-

Wall Street indices are trading slightly higher on the day. Dow Jones and Nasdaq gain around 0.1% each, Russell 2000 jumps 0.8% and S&P 500 trades flat

-

European stock market indices traded mixed today - German DAX dropped 0.1%, UK FTSE 100 gained 0.1%, French CAC40 added 0.3% and Dutch AEX dropped 0.3%

-

Japanese yen is the worst performing G10 currency today. JPY is pulling back after Bank of Japan conducted an unscheduled bond buying operation

-

Fed's Goolsbee said that Fed's effort to curb inflation is working and that he is not sure whether he will call for a hike in September

-

According to Reuters report, OPEC production dropped by 840k barrels in July

-

Cryptocurrencies traded mostly lower. Bitcoin dropped 0.1%, Ethereum traded 0.2% lower and Ripple declined 0.6%. Dogecoin gained 0.1%

-

Energy commodities traded mixed - oil gained around 1% while US natural gas prices declined 1%

-

Precious metals on relative USD weakness. Gold trades 0.6% higher, platinum jumps 1.6% and silver rallies 2%

-

AUD and NZD are the best performing major currencies while JPY, CHF and USD lag the most

-

Chicago PMI jumped from 41.5 to 42.8 in July (exp. 43.3)

-

Dallas Fed manufacturing index improved from -23.2 to -20.0 (exp. -22.5)

-

Italian CPI inflation decelerated from 6.4 to 6.0% YoY in July (exp. 6.1% YoY)

-

Italian GDP declined 0.3% QoQ in Q2 2023 (exp. 0.0% QoQ)

-

Euro area CPI inflation decelerated from 5.5 to 5.3% YoY (exp. 5.3% YoY)

-

Euro area GDP expanded 0.3% QoQ in Q2 2023 (exp. 0.2% QoQ)

-

German retail sales declined 0.8% MoM in June (exp. +0.2% MoM)

-

Japanese industrial production increased 2.0% MoM in June (exp. 2.4% MoM)

-

Chinese manufacturing PMI index increased from 49.0 to 49.3 in July (exp. 49.2) while services index dropped from 53.2 to 51.5 (exp. 52.9)

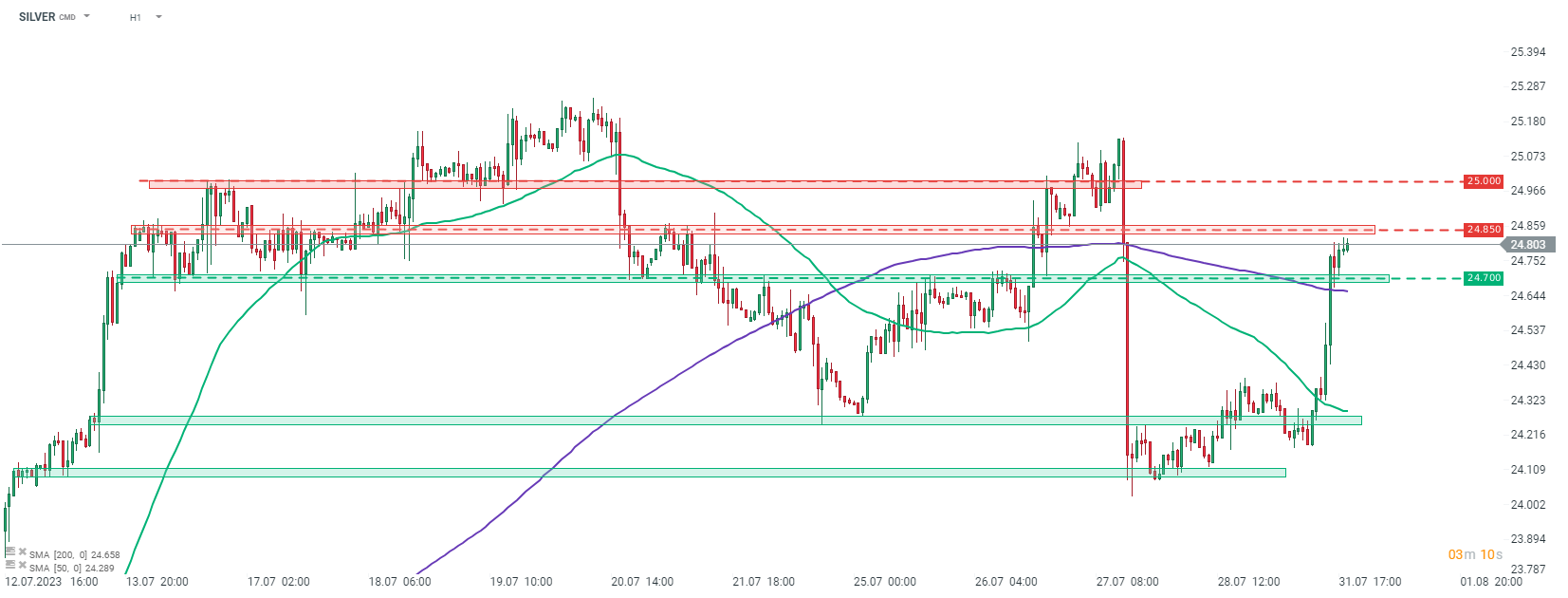

Weaker USD as well as dovish move from the Bank of Japan are boosting precious metals today. SILVER trades 2% higher and closes in on the short-term $24.85 resistance zone. Source: xStation5

Weaker USD as well as dovish move from the Bank of Japan are boosting precious metals today. SILVER trades 2% higher and closes in on the short-term $24.85 resistance zone. Source: xStation5

Silver in panic! Metal below $80⏬

Morning wrap (05.02.2026)

Daily summary: Nasdaq hits nearly two-month low, USD gains momentum, crypto deep in red (04.02.2026)

India: New battleground of the trade war?