- European equities gain for 7th week

- Dow and S&P 500 hit another record highs

- Turkey bans crypto payments

European indices ended their seventh consecutive week in green, the longest winning streak since May 2018 amid strong data from China which showed record 18.3% growth in the first quarter and 34.2% increase in March's retail sales. Also investors welcomed upbeat quarterly figures from Daimler. In Europe, the number of new car registrations in the EU jumped 87.3% year-on-year in March. DAX 30 rose 1.34% and finished the session at a new all-time high of 15,460 pts. CAC40 rose 0.85% and FTSE100 gained 0.52%.

US indices are trading mixed, Dow Jones and S&P 500 hit new all-time highs at the beginning of the session, while NASDAQ is trading near the flatline as the first-quarter earnings season started on a high note. Housing starts reached the highest level since 2006, while the University of Michigan's consumer sentiment for the US increased to 86.5 in April, from 84.9 in the previous month but below analysts’ estimates of 89.6. Still it is the highest reading since March 2020. On the corporate front, Morgan Stanleyposted strong earnings, following positive results from peers JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Bank of New York Mellon and Goldman Sachs. Meanwhile Bitcoin-related stocks including Riot Blockchain and Marathon Digital fell about 4% after Turkey banned the use of cryptocurrencies and crypto assets to purchase goods and services.

Both WTI crude and Brent are trading flat respectively around $63.32 and 66.90 a barrel. Elsewhere surged nearly 0.90 %to $ 1,778.00 / oz, while silver is trading 0.60 % higher, slightly above $ 26.00 / oz as the dollar hit a four-week low and US Treasury yields remained below last month's year highs.

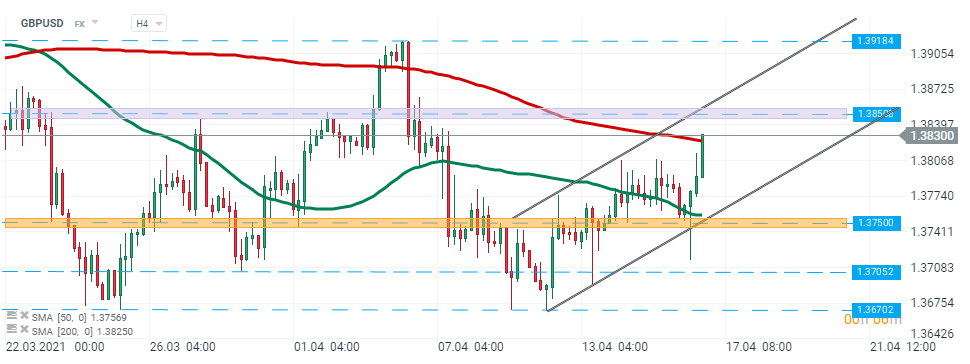

GBPUSD pair bounced off the major support at 1.3750 and is currently testing 200 SMA (red line). If buyers will manage to uphold momentum then resistance at 1.3850 could be at risk. On the other hand, if sellers manage to regain control, then downward impulse towards the lower limit of the ascending channel could be launched. Source: xStation5

GBPUSD pair bounced off the major support at 1.3750 and is currently testing 200 SMA (red line). If buyers will manage to uphold momentum then resistance at 1.3850 could be at risk. On the other hand, if sellers manage to regain control, then downward impulse towards the lower limit of the ascending channel could be launched. Source: xStation5

DE40 loses 2.6% 📉European stocks under pressure

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war