- The market is in an ultra positive mood. Wall Street indices record moderate gains, with both US500 and US100 trading around 0.30-0.40% higher, however indices keep consolidating around historic highs.

- Stock market gains are supported by the continuing weakening of the dollar, which today continues its downward movement after lower PCE data from the USA. The dollar remains one of the weakest currencies among the G10 countries today.

- Major European stock indices closed the session mixed, with DAX gaining 0.11% today, CAC 40 losing 0.03%, and FTSE 100 adding 0.04%.

- Volatility on the Warsaw Stock Exchange was also limited, with WIG20 losing just under 0.1%.

- EURUSD crossed the 1.10 USD level yesterday and remains above it today, confirming the bullish sentiment that has been ongoing since the beginning of October.

- US macro data package for November:

- PCE Inflation. Currently: 2.6% y/y. Expected: 2.8% y/y. Previous: 3.0% y/y

- Core PCE Inflation. Currently: 3.2% y/y. Expected: 3.4% y/y. Previous: 3.5% y/y

- Durable goods orders: Currently: 5.4% m/m. Expectations: 2.3% m/m. Previous: -5.4% m/m

- US inflation data at 14:30 showed lower-than-expected price pressure in November, strengthening expectations for Federal Reserve rate cuts next year.

- Oil prices are slightly slipping during Friday's session, while NATGAS is down almost 4%.

- Gold started the session with gains, GOLD broke out of a triangle formation and even tested the 2070$ level, followed by a pullback. Gains for the day were limited to 0.5%.

- Cryptocurrencies are consolidating around the highs after yesterday's gains. Bitcoin is holding around 44000 USD. Meanwhile, Ethereum is recording a 4.0% increase, and some Altcoins are gaining even double-digit percentages.

- Solana records nearly 4% gains above 90 dollars and currently jumps into the top 5 cryptocurrencies by market capitalization.

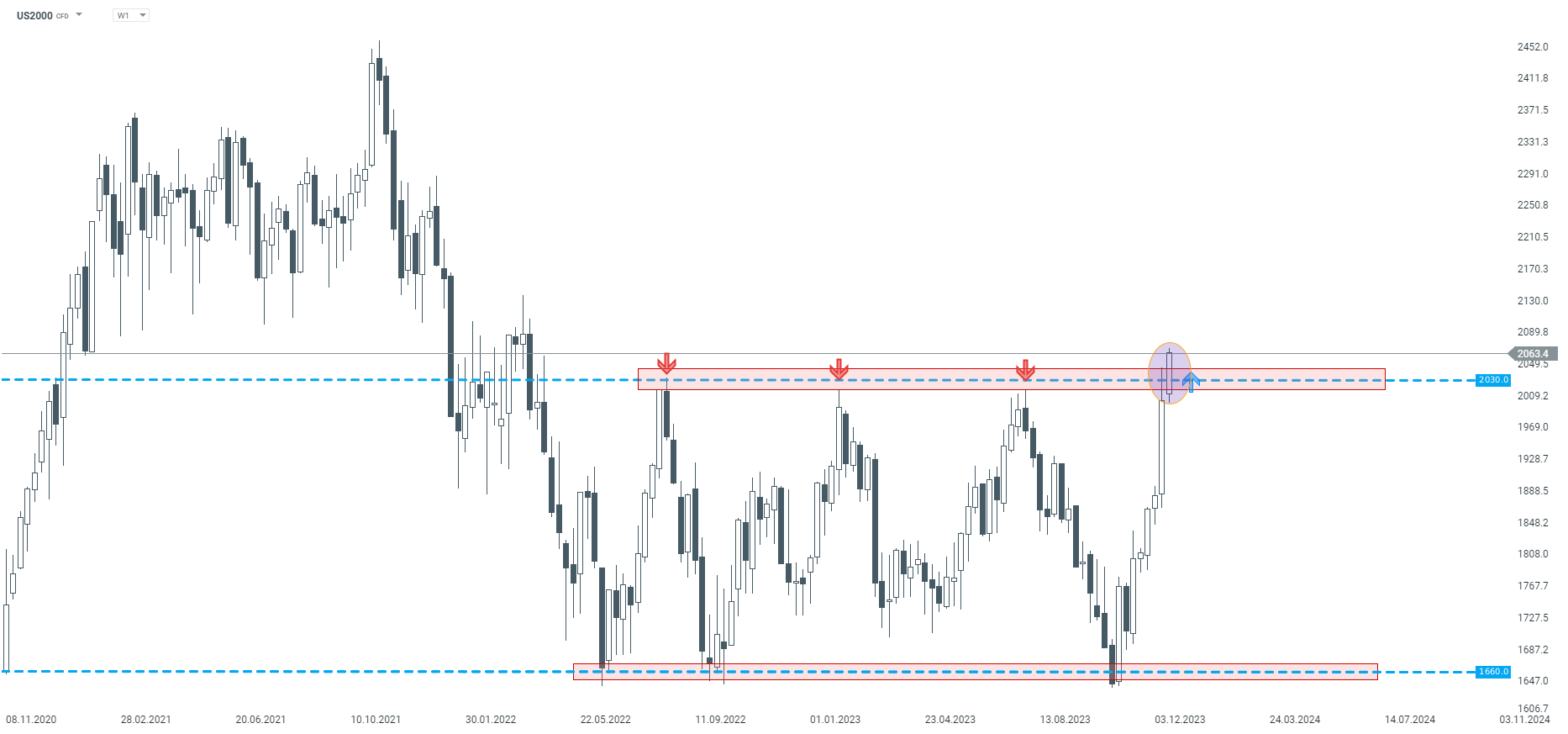

US2000 has a chance to end the week high and break out of the consolidation between 1660 points and 2030 points. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)