• Stimulus worries weigh on market sentiment

• Gold above $2000 per ounce

European indices finished today's session in mixed moods as re-imposition of some restriction measures in several countries and rising number of infections continued to worry investors. Also mixed bag of corporate earnings weighed on sentiment. Diageo and Bayer posted disappointing quarterly results, while BP stock jumped even as the firm cut its dividend for the first time in a decade as it promised to pay out 60% of surplus cash through share buybacks. During today's DAX 30 fell 0.4%, FTSE 100 closed near the flat line, FTSE MIB gained 1.2%, IBEX 35 rose 0.5% and the CAC 40 added 0.4%.

US indices are trading slightly higher as investors awaited signs of progress on US coronavirus relief package. Market attention focus on the fifth major coronavirus-aid bill, with Senate Democratic Leader Chuck Schumer saying talks with the White House were moving in the "right direction". Meantime House Speaker Nancy Pelosi told Fox today that she doesn't think there will be a deal this week. Also rising tensions between Washington and Beijing regarding Microsoft- TikTok deal and poor quarterly figures posted by Ralph Lauren and AIG capped gains. Yesterday President Trump said that the U.S. government should get a "substantial portion" of any deal price. Today, state-backed newspaper China Daily said the country will not accept the "theft" of the technology company.

Gold price finally managed to break above the $2,000 per ounce as the dollar continue to decline after a brief respite, which additionally supported safe-haven assets. Silver, like gold, continues to rally. Although nowhere near all-time new highs, it is making multi-year highs.

On the corporate front, Allianz, Regeneron Pharmaceuticals Inc., Moderna Inc Registered Shs, BMW AG, Honda will publish their quarterly results.

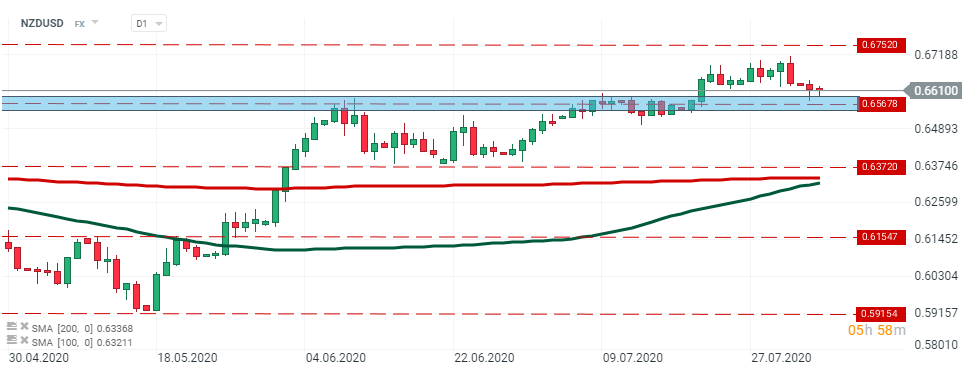

NZDUSD is testing local support at 0.6567. If sellers manage to take control on the market, then downward move into 0.6372 is possible. However as long as the price sits above the aforementioned level, one should expect the price to continue to rise. Local resistance is located at 0.6752. Source: xStation5

NZDUSD is testing local support at 0.6567. If sellers manage to take control on the market, then downward move into 0.6372 is possible. However as long as the price sits above the aforementioned level, one should expect the price to continue to rise. Local resistance is located at 0.6752. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!