- US stocks take a breath ahead of Fed meeting

- Several EU countries suspended the use of AstraZeneca’s Covid-19 vaccine

- President Biden plans first major tax hike in almost 30 years

European indices erased early gains and finished today's session mostly lower amid increasing concerns about a further slowdown in the Covid-19 inoculation campaign. Germany, Ireland and the Netherlands have joined the rising number of countries that have temporarily suspended the use of the COVID-19 vaccine developed by AstraZeneca and the University of Oxford due to an investigation into cases of blood clots. At the same time, number of new COVID-19 infections have been rising in Europe, especially in Germany and Italy. Meanwhile, stronger-than-expected industrial production and retail sales numbers from China provided some support. DAX 30 fell 0.3%, CAC 40 lost 0.4% and FTSE 100 finished 0.2% lower.

US indices are trading slightly above the flat line while the 10-year Treasury yield eased slightly to 1.616%, after reaching its highest level in more than a year on Friday. President Biden is planning the first major federal tax hike since 1993, Bloomberg reported. Meanwhile, some Americans already received their stimulus payments during the weekend and next 100 million stimulus checks will be delivered within the next 10 days. On the coronavirus front, the US government administered 100 million Covid-19 vaccine doses with about 35 million citizens fully vaccinated. Investors are waiting for Wednesday and the Fed decision on interest rates. The central bank is expected to acknowledge much better growth in the economy. However traders will focus on Fed’s interest rate outlook, which now does not include any rate hikes through 2023.

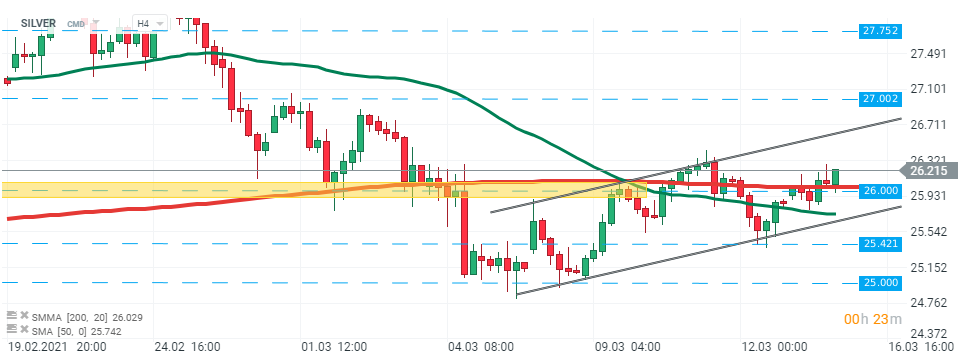

WTI crude fell more than 0.5% and is trading around $65.30 a barrel, while Brent is trading nearly 0.60% lower around $68.80 a barrel. Early in the session oil rose thanks to upbeat Chinese industrial production figures. Elsewhere gold rose nearly 0.3% to $ 1,731.00 / oz, while silver is trading 1.20 % higher near $ 26.20 / oz amid a slightly weaker dollar. Bitcoin fell from a new all-time high at $61,800 and is trading below $56.000.

Silver price managed to break above the major resistance at $26.00/oz which coincides with 200 SMA ( red line). If the current sentiment prevails, upward move could be extended to the upper limit of the ascending channel or even $27.00 handle. However, if buyers will manage to regain control and push the price below the aforementioned $26.00 level, then next support to watch lies at $25.42 level. Source: xStation5

Silver price managed to break above the major resistance at $26.00/oz which coincides with 200 SMA ( red line). If the current sentiment prevails, upward move could be extended to the upper limit of the ascending channel or even $27.00 handle. However, if buyers will manage to regain control and push the price below the aforementioned $26.00 level, then next support to watch lies at $25.42 level. Source: xStation5

US OPEN: Holiday season extinguish volatility despite political risks

BREAKING: US jobless claims below expectations!🚨

DE40: Regulatory and diplomatic escalations amid holidays

Chart of the day: USDJPY (24.12.2025)