-

Wall Street indices traded mixed today - Dow Jones trades 0.3% lower, Nasdaq gains 0.1% while S&P 500 trades flat

-

Russell 2000 outperformed other Wall Street indices. Small-cap index rallied over 2%, driven by outperformance of regional banks

-

European stock market indices recovered from earlier losses and finished today's trading slightly higher. German DAX gained 0.2%, UK FTSE 100 added 0.4% and French CAC 40 traded 0.1%. Polish WIG20 was outperformer in Europe with a 1.6% gain

-

Reserve Bank of Australia (RBA) delivered an unexpected 25 basis point rate hike, putting the official cash rate at 4.10% - the highest level since April 2011. AUD gained as market expected rates to stay unchanged

-

Wheat traded as much as 4% higher after a major dam on Dnipro river in Ukraine was destroyed and a flooding began in one of Ukraine's key growing regions. However, majority of gains has been erased already

-

Goldman Sachs now sees a 25% chance of US recession over the next 12 months, down from a previous forecast of 35%

-

US SEC sued Coinbase for operating as an unregistered broker since 2019. Company's shares plunged 20%

-

Cryptocurrencies traded lower following the news but the scale of the drop was much smaller than on Monday when Binance was sued. However, declines have been recovered later on and now major cryptocurrencies trade higher

-

GitLab rallied 30% after better-than-expected fiscal-Q1 2024 earnings (February-April 2023)

-

German factory orders dropped 0.4% MoM in April (exp. +3.0% MoM)

-

Spanish industrial production dropped 0.9% YoY in April (exp. +1.6% YoY)

-

Euro area retail sales dropped 2.6% YoY in April (exp. -3.0% YoY)

-

Oil traded lower earlier today but has recovered in the afternoon. New EIA forecasts point to price recovery by the end of the year amid drop in inventories

-

AUD and CAD are the best performing G10 currencies at press time while CHF and EUR lag the most

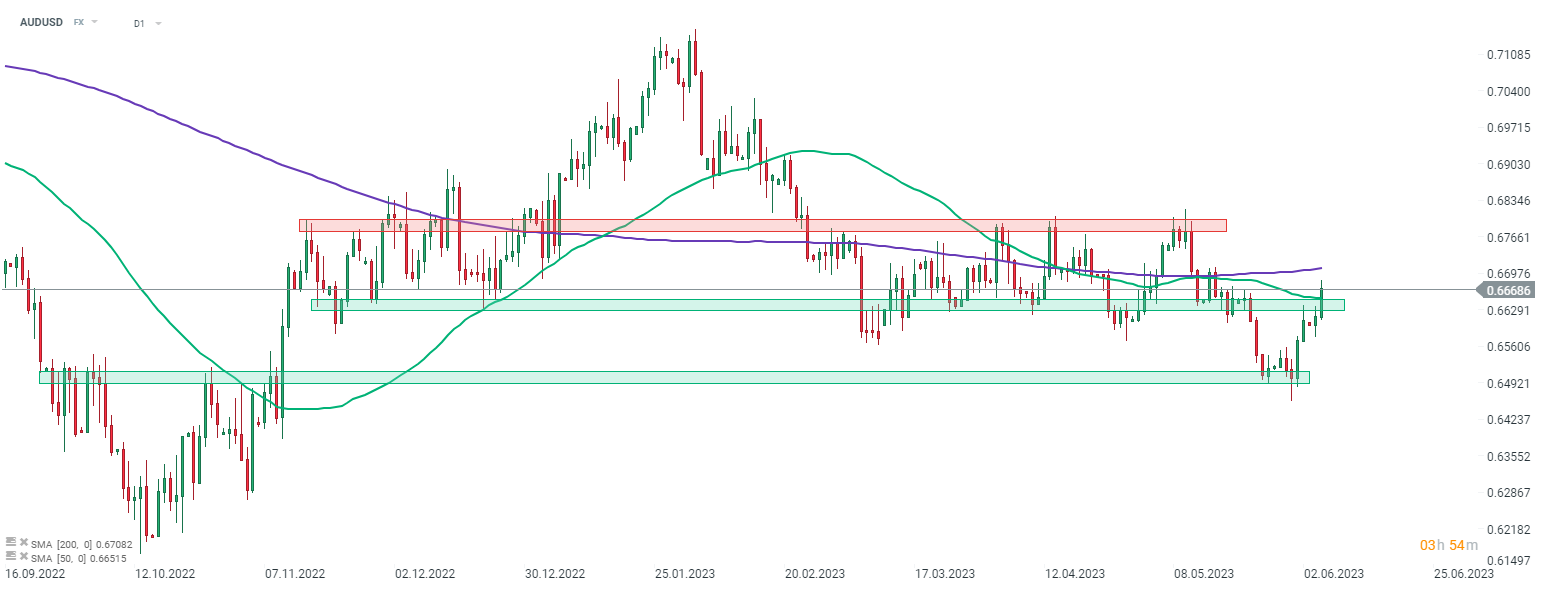

AUDUSD jumped today following an unexpected RBA rate hike. The pair jumped above the 50-session moving average (green line) for the first time since mid-May. Source: xStation5

AUDUSD jumped today following an unexpected RBA rate hike. The pair jumped above the 50-session moving average (green line) for the first time since mid-May. Source: xStation5

US Open: Rebound attempt on Wall Street 📈Meta Platforms surges 3.5%

BREAKING: EURUSD reacts 🗽US jobless claims lower than expected

VIX sell-off deepens amid rebound on Wall Street 📉

Chart of the day: AUDUSD Eyes Multi-Year Highs 🇦🇺 📈 Rate hike in February❓(22.01.2026)