- European equities rebound on Wednesday

- US30 hit new record high

- US crude stocks post sharpest fall since January

European indices finished today’s session higher, recovering yesterday's losses as investors welcomed a new batch of earnings results and economic health indicators. German package delivery and supply chain management company Deutsche Post lifted its operating profit forecast for 2021, while Danish shipping company Maersk posted upbeat quarterly figures and expects the solid performance will continue for the rest of the year. Stellantis posted strong quarterly revenue, and fashion giant Hugo Boss almost doubled its sales in mainland China in the first quarter.

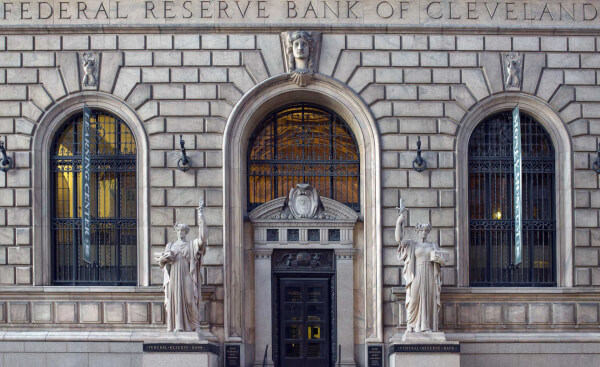

Also US stock indexes rebounded on Wednesday and Dow Jones reached a new intraday record amid strong quarterly earnings from General Motors and Activision Blizzard. ConocoPhillips stock rose more than 5% after an upgrade to buy from Bank of America. Tech stocks regained some ground thanks to US Treasury Secretary Yellen's who downplayed her yesterday's comments regarding rate hikes. Today Yellen said that she sees no inflation problem brewing so far. She also said that she is not trying to forecast Fed's rate path and that she strongly believes in Fed's independence. On the data front, ADP report showed that the US economy added 742k new jobs in April, the most since last September, adding to optimism that the labour market recovery is consolidating.

WTI crude rose more than 0.25% and is trading slightly below $65.37 a barrel, while Brent is trading nearly 0.5% higher around $68.70 a barrel. EIA data showed crude oil inventories in the US fell the most since early January and by more than three times what markets were expecting. Elsewhere gold rose 0.30% to $ 1,784.00 / oz, while silver is trading 0.30 % lower, around $ 26.40 / oz amid a slightly weaker dollar.

NZDUSD is one of the strongest currency pairs today after falling sharply on Tuesday. Pair manage to break above major 0.7207 level which coincides with 200 SMA (red line). If the current sentiment prevails, upward move may accelerate towards resistance at 0.7241, however before this happens buyers will need to break above the upper limit of the broadening wedge formation. On the other hand, if sellers will regain control, then nearest key support lies at 0.7150. Source: xStation5

NZDUSD is one of the strongest currency pairs today after falling sharply on Tuesday. Pair manage to break above major 0.7207 level which coincides with 200 SMA (red line). If the current sentiment prevails, upward move may accelerate towards resistance at 0.7241, however before this happens buyers will need to break above the upper limit of the broadening wedge formation. On the other hand, if sellers will regain control, then nearest key support lies at 0.7150. Source: xStation5

Daily summary: The Market recovers losses and awaits rate cuts

Three markets to watch next week (13.02.2026)

US OPEN: The market looks for direction after inflation data

BREAKING: US CPI below expectations! 🚨📉