-

European markets end the day mostly lower

-

US swing states still counting votes

-

NFP report above expectations

Even though the US presidential election took place on Tuesday, key American swings states are still counting votes. Still, Joe Biden is widely considered to have won the race as he now leads in Pennsylvania and Georgia. The drama is not over yet and financial markets will pay attention to US politics even after the final results, because President Trump might not want to concede straightaway.

European markets ended today’s session mostly lower after a few days of huge gains. DAX lost 0.70% while CAC 40 fell 0.46%. British FTSE 100 managed to end the day slightly higher. American stocks are trading below the flatline at press time with S&P 500 just a notch above the 3,500 pts mark.

Oil markets are under huge pressure again amid demand uncertainty. Brent prices came back below $40 a barrel. Precious metals tend to gain - silver prices are climbing towards $26 level while gold prices are swinging around $1,950 area.

The key macro event of the day was the release of NFP report. Data came in above expectations as the US economy added 638k jobs in October against expected 600k. Private nonfarm payrolls amounted to as much as 906k (vs exp. 690k). However, employment change in Canada turned out to be weaker than expected (83.6k vs expected 100k).

Markets will surely focus on US politics during the weekend as it remains key theme for financial markets. On Monday Canada will publish its housing starts data while Germany will release trade balance figures. Apart from that, US investors will pay attention to earnings season which is not over yet.

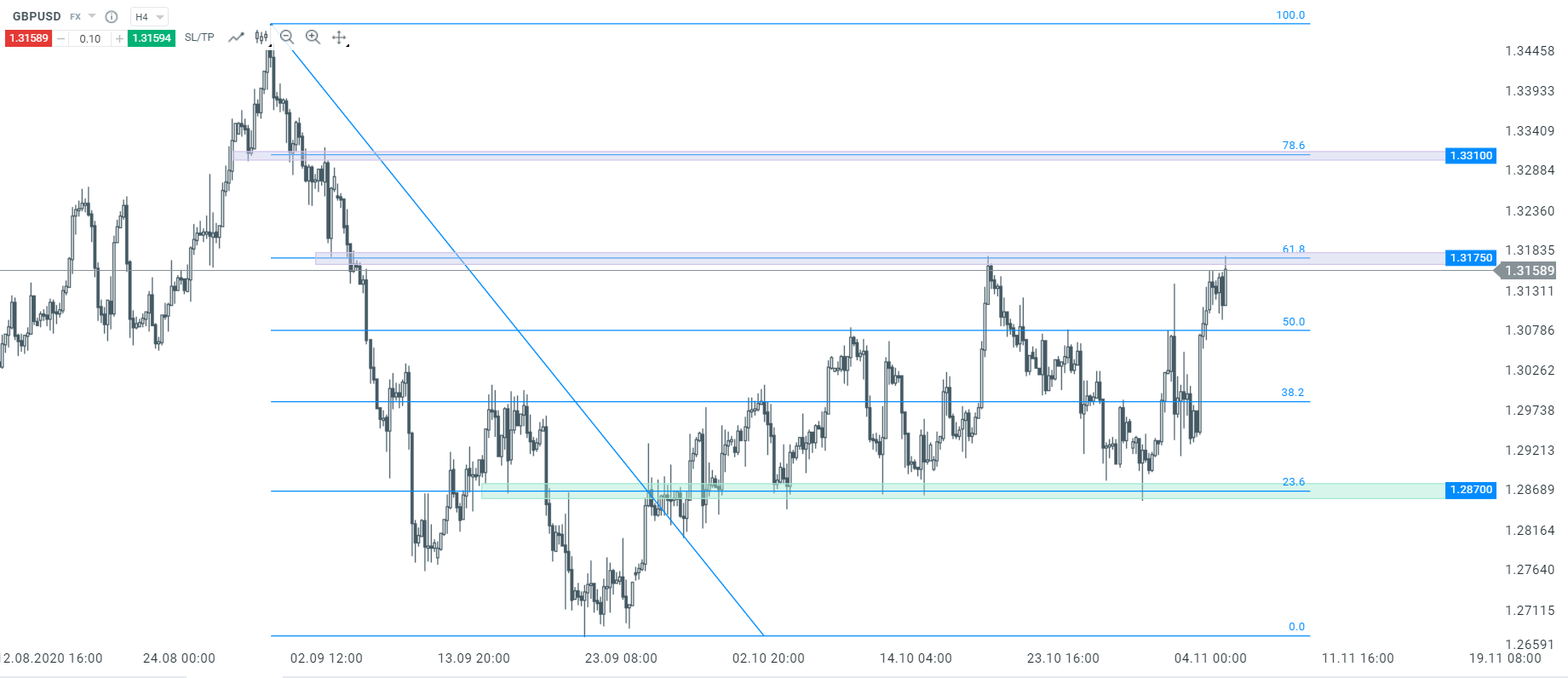

Looking at H4 time-frame, GBPUSD is currently testing key resistance area at 1.3175. It coincides with previous price reactions and 61.8% Fibo retracement of the recent downward move. Should the price break above this level, one might expect a move towards 1.3310. Source: xStation5

Looking at H4 time-frame, GBPUSD is currently testing key resistance area at 1.3175. It coincides with previous price reactions and 61.8% Fibo retracement of the recent downward move. Should the price break above this level, one might expect a move towards 1.3310. Source: xStation5

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI