-

The Bundestag approves record military orders worth €52 billion, covering 29 contracts for the Bundeswehr; shares of Rheinmetall, Renk, and Hensoldt rise.

-

Orsted and Vestas gain after a U.S. court overturns the ban on new wind projects in the United States, restoring growth prospects for the sector.

-

Thyssenkrupp expects a net loss of €400–800 million in the current fiscal year due to weak steel market conditions and costly restructuring; shares fall by around 10%.

-

The Bundestag approves record military orders worth €52 billion, covering 29 contracts for the Bundeswehr; shares of Rheinmetall, Renk, and Hensoldt rise.

-

Orsted and Vestas gain after a U.S. court overturns the ban on new wind projects in the United States, restoring growth prospects for the sector.

-

Thyssenkrupp expects a net loss of €400–800 million in the current fiscal year due to weak steel market conditions and costly restructuring; shares fall by around 10%.

Next week, the German Bundestag will approve record defense spending worth €52 billion (around $61 billion), covering 29 contracts for the Bundeswehr. This is the largest single-budget decision in the history of the German armed forces and aims to transform it into the strongest conventional military force in Europe. Key planned investments include €22 billion for basic military equipment and uniforms, €4.2 billion for Puma infantry fighting vehicles, €3 billion for advanced Arrow 3 interceptor missiles in cooperation with Israel, and €1.6 billion for reconnaissance satellites, which are expected to significantly enhance intelligence and monitoring capabilities.

The scale of these measures reflects an accelerated military modernization that began after Russia’s full-scale invasion of Ukraine in 2022. At that time, former Chancellor Olaf Scholz announced a “historic turning point” (Zeitenwende), and current Chancellor Friedrich Merz continues this course with even greater determination, allocating hundreds of billions of euros to rebuild neglected armed forces and fundamentally reshape Europe’s security architecture. Merz has repeatedly emphasized that the goal of these measures is to protect the freedom of future generations. During a recent live citizen meeting, he stated: “The world around us has completely changed. We want to be able to defend ourselves so that we never have to.”

Germany’s record defense spending fits into the broader context of European efforts to strengthen security in response to increasing threats from Russia. It includes both the purchase of modern air defense systems and the development of the domestic defense industry, as well as deepening international cooperation. The aim is not only to ensure continental stability but also to create a modern, well-equipped army capable of rapid response to contemporary threats. The unprecedented scale of investment demonstrates that Germany takes European security seriously and is consistently implementing its ambitious military modernization plan.

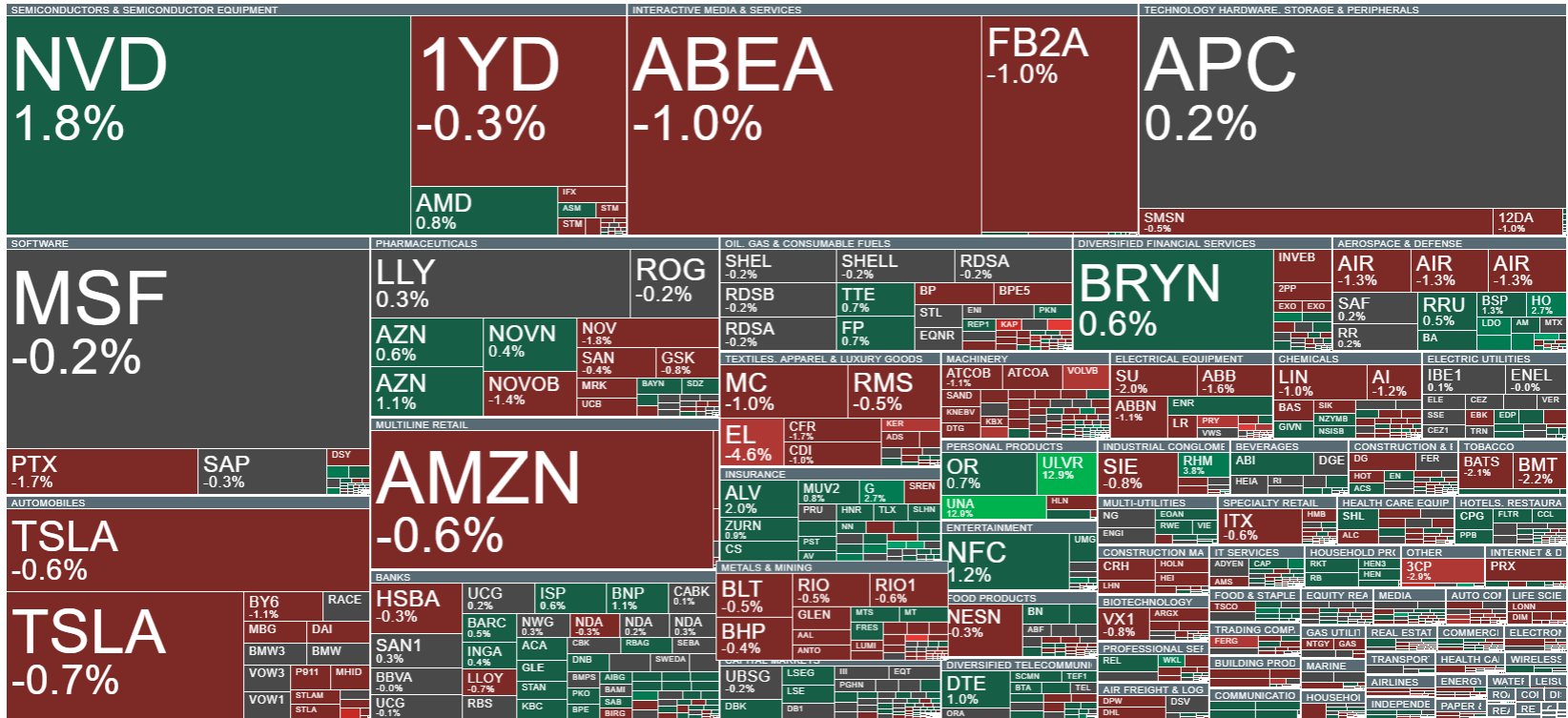

Currently, volatility is observed across the broader European market.

Source: xStation

During today’s session, index futures are rising noticeably, recovering some of the earlier losses and confirming an improvement in short-term market sentiment. However, in a broader context, prices are still moving within a long-term consolidation range, meaning that despite the current rebound, there has not yet been a sustained breakout above the previous trading range or a change in the dominant trend structure.

Source: xStation

Company News:

Shares of Rheinmetall (RHM.DE), Renk (R3NK.DE), Hensoldt (HAG.DE), and other defense companies are rising following the German parliament’s decision on record defense orders worth €52 billion (around $61 billion). The orders cover 29 contracts for equipment and services for the Bundeswehr as part of the plan to transform it into Europe’s strongest conventional army. This represents the largest number and highest value of contracts approved at once in Bundestag history, highlighting the scale of the armed forces’ modernization and boosting investor enthusiasm.

Shares of clean energy companies such as Orsted (ORSTED.DK) and Vestas (VWS.DK) are also rising after a U.S. federal judge overturned the nationwide ban on new wind projects imposed by Donald Trump. The decision allows onshore and offshore wind projects in the U.S. to proceed, giving the sector a boost after months of regulatory uncertainty.

Thyssenkrupp (TKA.DE) expects a significant net loss in the current fiscal year (October 2025 – September 2026) due to weak conditions in the steel industry and high restructuring costs, estimated at around €350 million. As a result, the company anticipates a loss of €400–800 million, which has negatively impacted investor sentiment, with shares falling approximately 10% during today’s session. The restructuring plan includes reducing headcount at steel plants by 40% (around 11,000 employees) and cutting steel production from 11.5 million tons to 8.7–9 million tons, while simultaneously investing in low-carbon steelmaking technologies.

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone

Morning wrap (03.03.2026)