Oil

-

Barclays boosted oil price forecast and now see Brent barrel at $113 at the end of Q2 2022

-

Barclays expects Russian daily oil production to drop by 1.5 million barrels

-

Citi projects average Brent price in this and the next year at $111 per barrel. However, Citi expects price in Q3 to be $99 per barrel

-

Citi signals that a lot of commodities are still off the markets, including Iranian crude. The bank expects return of around 500k bpd of production no sooner than at the start of next year

-

Goldman Sachs sees oil price averaging at $140 per barrel between July and September 2022

-

Prices should remain elevated if the OPEC countries fail to offset drop in Russian production and lack of Iranian supply

-

Tanker freight rates are quickly increasing. Stocks like Kinder Morgan (KMI.US) or Nordic American Tankers (NAT.US) should be on watch

-

Saudi Arabia increased export prices for the next month. Premium over benchmark for deliveries to Asia increased to $6.5 per barrel while premium over benchmark for European deliveries sits at $4.3 per barrel. Increasing prices signals that Saudi Arabia sees high demand for its oil, at least in short-term

-

It is expected that Chinese demand for oil will rebound in the coming weeks as pandemic restrictions in the country are eased

-

India imports around 0.8m bpd from Russia while Chinese imports from Russia sit at around 1.6m bpd currently. India imports record quantities of Russian oil. Lack of record purchases of discounted Russian oil by China signals that demand in the country has not fully recovered yet

Chinese imports of Russian oil recovery but are still far off 2020 highs. Source: S&P Platts

Chinese imports of Russian oil recovery but are still far off 2020 highs. Source: S&P Platts

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app Brent (OIL) trades close to $120 per barrel. On the other hand, some tanker operators are still trading at relatively low valuation, given increasing freight rates. Source: xStation5

Brent (OIL) trades close to $120 per barrel. On the other hand, some tanker operators are still trading at relatively low valuation, given increasing freight rates. Source: xStation5

Natural Gas

-

US prices jumped to 13-month highs amid expectations of very high temperatures in the southern United States, what would boost demand for electricity

-

Just as it is the case with oil, freight rates for LNG cargoes are increasing quickly. United States are near its maximum export capacity

-

Oil production dropped to around 95 bcf, which is around 2 bcf below levels that would allow to easing of supply-demand situation

-

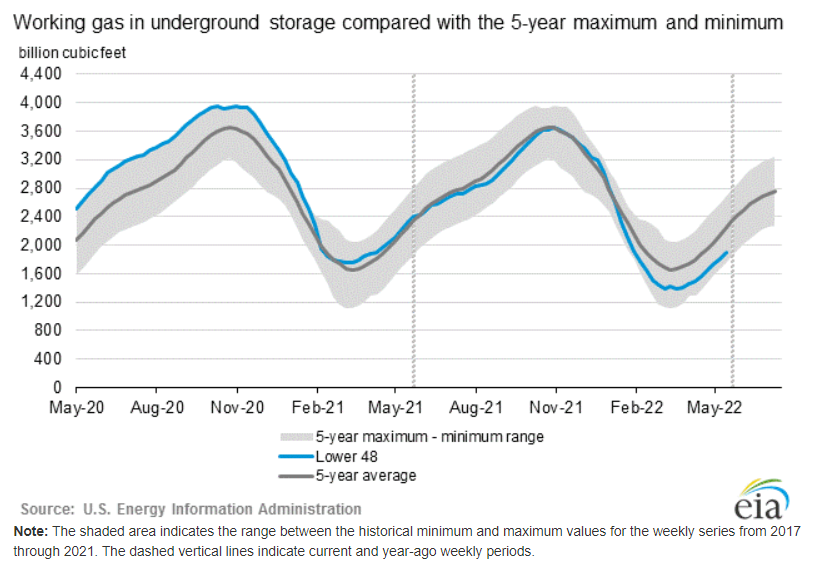

Natural gas stockpiles are not filled quickly enough to return to 5-year averages. Stockpiles were near 5-year average last year

-

Some experts expect the highest temperature in June 15-20 period, what may push US prices above $10 per MMBTU

US natural gas stockpiles are being filled but still remain below the 5-year average. Source: EIA

US natural gas stockpiles are being filled but still remain below the 5-year average. Source: EIA

NATGAS trades near $9.50 resistance. In case we see a break above, an upward move may extend towards the 10.00-10.30 area, where price reactions occured in 2005 and 2008. Long-term seasonal patterns signal that we are nearing a local peak. Meanwhile, short-term seasonal patterns hint that price may trade sideways until July and then launch an upward move that will last until the turn of October and November. Source: xStation5

NATGAS trades near $9.50 resistance. In case we see a break above, an upward move may extend towards the 10.00-10.30 area, where price reactions occured in 2005 and 2008. Long-term seasonal patterns signal that we are nearing a local peak. Meanwhile, short-term seasonal patterns hint that price may trade sideways until July and then launch an upward move that will last until the turn of October and November. Source: xStation5

Wheat

-

Concerns mount that it will impossible to export Ukrainian wheat from the country

-

Ukraine says that even if port blockade is lift it would take months to de-mine trade routes

-

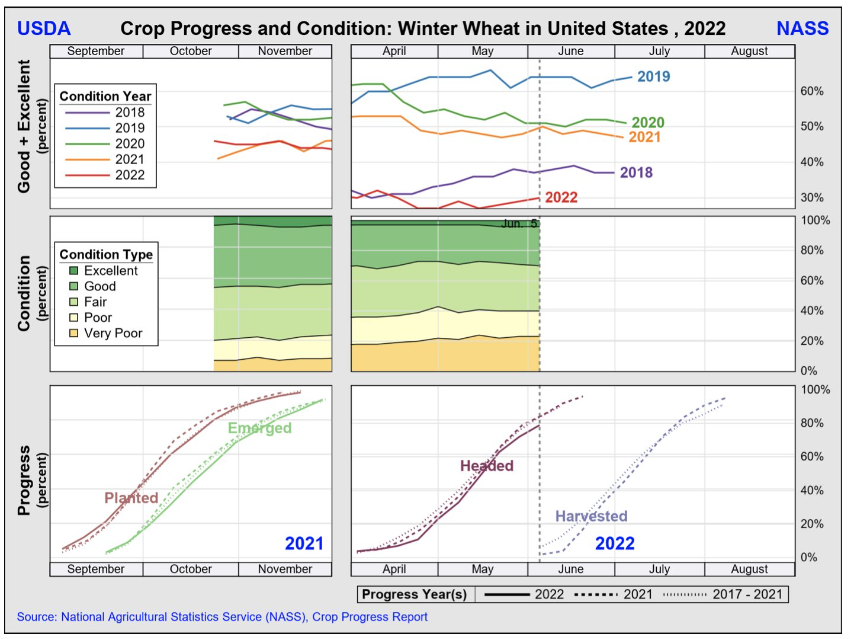

US crop quality improved ahead of harvest but remains worse than in previous 5 years

-

Slow harvest progress could potentially trigger another upward price impulse

-

USDA expects prices at around 1075 cents per bushel this year

Quality of US wheat improved ahead of harvest season but remains worse than in previous 5 years. Source: USDA

Quality of US wheat improved ahead of harvest season but remains worse than in previous 5 years. Source: USDA

WHEAT continues to trade below the upward trendline. Official US government price forecasts for this year remain close to current market prices. Source: xStation5

WHEAT continues to trade below the upward trendline. Official US government price forecasts for this year remain close to current market prices. Source: xStation5

Silver

-

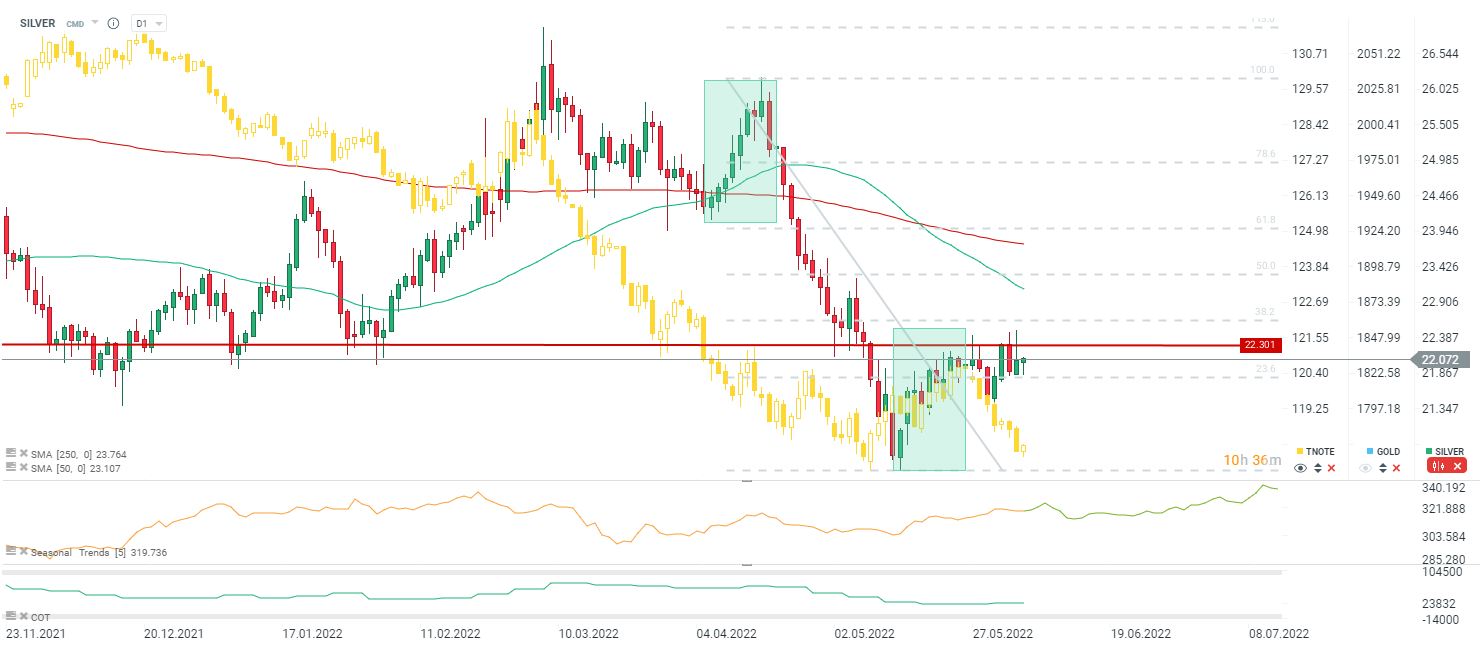

Silver prices, just like gold prices, is being pressured by strong US dollar and rising yields

-

Silver bulls managed to defend a key support. However, unless price recovers above $22.3 per ounce, risk of sell-off resuming remains

-

Seasonal low should be reached near mid-month. Speculative positioning data suggests that silver is relatively oversold, what could be seen as contrarian signal

-

Volatility on the silver market is likely to pick-up after FOMC meeting next week

Silver price trades near a key $22.30 resistance. Source: xStation5

Silver price trades near a key $22.30 resistance. Source: xStation5