-

European markets trade mixed ahead of ECB and US GDP

-

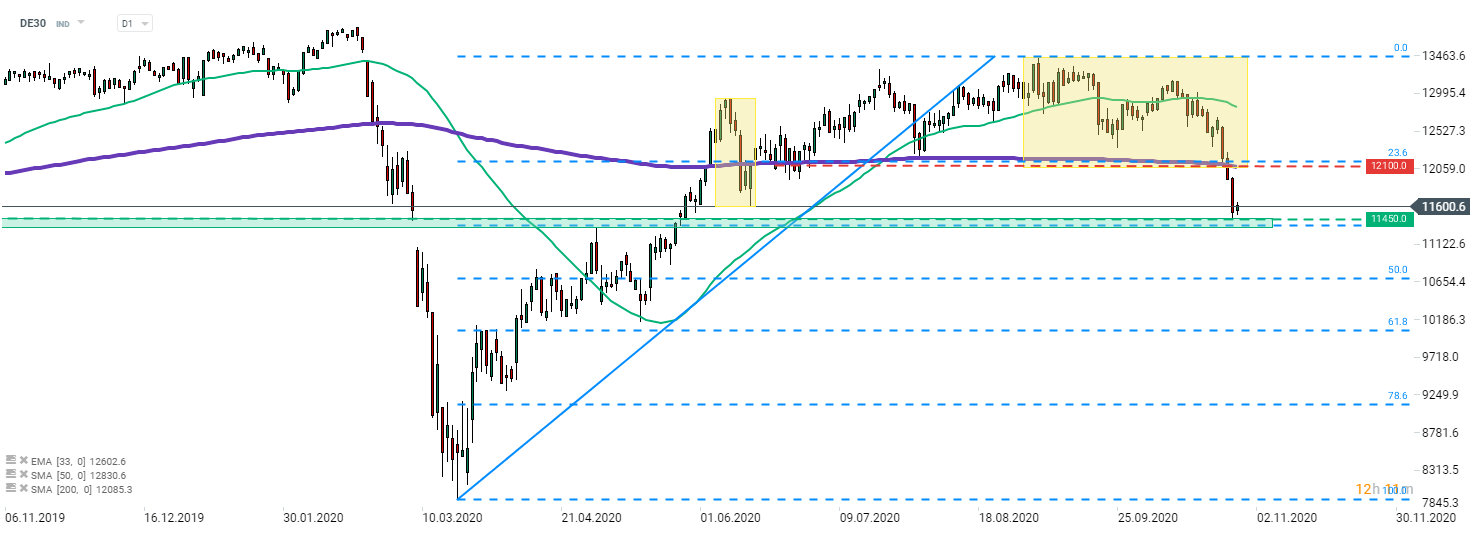

DE30 halts declines at 11,450 pts

-

MTU and Volkswagen released earnings reports

European markets halted declines and are trading mixed on Thursday. Investors await news on new coronavirus restrictions as well as US GDP report and ECB rate decision. Last but not least, investors should keep in mind that US presidential elections are next week and poll results can have influence on the markets.

DE30 tested support at 11,450 pts but was unable to break lower so far. Index is likely to be volatile in the afternoon when the US GDP report is released and ECB announces its decision. Return of selling pressure will put the aforementioned support in the spotlight once again. Source: xStation5

DE30 tested support at 11,450 pts but was unable to break lower so far. Index is likely to be volatile in the afternoon when the US GDP report is released and ECB announces its decision. Return of selling pressure will put the aforementioned support in the spotlight once again. Source: xStation5

Company News

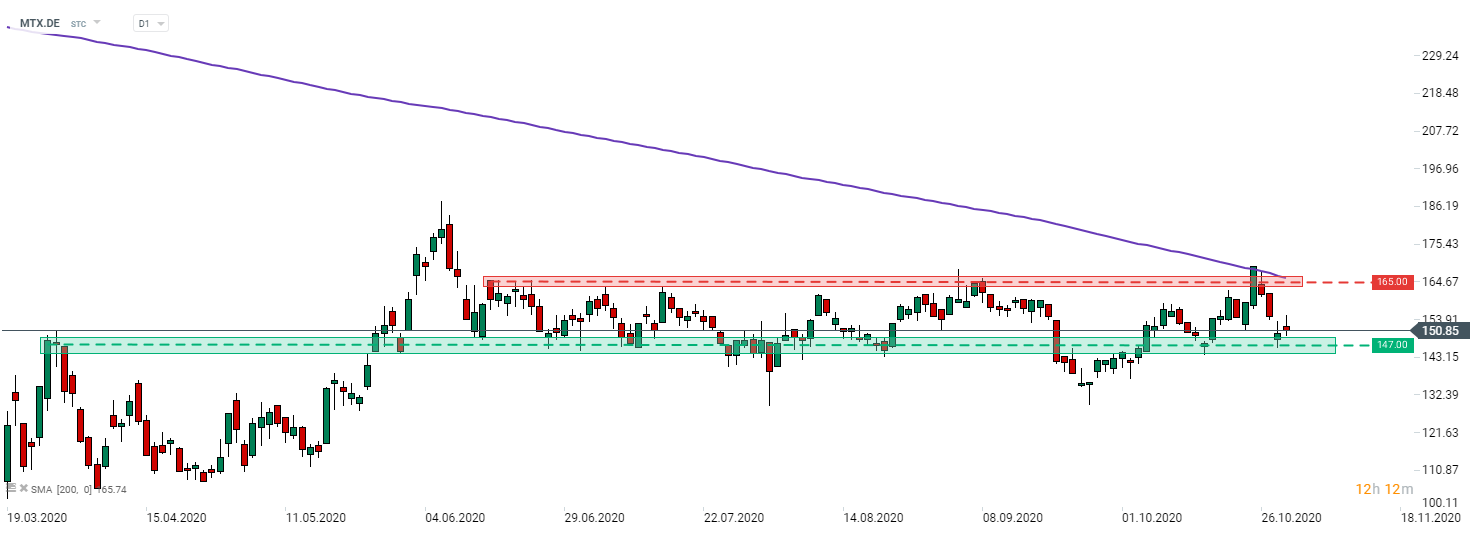

MTU Aero Engines (MTX.DE) reported Q3 earnings today. Aircraft part manufacturer generated €16 million in net income, down from €125.5 million last year. Earnings per share at €0.28 were almost 90% YoY lower. Revenue dropped from €1.16 billion in Q3 2019 to €0.91 billion in Q3 2020 Backlog order at the end of September stood at €18.8 billion compared to €19.8 billion at end-2019. Company expects revenue to full-year revenue to be in €4-4.2 billion range, down from €4-4.4 billion in July's forecast.

Volkswagen (VOW3.DE) reported lower Q3 net profit at €2.58 billion (€3.79 billion in Q3 2019). Revenue dropped from €61.42 billion to €59.36 billion. Operating profit declined 30% YoY to €3.18 billion. Company still expects full-year sales to be significantly lower than in 2019 but said that situation improved in the third quarter, mainly on the back of solid demand from China.

MTU Aero Engines (MTX.DE) pulled back after a test of 200-session moving average (purple line). However, stock found support at the lower limit of the trading range and may be looking towards the upper limit as a target (€165). Source: xStation5

MTU Aero Engines (MTX.DE) pulled back after a test of 200-session moving average (purple line). However, stock found support at the lower limit of the trading range and may be looking towards the upper limit as a target (€165). Source: xStation5

CHN.cash under pressure despite positive Trump remarks 🚩

Wall Street optimism tempers amid falling odds of December Fed rate cut

DE40: Decline of sentiment in Europe

Morning wrap (31.10.2025)