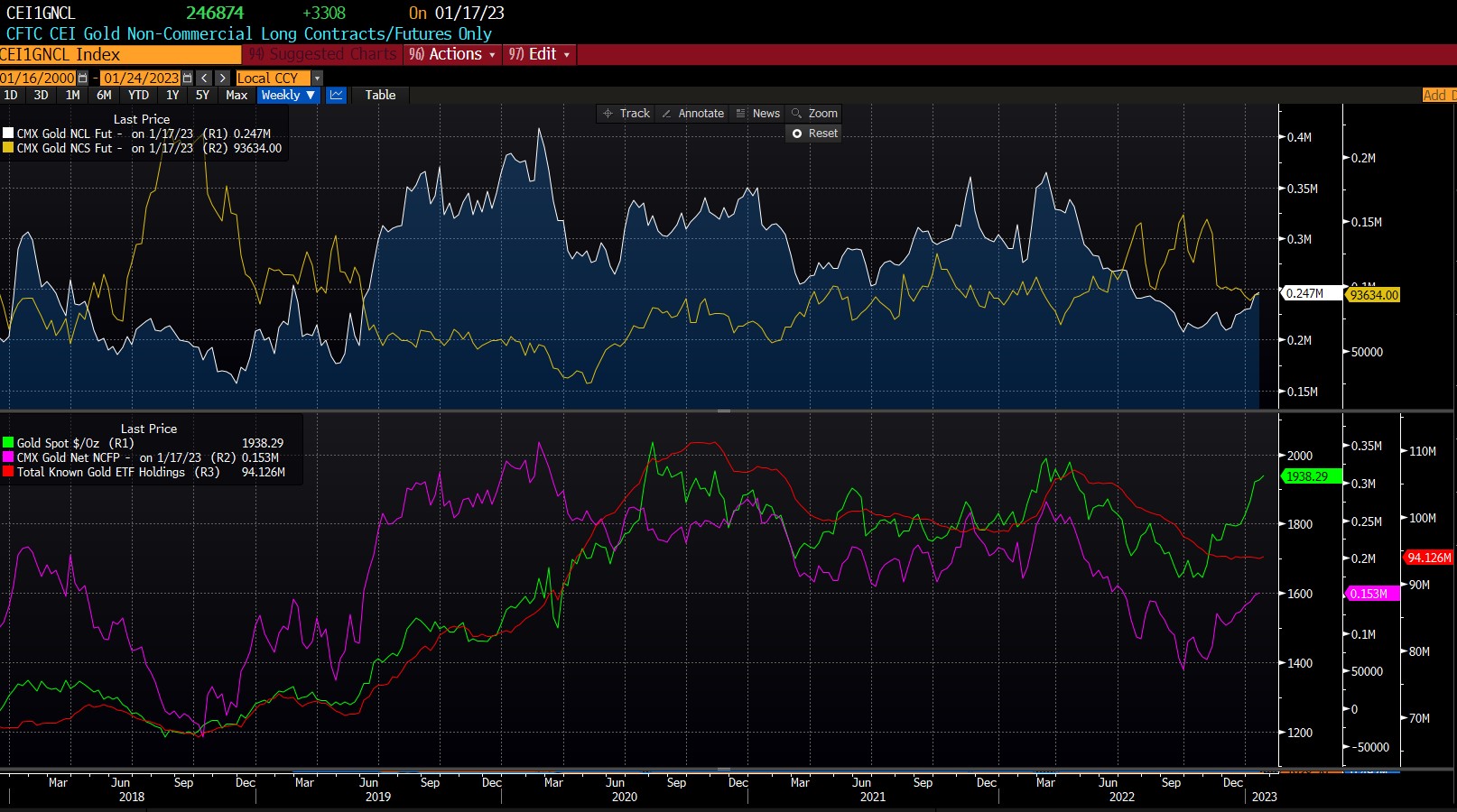

We can observe a recovery in speculative positioning on gold futures

-

Chinese reopening and cheap USD suggest that retail demand for gold in China may return

-

Strong economic growth as well as positive demographic outlook in India also hints at solid retail demand from this country

Gold gained 5% since the beginning of the year and it is the best start of the year it had since 2015. Source: Bloomberg

Gold gained 5% since the beginning of the year and it is the best start of the year it had since 2015. Source: Bloomberg

Speculators are becoming more and more active on the gold market. ETFs remain passive, what limits potential for strong gains on the gold market. Source: Bloomberg

Speculators are becoming more and more active on the gold market. ETFs remain passive, what limits potential for strong gains on the gold market. Source: Bloomberg

Should GOLD finish January near $1,940 per ounce, it will be the third highest monthly close in history (trailing only July and August 2020)! Source: xStation5

Should GOLD finish January near $1,940 per ounce, it will be the third highest monthly close in history (trailing only July and August 2020)! Source: xStation5