-

Coronavirus threat is still serious in the US

-

US equities continue to surge

-

Gold gradually approaching $1,800.00 level

Global financial markets are still under pressure. Almost everyday investors are “bombarded” with new coronavirus updates. The situation looks particularly disturbing in the US where new Covid-19 cases are rising in at least 36 states. Therefore stocks in Europe seem to be cautious - FTSE 100 lost 0.90% while other indices finished the session near the flatline. DAX did relatively well and added 0.64%.

Ironically, stocks in the US (where coronavirus situation is getting uglier) tend to rise. After a mixed open, all major US indices started gaining momentum. Nasdaq and Russell 2000 are adding around 1.00% right now. Some market participants can surely think about the common phrase “don’t fight the Fed” under the circumstances.

One should certainly take a good look at precious metals today. Silver spot price is rising over 2% at press time while gold is up around 0.65%. As far as gold is concerned, its price is relentlessly approaching $1,800.00 mark. Breaking above this barrier would definitely bring even more attention as these levels were not seen since 2011.

In terms of economic data, today’s calendar was really busy. Industrial production in Japan declined in May 8.4% MoM (vs expected -5.6%). On the other hand, Chinese PMIs extended some gains as indices are still above 50 pts mark. British GDP data came in slightly below expectations (-2.2% QoQ in Q1 2020) while readings from the US turned out to be mixed. Chicago PMI unexpectedly amounted to 36.6 (vs expected 45.0), but CB Consumer Confidence managed to beat market expectations.

Tomorrow one should pay attention to PMIs from major economies. Germany will release a bunch of hard data including unemployment change and retail sales report. In the afternoon investors will get to know ADP employment report from the US as well as EIA’s crude oil inventories. Traders will have a day off in Canada and Russia.

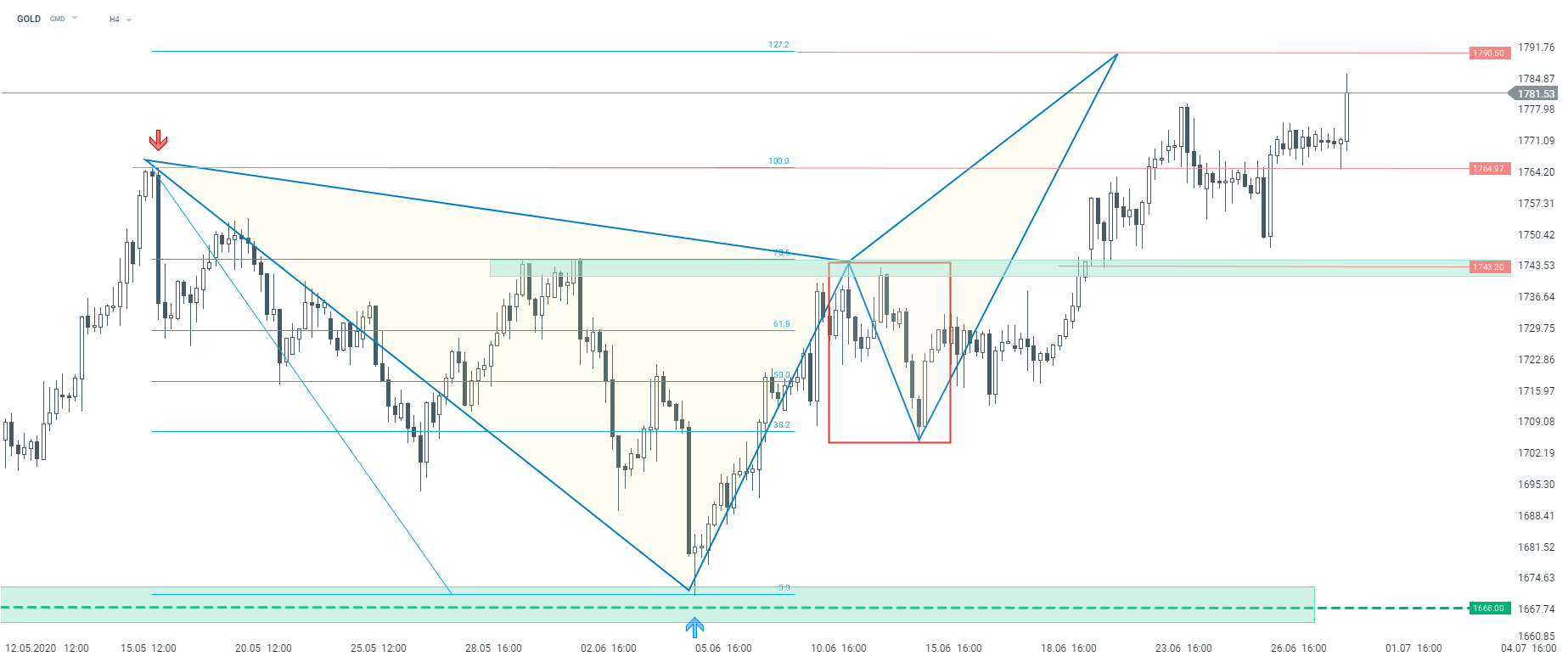

Gold price is relentlessly approaching $1,800.00 mark. Investors might expect a strong resistance there as these levels were not seen since 2011. Some market participants surely bet on the yellow metal amid the ongoing global uncertainty. $1,790.50 may be treated as a short-term resistance. Source: xStation5

Gold price is relentlessly approaching $1,800.00 mark. Investors might expect a strong resistance there as these levels were not seen since 2011. Some market participants surely bet on the yellow metal amid the ongoing global uncertainty. $1,790.50 may be treated as a short-term resistance. Source: xStation5

Will Nvidia’s report reignite optimism on Wall Street?

Nvidia’s report blows past expectations on Blackwell 📈 Will the AI boom last?

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%